Binance New Features:- Spot Copy Trading has seen impressive growth. The number of Spot Copy Trading portfolios on Binance has surged over 52 times in the past year.

In light of this growing demand, Binance, the world’s largest centralized cryptocurrency exchange (CEX) by trading volume, has rolled out five new features to upgrade its Spot Copy Trading platform.

Its spot copy tading platform enables everyday users – especially beginners – to replicate the strategies of top-performing traders in real time. This helps new traders in making profits via trading without much experience and knowledge.

Now in order to drive better performance with new tools, it has rolled out new features.

What are the New Trading Features of Binance

Binance has introduced five powerful upgrades to its Spot Copy Trading platform. They are aimed at enhancing user control, transparency, and strategy access. The features are:

1. Auto-Invest for Spot Copy Trading: With this new feature, users can now schedule recurring copy trades. They can do this by setting parameters such as investment amount, trade frequency, and stop-loss percentages.

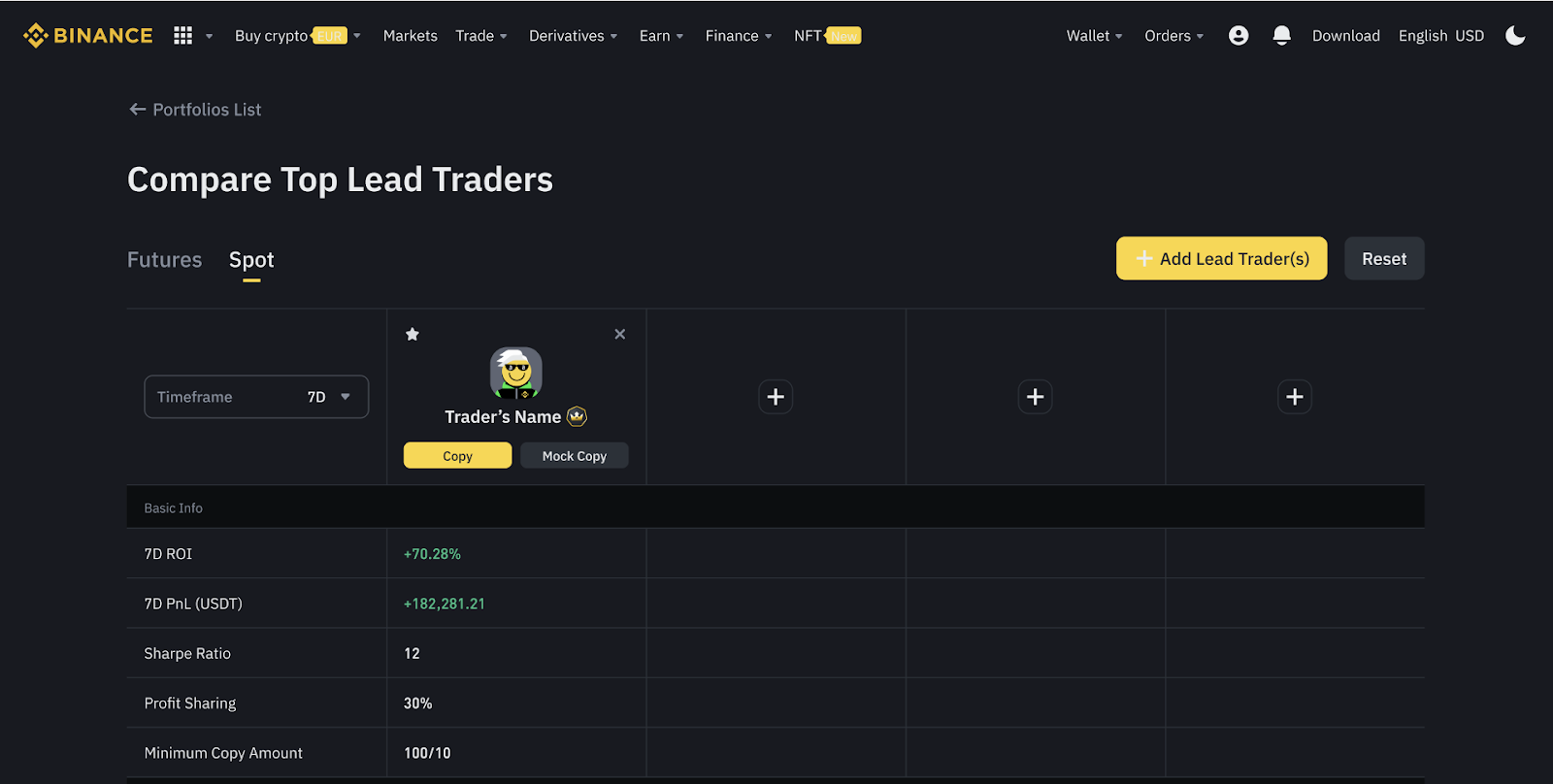

2. Lead Trader Comparison Tool: This is the most helful feature launch among all five. This feature allows users to compare multiple lead traders side-by-side.

According to the official annoncement, the comparision metrics can be ROI, win rate, profit-sharing ratios, number of copiers, top traded tokens, and total PnL.

3. Mock Spot Copy Trading: With this new tool, users can simulate copy trading with virtual funds to test strategies without financial risk. In this, successful mock portfolios may also qualify for promotional rewards.

4. Spot Failed Orders Tab: This is a new tab within copy portfolios. It will display failed trade orders, helping in improving transparency by allowing users to review incomplete or unsuccessful trades.

5. Private Portfolios for Lead Traders: Not only for users, Binance has also launched new tools for the experts.

Lead traders can now set portfolios to “invite-only”. This will help in limiting follower access and supporting private strategy sharing or premium group offerings.

These feature launches come as Binance also launches major airdrop update. It has now launched the Alpha Point points system to determine eligibility for wallet TGE and Alpha token airdrop activities.

In Binance’s spot copy trading system, users retain 90% of the profits. Interestingly, the lead traders they follow receive a 10% performance fee.

This model incentivizes lead traders to maintain high performance and aligns their interests with those of their followers.

Boost for Spot Copy Trading?

Spot copy trading has experienced significant growth globally. This is driven by increased interest from younger investors, platform innovations and increasing adoption among CEXs.

According to Bitget report, significant portion of copy traders are under 25 years old. This accounts for 44% of users, indicating strong adoption among Gen Z.

Several CEXs are increasingly offering spot copy trading. Binance – entered in 2023 – and Bybit are the newer entrants in the space. They are focusing on advanced metrics and transparency.

Bitget, launched earlier, pioneered multi-market and community-driven features, while KuCoin and OKX, launched in 2022.

They continue to refine their platforms with tailored risk preferences and multi-market strategies. Different CEXs offer various strengths in copy trading but it depends on your market preferences and risk tolerance.

Nonetheless, these new copy trading features by Binance are sure to come as a boost for copy traders and the market.

Also Read: The Big Update for XRP Community by Ripple Prez.

The post Binance Launches 5 New Trading Features for CEX – What are they appeared first on CoinGape.