The fundamental promise of DeFi was to democratize finance, eliminating gatekeepers and making capital strategies accessible to everyone. Yet as the ecosystem has evolved, a paradox has emerged: increasing complexity has created cognitive barriers that limit participation to technical specialists, contradicting DeFi’s foundational ethos.

@gizatechxyz was founded with a clear mission: to transform how capital operates in decentralized systems. They bridge the best offerings of DeFi to users without requiring technical expertise, enhance capital efficiency for protocols and networks, simplify integration and streamline financial innovation for developers.

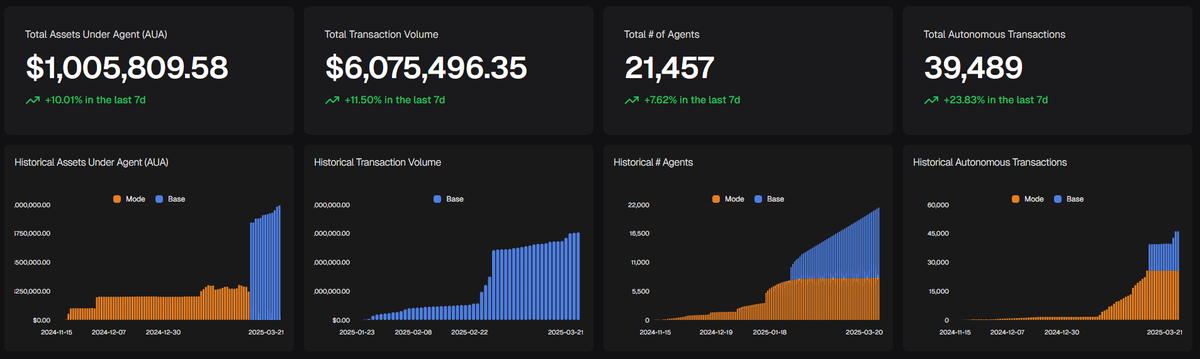

Today, They’ve reached a transformative milestone: Giza Agents now autonomously manage over $1 million in capital across decentralized networks, operating continuously without human intervention while serving thousands of users across the DeFi ecosystem.

This milestone, while notable, is only the first output of a system designed to scale exponentially. A signal that autonomous capital management is no longer theoretical, but operational. From $1 million to billions, Giza is engineered to grow without linear constraints.

Intelligence in Action: The Numbers Behind $1M

https://metrics.gizatech.xyz/

Beyond the headline figure, here are the metrics revealing how agents are already transforming DeFi:

$1,000,000+ AUA: This is capital managed autonomously by intelligent machines, free flowing through decentralized systems. This is not human-prompted transactions or instruction-based automation, this is truly autonomous capital making decisions and executing strategies without requiring human input.

$6,000,000+ in Transaction Volume: Our agents have transformed static capital into dynamic financial energy, generating over $6M in ecosystem activity. This 6.08x Capital Productivity Index demonstrates how autonomous systems will become the primary drivers of liquidity and value creation in next-generation DeFi.

21,400+ Personalized Treasury Managers: Each agent operates as a customized financial manager, adapting to individual preferences. We’ve shattered the one-size-fits-all model of traditional DeFi vaults.

39,400+ Autonomous Transactions: Nearly 40,000 on-chain operations executed without human intervention. Each represents a precise, mathematically-verified decision capturing value impossible for human operators.

Zero security incidents across all agent deployments.

What’s Next

This $1M milestone represents the output of a single specialized agent after a few weeks of operation. ARMA is the first manifestation of a much broader vision, an isolated proof point of what’s possible when intelligence and capital are tightly integrated. Giza is the foundational infrastructure for an emerging ecosystem of autonomous, intelligent businesses.

New classes of agents are already in development. Some built by the Giza team, others by independent developers building on top of the protocol. Each is designed not just to operate independently, but to contribute to Giza’s broader vision: transforming static liquidity into intelligent capital, and enabling decentralized systems to self-operate at scale and democratize finance.

LRT agents will optimize restaking strategies in real time, adapting to yield curves and risk thresholds without manual input. Memecoin agents will serve as hyper-responsive market participants, absorbing volatility and unlocking structured liquidity in previously chaotic markets.

Delta-neutral agents will execute market-making and hedging strategies across fragmented venues, reducing inefficiencies and tightening spreads across DeFi. Protocol-specific agents will automate complex financial primitives, and manage protocol-owned liquidity, turning idle treasuries and fragmented assets into productive capital.

Ecosystem agents will embed intelligence at the network layer, within rollups, appchains, and L2s, bootstrapping usage, creating sustainable activity, and driving market discipline aligned with network health metrics. These agents won’t simply act within ecosystems; they will help shape their trajectory.

Institutional agents will bridge the gap between algorithmic execution and enterprise-grade constraints, offering customized security and risk parameters, enabling scaled capital to enter DeFi without rebuilding infrastructure from scratch.

At the user level, agent-native wallet integrations will entirely abstract away the cognitive burden of DeFi, replacing dashboards and manual inputs with intelligent automation that reflects the user’s intent.

Together, these agents will serve the mission Giza was built for: to abstract the cognitive and operational complexity of decentralized finance, and to unlock the next trillion dollars of productive liquidity through programmable intelligence.

The post The Dawn of Autonomous Finance: Giza Agents Surpass $1M in Managed Capital appeared first on CoinGape.