Bitcoin price holds firm above $103,000 as GD Culture commits $300M to crypto reserves, supporting bullish momentum toward $105,700 breakout.

Bitcoin price holds above $103,000 as GD Culture commits $300 million to BTC reserve

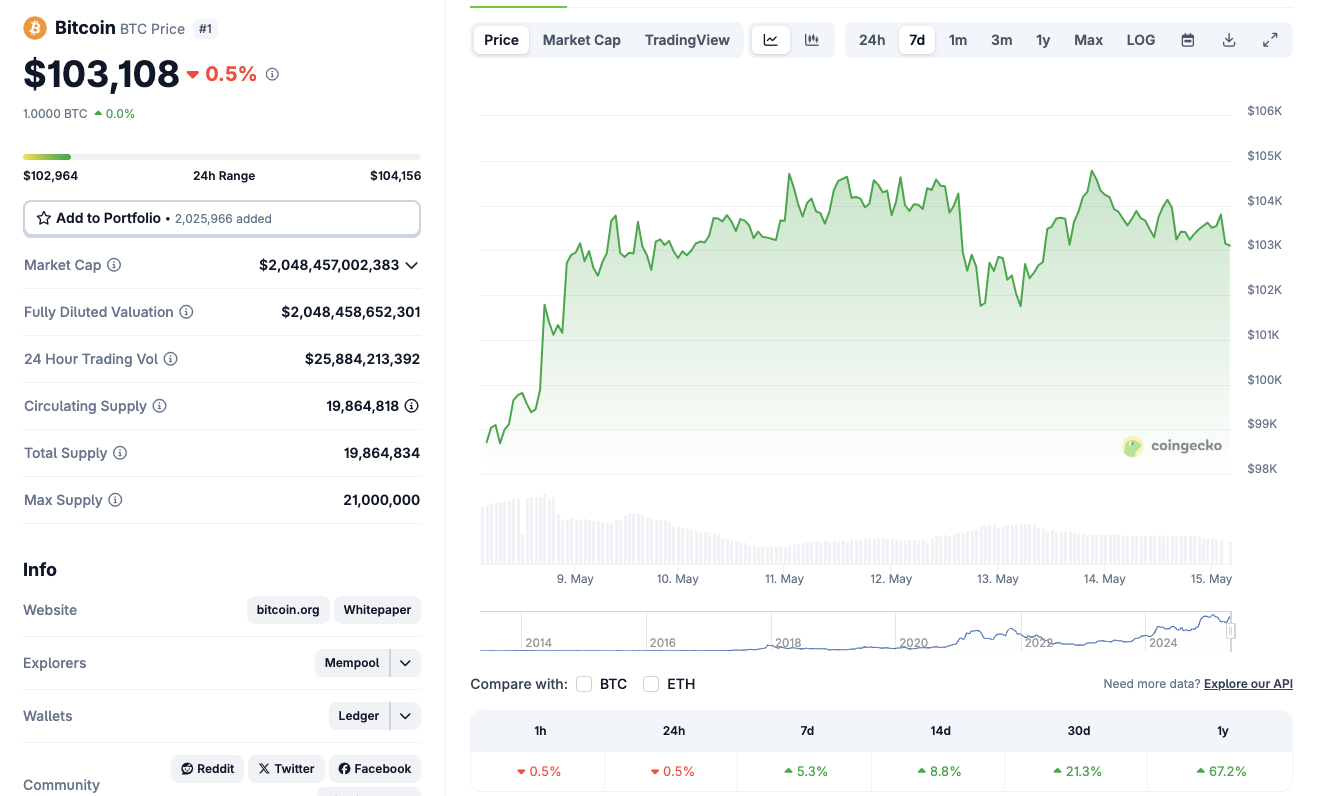

Bitcoin traded steadily above $103,000 on Thursday as GD Culture Group announced a $300 million capital injection for its crypto treasury strategy.

The funding, secured through a Common Stock Purchase Agreement, will be deployed by its subsidiary AI Catalysis to acquire digital assets including Bitcoin and Trump Coin.

The company stated this move is designed to reinforce its balance sheet and expand its exposure to decentralized financial systems.

By actively building a crypto reserve, the group aims to enhance long-term shareholder value and adopt crypto-native treasury practices.

The announcement coincided with stable Bitcoin price action, as BTC hovered just above $103,000, eyeing the $105,000 psychological level amid broader market consolidation.

