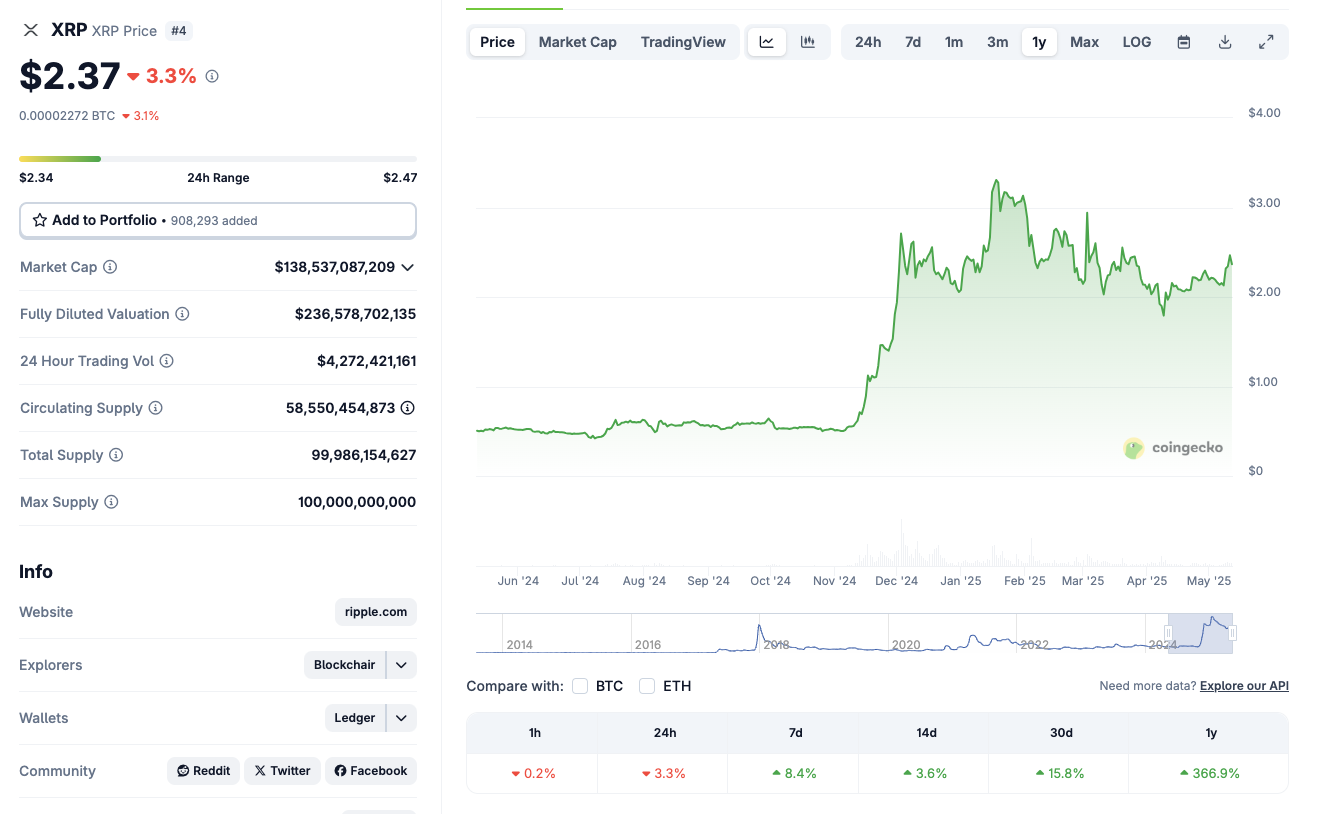

Ripple (XRP) price plunged 2.7% on Sunday, May 11, bucking the broader crypto market rally, as a fresh legal controversy involving U.S. President Donald Trump triggered a wave of profit-taking.

The pullback erased approximately $360 million in XRP trading market volume on Sunday, reigniting regulatory risks around Ripple, just days after securing a 50 million legal settlement in its long-running case against SEC.

Ripple (XRP) Price Decouples from Market Rally as BTC Holds Above $104,000

Ripple (XRP) price struggled for traction on Sunday, despite Bitcoin extending its recovery above $104,000. Other layer-1 rivals Ethereum and Solana also gained 5.4% and 4.8% respectively according to Coingecko data. In contrast, XRP price slipped 2.7% to $2.41, decoupling from the market rally.

The underperformance was catalyzed by renewed legal concerns after reports surfaced that President Trump, who recently called for XRP to be part of a “strategic crypto reserve”, may have been misinformed about Ripple’s ongoing regulatory standing.

Just days after Ripple secured a long-awaited $50 million final settlement with the SEC, this perceived political endorsement has inadvertently attracted fresh scrutiny.

XRP/BTC ratio fell 3% to its lowest level in two months, confirming the decoupling trend and reinforcing bearish divergence in cross-asset sentiment.

This metric often serves as a proxy for institutional allocation preferences, and the current trend suggests Ripple price may continue lagging if the broader rally persists without a sentiment reversal.

Why is XRP Price Going Down Today?

