The adoption rate of Bitcoin is skyrocketing, and even the popular gaming organization, GamesStop, has decided to adopt it for its treasury, affecting its stock price. This decision aligns with many companies like MicroStrategy, Metaplanet, and others. Interestingly, the investors initially took it as positive news, but later, the GME stock price plunged. What’s happening, and will it recover?

Why Did the GME Stock Price Crash 25% Today?

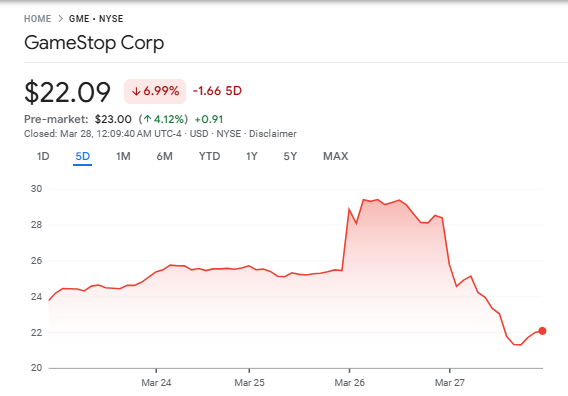

In contrast to the GME stock price’s 16% rally on March 26, it has crashed by 25% today. The earlier boost came right after the announcement as investors considered it a highly bullish opportunity. Interestingly, along with this, the GameStop-inspired GME memecoin price surged 30%.

At that time, the Gamestop short sale volume surged to $30.85M on March 27 after a massive 234% volume surge. Interestingly, this level was closer to the 2021 short squeeze. Additionally, the GameStop stock trading volume peaked amid the price surge.

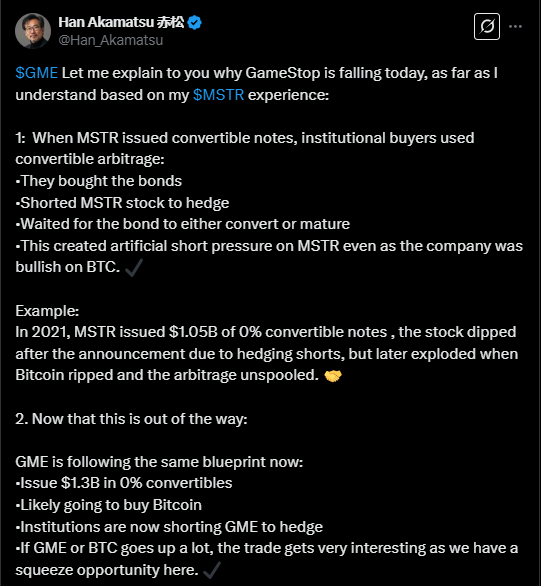

However, this all came falling with Gamtesop’s plan to raise $1.3M to buy Bitcoin for its treasury. The investor’s sentiments were impacted as the company is issuing debt to buy as they intended to offer $1.3M aggregated principal convertible senior notes due in 2030. The same reaction was noticed during MicroStrategy’s note issues.

Experts co-relate these events before predicting a massive GME stock price uptrend.

In 2021, MSTR issued $1.05B of 0% convertible notes, the stock dipped after the announcement due to hedging shorts, but later exploded when Bitcoin ripped and the arbitrage unspooled.

What’s Experts Take on GameStop Bitcoin Buying?

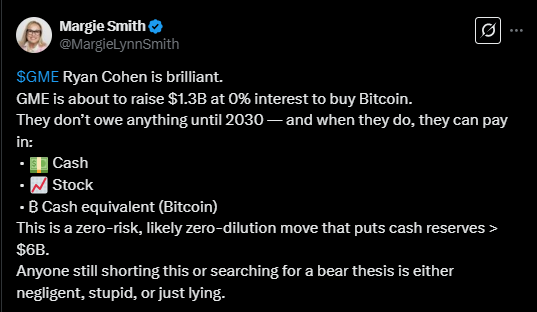

Although there are mixed sentiments around this GameStop Bitcoin buying news, experts have appreciated this approach. Margia Smith has called it “a zero-risk, likely zero-dilution move that puts cash reserves > $6B.”

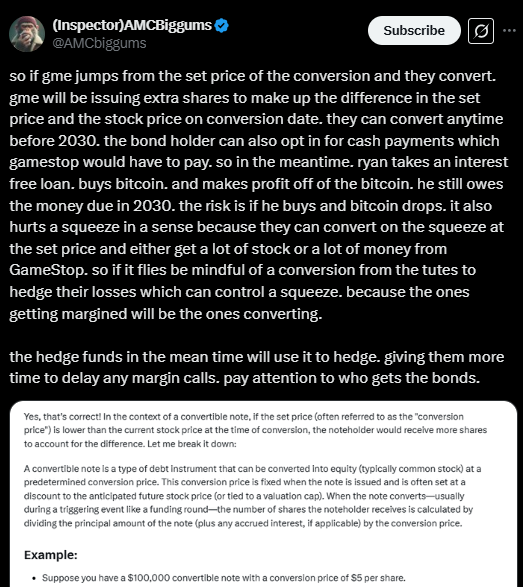

However, other fears that GameStop could lose money if the price of Bitcoin drops. This is because Ryan Cohen, the chairman, took the interest-free loan, but he still owes the money until 2030, and anything can happen between this.

Experts also believe that this strategy could impact the GameStop stock price’s short squeeze. They claim that if the price increased, the bondholders would prefer to convert their bonds. As a result, the share supply will increase and impact the squeeze in a limiting manner.

Additionally, the institutions can convert their bonds to hedge their losses. This empowers them to control the stock uptrend. Besides, the biggest question is whether the downtrend will continue.

Will GME Stock Price Recover?

Considering the MSTR stock’s bullish rally with Bitcoin buying, it is anticipated that GameStop stock’s long-term trajectory will be bullish. For now, the $1.3M loan has affected investors’ sentiments, resulting in bearish liquidity.

However, this downtrend will continue for some time, as several technical factors highlight the possibility of a crash to $16.83. This is because if the selling pressure continues, this is key support carrying liquidity.

Additionally, Nasdaq has implemented the Short Sale Restriction (SSR), which will expire soon. As an impact, the short seller would re-enter the market aggressively, which could result in a further GME stock price crash.

After a quick bounce-test on $GME sees continued bearish liquidity. With LDPM-L7 (brown line) failing to support, the next step is LDPM-L1 (pink line) at ~$16

Not to mention, bond conversion poses risks due to conversions, dilution, and continuously pressuring market sentiments. If all the factors align, the price may crash, but the increased buyer pressure may bring different results

The post Why GME Stock Price Plunged 25% After Bitcoin Treasury News & Will It Recover? appeared first on CoinGape.