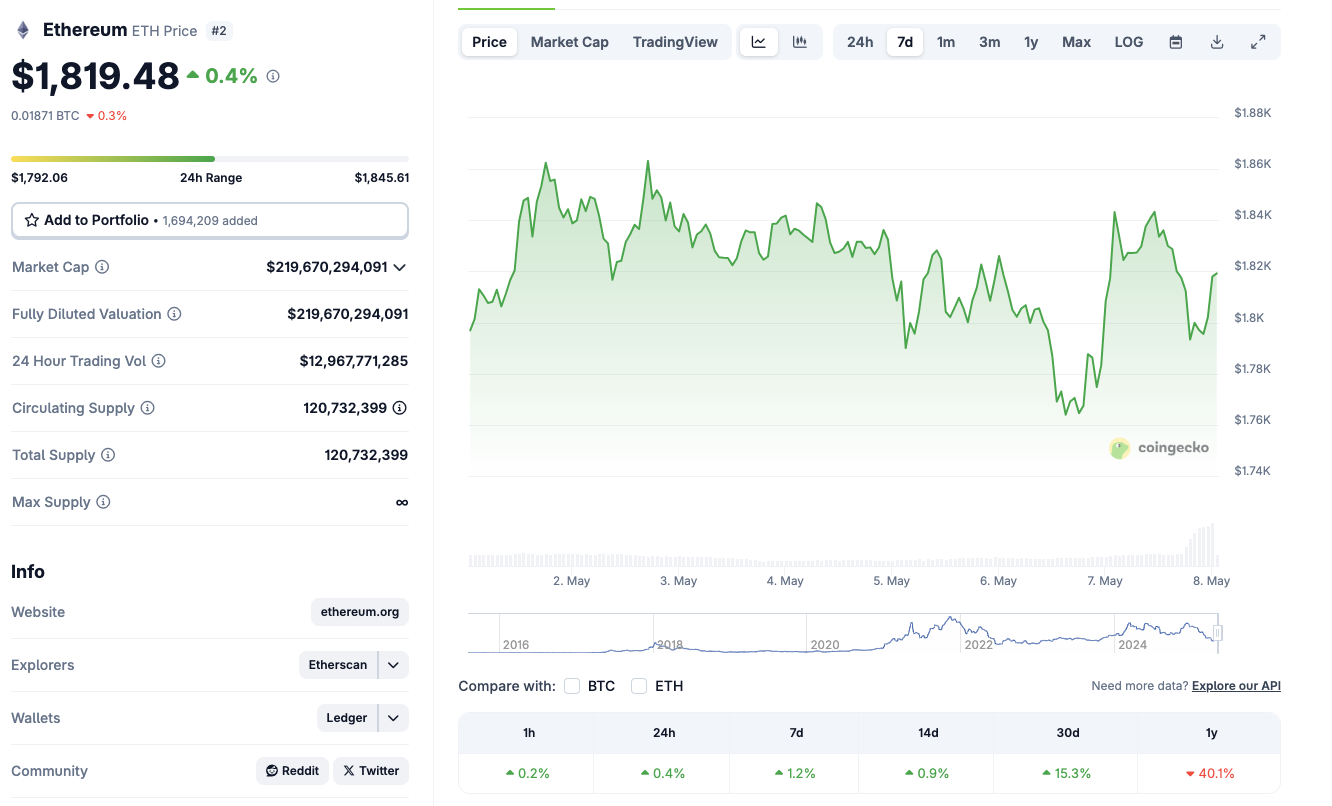

Ethereum price breaks above $1,845 rising 0.4% after the US Fed announced a rate pause on Wednesday May 7. ETH Open interest breaking above the $21 billion market after Vitalk’s recent network update proposal signals more upside ahead.

ETH Holds Above $1,845 After Fed Rate Pause Spurs Risk Asset Rally

Ethereum (ETH) began showing upward momentum following the Federal Reserve’s latest monetary policy announcement. On May 7, ETH rose by 0.4% to break above the $1,845 resistance, buoyed by market optimism after the FOMC voted to keep interest rates steady at 4.25%–4.50%.

