Solana price broke above $180 as Pump.fun’s new revenue-sharing model renewed bullish momentum and creator-driven trading activity.

Solana (SOL) Breached $180 amid Pump.fun Revenue Sharing Update

Solana climbed to $183.61 Tuesday, gaining 5.8% as Pump.fun announced its new 50% revenue sharing initiative for coin creators.

The platform will now distribute 0.05% in SOL per trade to eligible creators, a move poised to drive adoption and incentivize continuous token launches. The model includes all coins actively trading, newly created, or those graduated to PumpSwap.

Solana price action, May 13, 2025 | Source: Coingecko

Market participants responded swiftly. The announcement, which garnered over 1.7 million views, reaffirmed Solana’s role in the creator economy and drew a fresh wave of speculative and builder-driven interest.

Solana price looks set for more upside action in the coming days as rising engagement from meme-fueled platforms like Pump.fun could further reinforce the network’s appeal during cycles of memecoin-led rallies

Derivatives Data Validates Bullish Thesis as Traders Load Longs

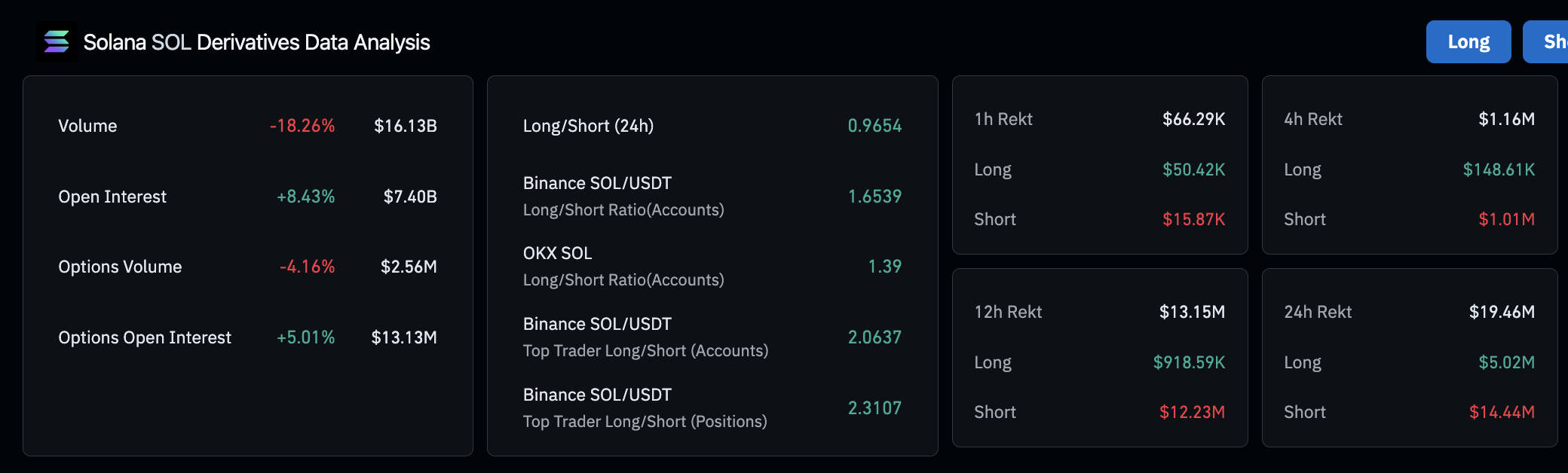

Coinglass derivatives trading data show increased capital inflows within Solana markets. On Tuesday, SOL Open interest jumped 8.43% to $7.40 billion, showing new capital entering the market.

Although trading volume declined 18.26% to $16.13 billion, the rise in open interest suggests sustained positioning rather than short-term exits.

Options markets also show a mild rebound in positioning, with open interest up 5.01% to $13.13 million despite a 4.16% drop in options volume.

Long/short positioning tilts clearly bullish. On Binance, the top trader long/short ratio stands at 2.31, and OKX accounts show a ratio of 1.65, both indicating leveraged bets favoring upside.

This directional bias is further supported by liquidation data: in the last 24 hours, $19.46 million in positions were wiped out, with $14.44 million from shorts, and just over $5 million long positions closed.

Combined with Pump.fun’s incentive alignment, the derivatives setup adds technical weight to the argument for a near-term continuation on the ongoing Solana price rally toward $190 to $195.

Solana Price Forecast Today: Bullish Continuation Eyes $190–$195 Range

Solana (SOL) is trading at $183.29, holding firm above the $179.11 midline of the Keltner Channel (KC), signaling a continuation of bullish structure.

The daily candle structure shows consistent closes above the KC basis line, reinforcing strength in the current uptrend. Notably, SOL is also trending near the KC upper band, suggesting that a breakout attempt toward the $190–$195 range remains technically valid in the near term.

The presence of wide-bodied bullish candles since May 9, supported by increasing volume, highlights renewed buyer conviction. The Parabolic SAR at $154.80 remains well below the current price, indicating trend strength is intact and that any near-term downside pressure would likely be corrective rather than structural.

Importantly, the Bollinger Band %B (BBP) indicator at 32.89 shows SOL remains in the upper half of its volatility band, a common feature of sustained rallies. This echoes the technical setup seen in the Bitcoin price forecast today, where BTC too is trading above key bullish trend markers.

While a brief pause near $183.75 resistance could lead to short-term consolidation, the rising volume profile and broadening volatility range support the likelihood of a continuation move.

Should SOL price close decisively above the KC upper band, momentum could accelerate toward the $195 mark.

On the flip side, failure to maintain above $179, however, may open the door to a retest of the KC midline and potentially the 20-day SMA region near $160.47.

The post Solana Price Moves Above $180 amid Pump.fun 50% Revenue Sharing Signal appeared first on CoinGape.