Bitcoin price closed trading at $84,220 on Friday, March 21, with positive momentum from multiple news events. Here’s how Coinbase latest $5 bilion acquisition deal could impact Bitcoin prices in the long-term .

Bitcoin holds $84K as Coinbase moves to Acquire Deribit

Bitcoin (BTC) closed trading around the $84,200 mark on Friday, March 22, as markets retreated from upwards volatility triggered by Trump’s appearance at Blockwork’s Digital Asset Summit.

Following Trump’s speech advocating for Stablecoin regulations, and long-term BTC holding, BTC price raced to a weekly timeframe peak of $85,900 before returning 4% to close trading on Friday around $84,228.

The impact of Trump’s BTC price was short-lived since his major talking points during speech had been relatively priced in during the previous market really.

However, a recent media report surrounding Coinbase acquisition of derivatives-based crypto exchange could have far reaching longer-term impacts on Bitcoin price.

According to Bloomberg reports, Coinbase, the largest US-based cryptocurrency exchange has entered advanced talks to acquire Deribit, the world’s leading bitcoin and ether options trading platform.

Notably Bloomberg cited anonymous sources in the report, showing that the deal has not yet being made official.

“The companies have notified regulators in Dubai about the discussions as Deribit holds a license there, which would be taken over by any acquirer.”

– Bloomberg, March 21, 2025.

Coinbase representatives were also coy on the rumours, declining to confirm any ongoing deal discussions. ,

“We have a bold mission to increase economic freedom in the world, and are constantly exploring opportunities around the world to build, buy, partner and invest to accelerate our roadmap.”

– Coinbase.

While official sources from Deribit and Coinbase keep mum, Bloomberg’s latest report suggests negotiations are progressing with the options trading platform reportedly valued between $4 billion and $5 billion.

Coinbase (COIN) Traders See Mild Gains as Deribit acquisition hints Dubia Expansion

Considering that Deribit holds an active license to operate in Dubai, Coinbase’s decision to pursue this acquisition appears to be a strategic move to expand into the Middle Eastern market. With increasing regulatory pressure from the U.S. and EU, regions such as the United Arab Emirates, Hong Kong, and Singapore have emerged as key global hubs for blockchain and cryptocurrency businesses.

The softening stance on crypto regulation in the U.S. could influence the trajectory of this deal.

With growing institutional support and strategic reserve announcements expected, the industry could witness a shift in policy under former President Trump’s potential return. Trump recently reiterated his support for cryptocurrency at Blockworks’ industry event this week.

If finalized, Coinbase’s acquisition of Deribit could enhance its global footprint, broaden its derivatives offerings, and position the exchange to benefit from increasing institutional and sovereign adoption of cryptocurrencies—particularly in the Middle East and Asia.

Will Coinbase Acquisition of Deribit Impact Bitcoin Price?

According to Bloomberg Deribit it’s the largest Options trading platform for Bitcoin and Ethereum. Options trading is an institution-dominated space.

By acquiring Deribit, Coinbase can deploy options trading offerings, not only to US-based customers but also institutions with corporate headquarters in crypto hotbeds like Dubia, Singapore and Hong kong.

Hence, the Coinbase acquisition deal for Deribit, could be yet another major catalyst that could spark increased institutional adoption of BTC in the months ahead. Notably, Donald Trump crypto strategic reserve heading for congressional approval could be a key determinant in Bitcoin global appeal as 2025 unfolds.