$40B options open interest reaffirms bullish resilience

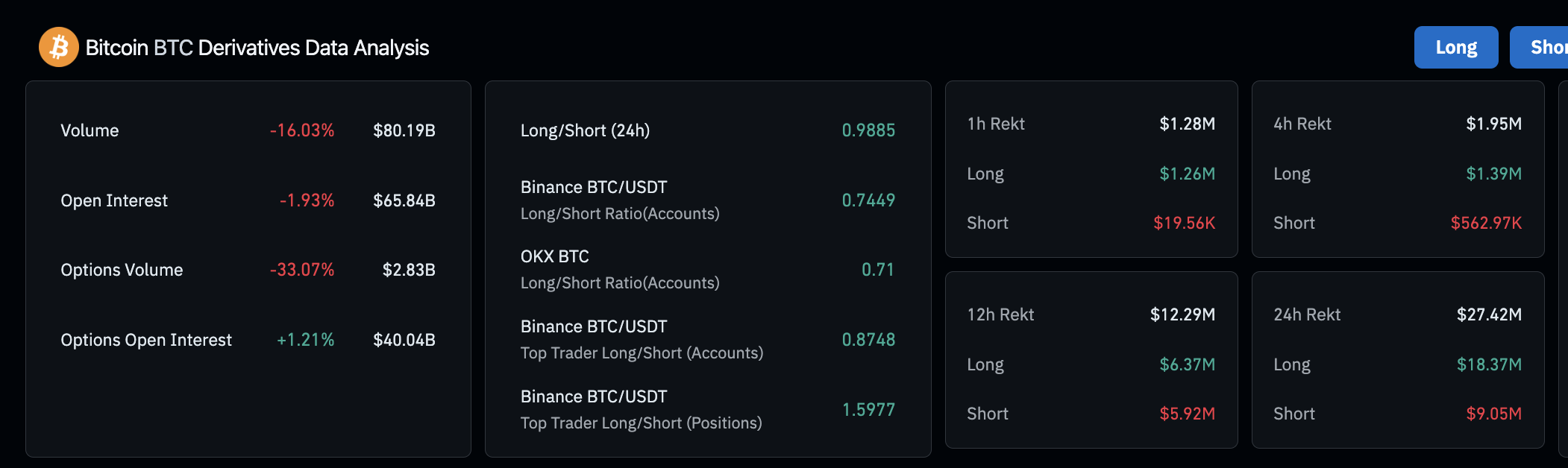

Bitcoin derivatives data on Thursday signaled continued bullish conviction among market participants, despite a drop in trading volume.

According to Coinglass, Options open interest rose 1.21% to $40.04 billion, its highest in over a week, while total open interest across BTC derivatives held firm at $65.84 billion, down only 1.93%.

This increase in options positioning, even as total volume declined by over 16% to $80.19 billion, reflects strategic accumulation amid low-volatility consolidation.

Options trading volume itself fell sharply by 33% to $2.83 billion, yet the persistence of high open interest indicates traders are holding positions rather than unwinding them. Long/short ratios across major exchanges such as Binance and OKX remained near parity, with Binance accounts showing a 0.7449 ratio and top trader positions favoring longs at 1.5977.

Rekt data further revealed $27.42 million in liquidations over 24 hours, with long traders taking the brunt at $18.37 million. The data suggests positioning is skewed bullish but not overly leveraged, reinforcing Bitcoin’s ability to absorb volatility and maintain bullish consolidation above $103,000.