Although the Fed acknowledged heightened economic uncertainty, its decision to slow balance sheet reduction was taken as a dovish tilt by investors. This bolstered risk-on sentiment across the board, particularly for assets like ETH.

As U.S. Treasury yields declined, ETH price pushed through intraday resistance at $1,845—an encouraging technical signal amid growing demand for decentralized assets.

On-chain data has also confirmed reduced selling pressure, as Ethereum’s Age Consumed and exchange outflow metrics indicate investor confidence post-FOMC.

Should macro sentiment remain stable, ETH appears poised to target the $1,950 resistance, last seen in mid-March.

This short-term trajectory is further supported by strong derivatives data and ongoing developer activity.

Vitalik’s Upgrade Proposal Adds Momentum to ETH Bullish Thesis

Vitalik Buterin, Ethereum’s co-founder, unveiled an outline for Ethereum’s next major upgrade just days before the Fed decision.

The proposal, focused on statelessness and improved node efficiency, aims to streamline the protocol’s long-term scalability and decentralization. Key upgrades include better witness compression, state storage optimization, and a modular execution design.

Vitalik’s timing appears strategic, given the growing regulatory scrutiny and Layer 2 chains encroaching ETH market share.

By tackling scalability without sacrificing decentralization, the upcoming changes may restore investor conviction, especially after Ethereum’s relative underperformance versus competitors like Solana in early 2025.

Market participants welcomed the announcement as bullish, interpreting it as evidence of Ethereum’s long-term growth prospects.

Derivatives Data Confirms Trader Confidence in Ethereum’s Breakout Potential

The derivatives market paints a similarly bullish picture for Ethereum, as key metrics reflect renewed investor engagement.

Over the last 24 hours, Ethereum Open Interest surged 2.65% to $21.35 billion, signaling $400 million in new capital committed to ETH futures.

Beyond that, Coinglass data shows options volume soared 40.34% to $594.76 million, and Options Open Interest rose 4.84% to $4.19 billion.

These sharp increases suggest speculators are pricing in higher volatility and directional movement ahead. The Binance ETH/USDT long/short ratio stood at 2.1486, with OKX ETH traders showing an even more bullish ratio of 2.26—meaning over twice as many accounts are long versus short. Among top traders on Binance, the long/short position ratio hit 2.8153.

Liquidation data supports this bullish trend. In the past 12 hours, ETH shorts accounted for $6.07 million in losses versus $14.33 million in long liquidations. Despite higher long exposure, short rekt data indicates traders mispositioned for further downside are being flushed out.

The cohesive uptrend in both futures and options interest suggests Ethereum’s next price leg could challenge the $1,950 and $2,050 zones if macro momentum and dev updates stay aligned.

Ethereum price forecast today: ETH eyes $1,938 breakout amid Bollinger Band squeeze

Ethereum’s price action continues to consolidate above $1,800, with signs pointing toward a potential upside breakout. The current candlestick structure reflects a tightening range within the Bollinger Bands, suggesting a volatility squeeze that typically precedes a directional move.

The upper Bollinger Band sits at $1,938, aligning as a near-term resistance level and price target should bullish momentum persist. Ethereum price forecast today leans moderately bullish, contingent on volume expansion and directional confirmation.

The Directional Movement Index (DMI) supports this outlook, as the blue DI+ line has just crossed above the orange DI, a classic bullish signal indicating shor-term momentum is shifting in favor of buyers.

However, the ADX, though rising slightly, remains under 20, implying that the trend is not yet firmly established. A confirmed bullish bias would require a daily close above $1,850 with volume expansion to validate the setup.

Conversely, a drop below the middle Bollinger Band at $1,762 would shift the short-term bias bearish, potentially dragging ETH back toward $1,700.

The post Ethereum Price Analysis Today: ETH to Breach $1,950 if FOMC Reactions Align With $21B Open Interest Surge appeared first on CoinGape.