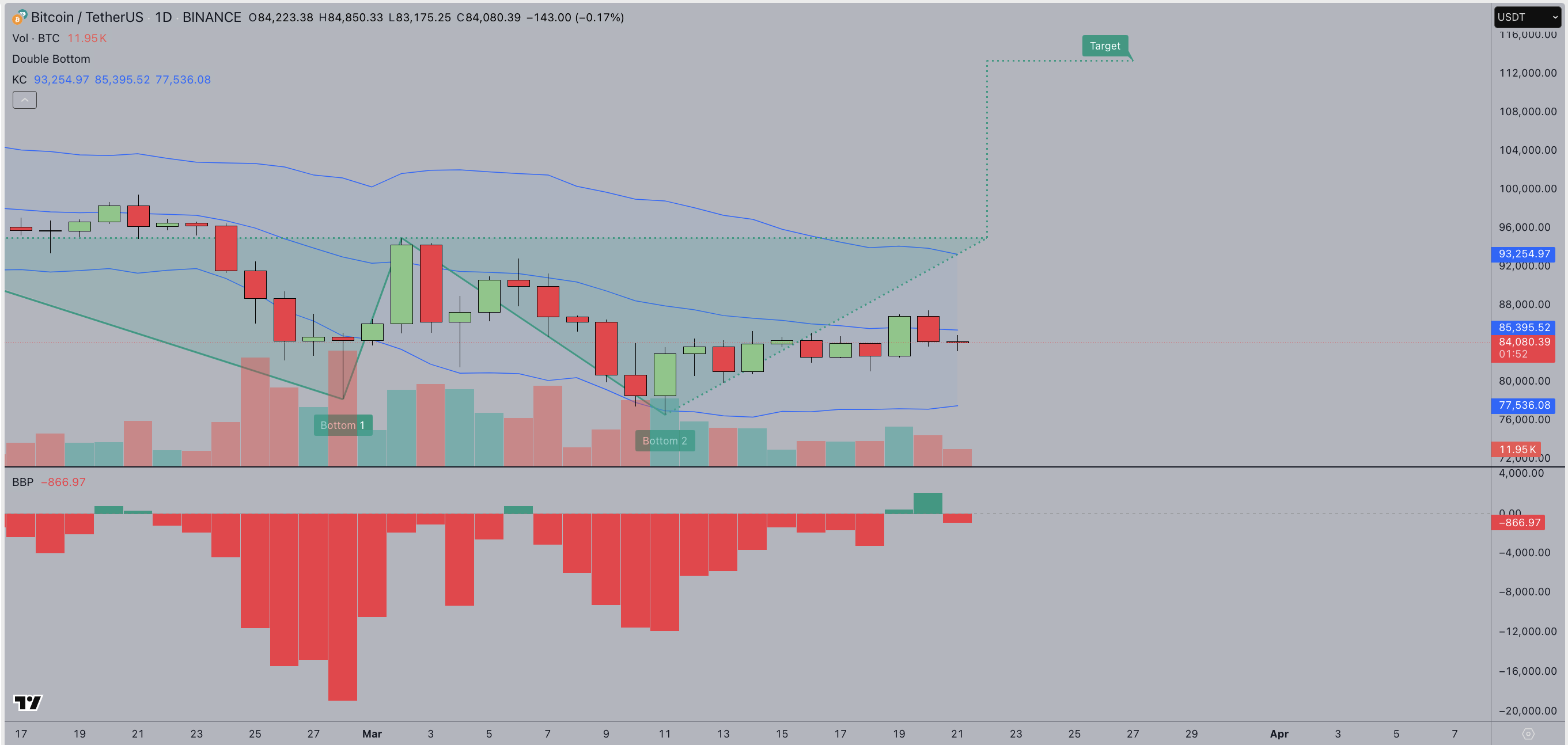

Bitcoin price forecast: Double-bottom pattern hints at $114,000 rebound target

Bitcoin price forecast signals on the BTCUSD daily chart shows a confirmed double-bottom reversal pattern, a historically bullish structure suggesting a potential move toward a long-term target of $114,000. The pattern formed with two distinct lows, at $78,000 and $76,000 followed by a breakout above the neckline resistance. At press time BTC Price is currently consolidating around $84,053, hovering near the middle Keltner Channel (KC) level of $85,392, indicating a neutral market trend as traders await the next major directional move.

A bullish scenario could unfold if Bitcoin price can decisively reclaim the upper KC boundary at $93,252, especially if accompanied by increased trading volumes. More so, the BBP (Balanced Bull and Bear Power) indicator, while still negative at -859.38, has begun a reversal with green bars emerging—an early signal of bullish divergence.

Conversely, failure to hold support at $77,533—the lower KC band—could invalidate the breakout structure, triggering renewed selling pressure. If bears regain control in the secenraio, BTC price risks retesting liquidity zones around $75,000, delaying the bullish trajectory.

The next few sessions could be pivotal; as sustained price action above $85,000 strengthens could case for a continued uptrend toward the $114,00o target.

The post Bitcoin Price Could Hit $114,000 as Coinbase Enters $5B Deal to Buy Deribit appeared first on CoinGape.