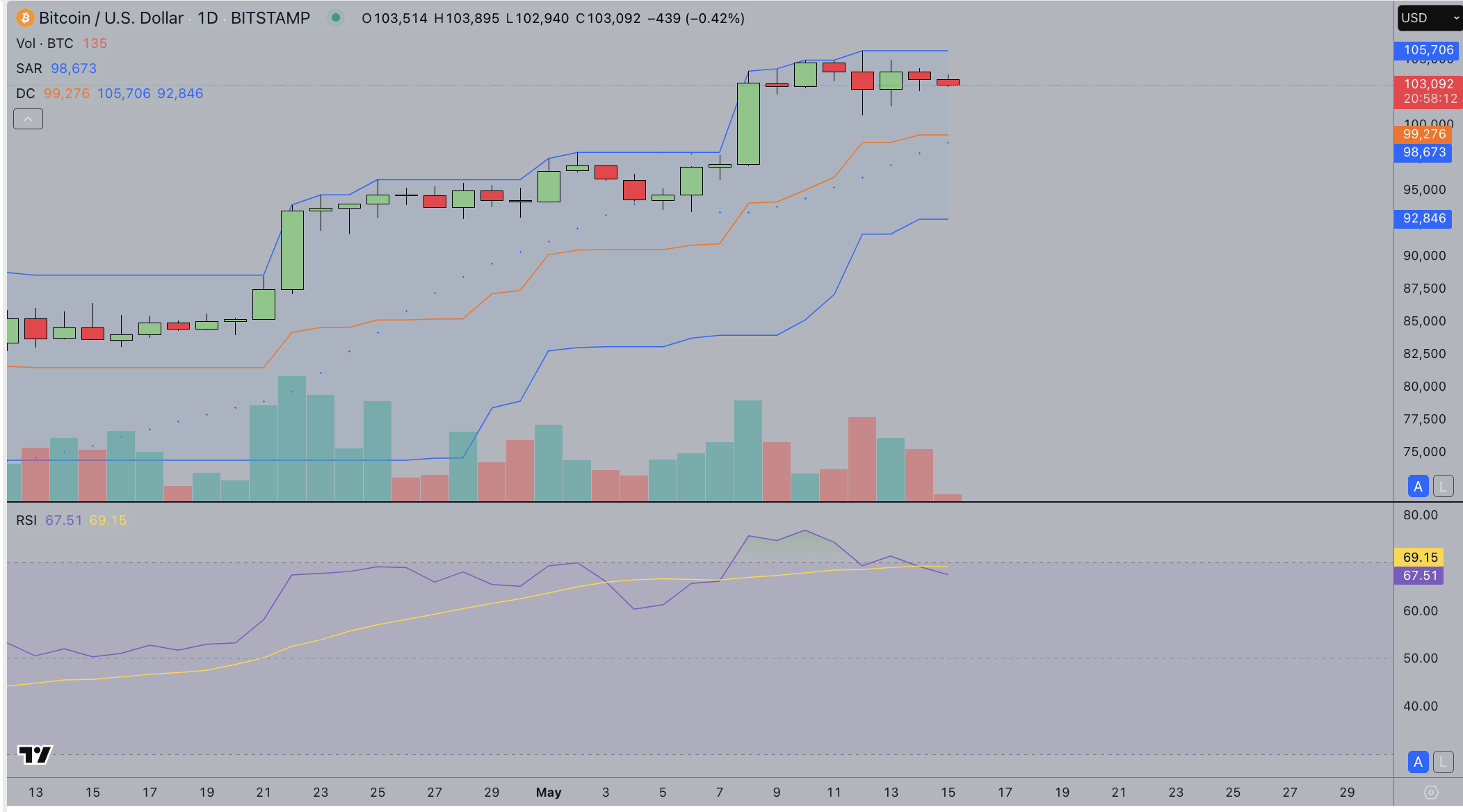

Bitcoin price forecast today: Bulls eye $105,700 breakout as momentum consolidates above $103,000

Bitcoin price held firm above $103,000 on Thursday, signaling continued strength despite short-term consolidation below the $105,706 resistance.

The Relative Strength Index (RSI) at 67.42 and 69.14 reflects ongoing bullish momentum, though it has modestly declined from its May 9 peak, suggesting a temporary cool-off in buying pressure rather than a reversal. The price remains comfortably above the Parabolic SAR level at $98,673, indicating that the bullish trend remains intact.

Volume has moderated during this consolidation phase, pointing to a healthy pause rather than a breakdown.

Support from the Donchian Channel midpoint at $99,276 provides a firm floor for price action, with the lower band at $92,846 acting as a secondary safeguard.

Bitcoin price forecast today is skewed to the upside so long as price action holds above $99,000 and maintains distance from its lower volatility bands.

A daily BTC price close above $105,700 would confirm breakout continuation toward new monthly highs, while failure to hold $99,000 could expose downside risk to the SAR level. Current indicators suggest bullish resilience, backed by declining sell volume and a structure that continues to respect ascending trend signals.

The post Bitcoin Price Holds Above $103K as GD Culture Commits $300M to Crypto Reserves, $105.7K Breakout Next? appeared first on CoinGape.