Solana (SOL) is dropping after Bitcoin closed below $103,000, forcing many altcoins to tumble. SOL is one of the worst performers today, May 15, after an intraday loss of 8% to trade at $170 at press time. More sell signals have emerged, suggesting it is facing another crash to the $150 support level.

Solana Price Crashes as Crypto Market Flips Bearish

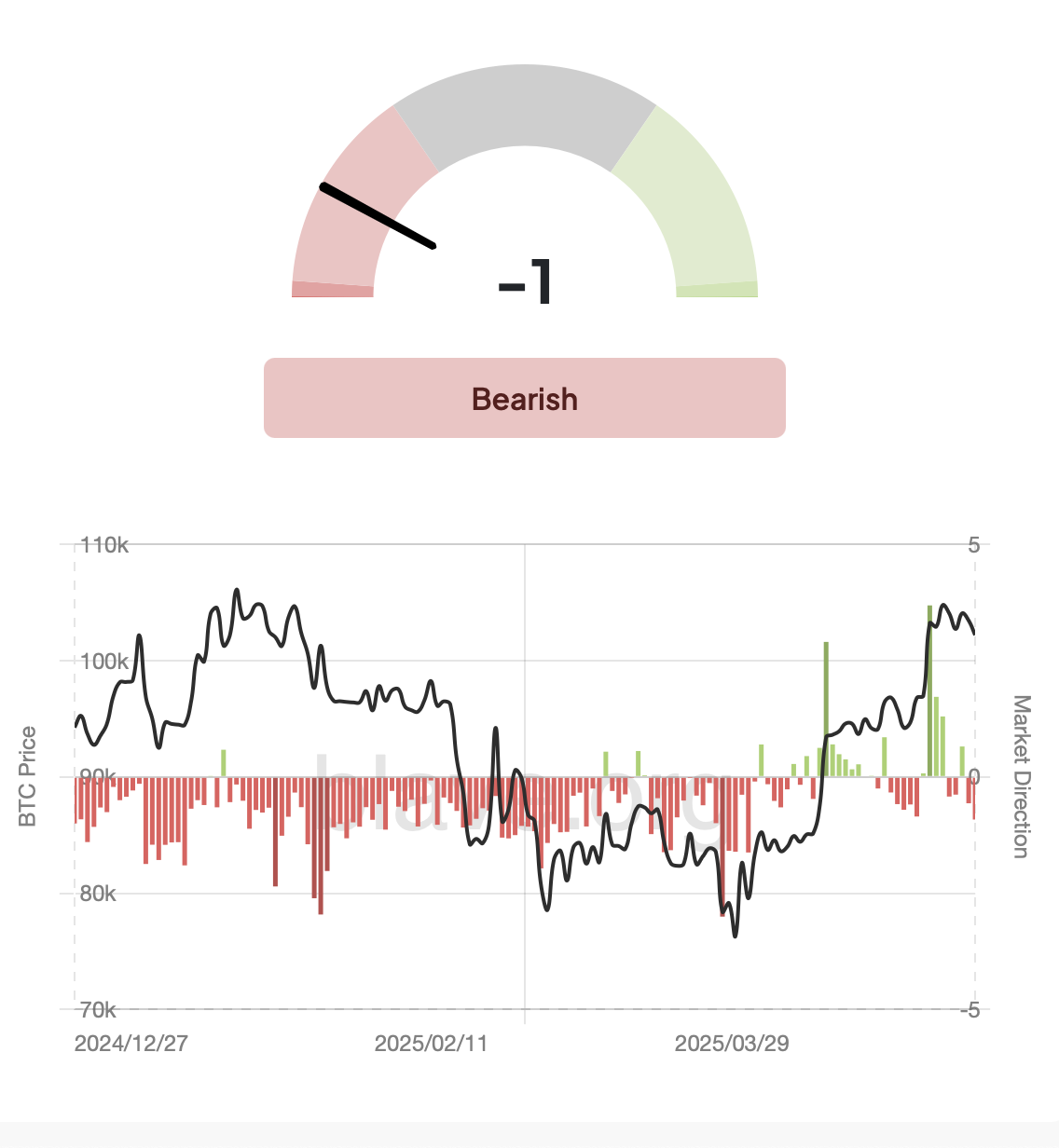

The price is Solana is dropping today as the crypto market flips bearish, as seen in the Market Direction indicator. This indicator has a value of -1, which is a sell signal that shows crypto prices will likely continue with the downward momentum.

This negative metric follows downward moves across the crypto market, with Solana price crashing from an intraday high of $181 to an intraday low of $170.

SOL’s downtrend mirrors the steep decline across the broader market, with Bitcoin dropping by around 1.4% to trade at $102,000 while other top altcoins like Ethereum and XRP have lost 2.8% and 4% of their value, respectively.

The widespread losses have caused $314 million in long liquidations in the last 24 hours, according to data from Coinglass. With bears taking control, the technical outlook suggests the SOL price will drop to test lower support levels.

4-Hour Chart Signals $150 SOL Dip

The four-hour Solana price chart shows a bearish divergence as SOL rallied towards $300 when the RSI was dropping. A similar divergence occurred in late April that led to Solana dropping by 11% in under a week to below the Volume Weighted Average Price (VWAP).

A similar trend is in play, with SOL’s recent 8% crash coinciding with a drop below the VWAP. SOL has been holding levels above this price, which supported the upward move to $184, but after losing this support, traders should watch for the previous weekly VWAP level of $161. If buyers step in at $161, it will support a bullish Solana price forecast.

Traders should note that if the $161 level fails to hold, it could cause a drop to lower levels between $150 and $153. Buyers may be waiting for such a downswing to buy low, which will allow the price to bounce back up.

Whales Open Short Positions

The Holder Concentration index shows that whales or large addresses are opening bearish bets on Solana as they expect the price to drop further. This metric has turned negative, a sign that whales are holding more short positions than long positions, which strengthens the thesis that SOL price may crash to $150.

At the same time, the index has fallen from 0.439 to -1.217 within 24 hours, which shows that whales likely exited their long positions as they are no longer dominating the market.

Considering the three metrics that all point towards a sell signal for Solana price, it is likely that a dip to $150 is next after today’s 8% crash. However, at this level, buyers will likely start accumulating again, allowing SOL to bounce back up.

The post Solana (SOL) Crashes 8% as Sell Signals Multiply – Is $150 Next? appeared first on CoinGape.