Ripple’s recent downturn follows a news-driven rally that began with regulatory clarity. However, price action has failed to hold above $2.50, an area tested thrice in the past 30 days and rejected each time with significant sell-side pressure.

The latest legal flare-up centers around Ripple being mentioned in a presidential policy draft as a strategic digital asset for U.S. reserves.

Sources close to Capitol Hill say the inclusion may have stemmed from lobbying input misaligned with the token’s regulatory profile. The backlash was swift: compliance bodies reportedly reopened due diligence reviews, and sentiment in legal-risk-sensitive trading desks quickly turned defensive.

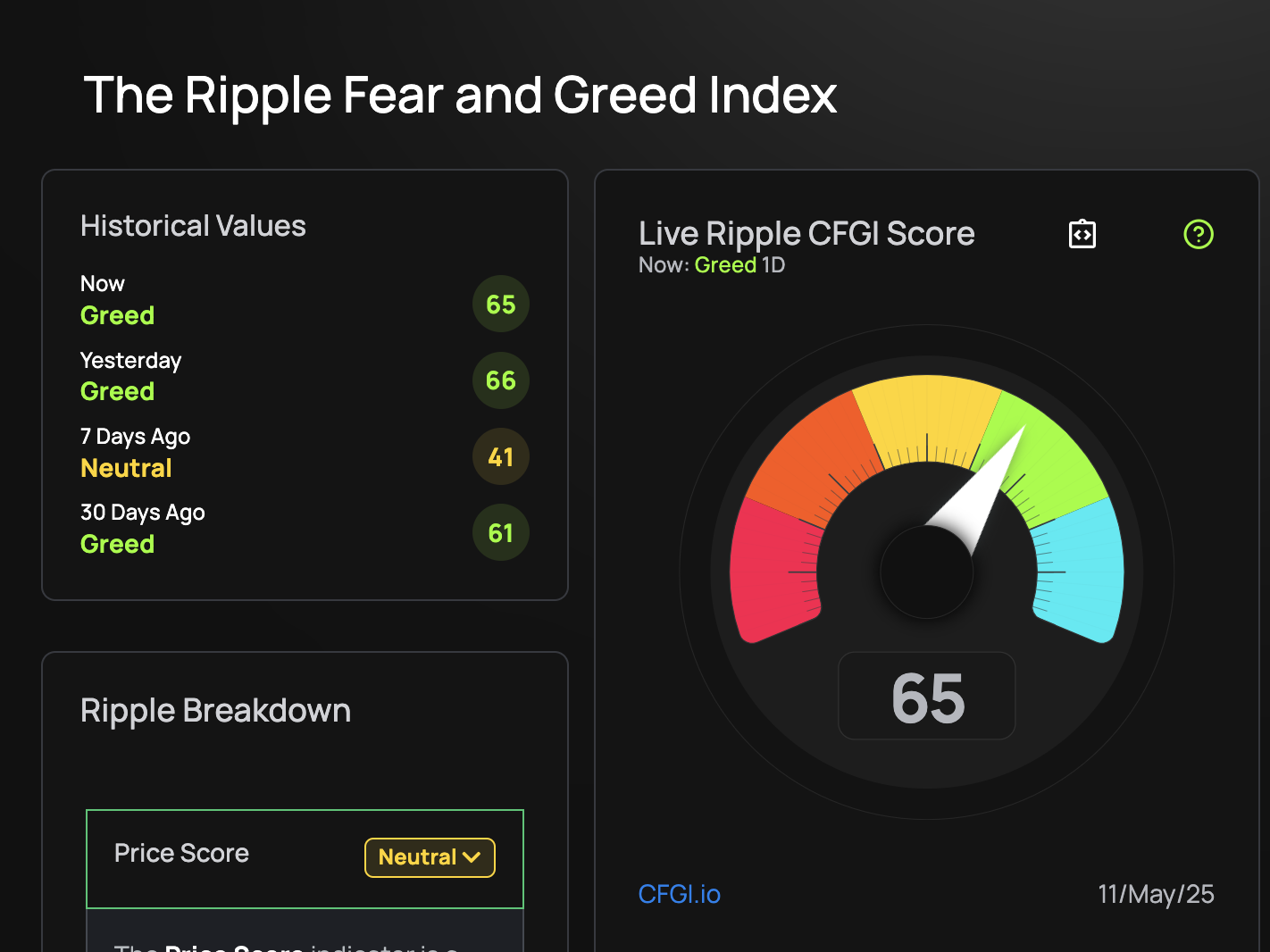

This fresh uncertainty arrives amid already stretched technical conditions. The XRP Fear and Greed Index slipped from 78 to 63 within 24 hours, while social sentiment turned net-negative, according to data from CFGI.io and LunarCrush.

Weekly RSI, which had reached an overbought 74 on Friday, reversed sharply to 65, indicating loss of upward momentum..

If market risk appetite continues without XRP participating, the $2.25 support zone may fail, opening a retest of the 20-day EMA at $2.09.

What do XRP Derivative Traders Anticipate in the Week Ahead?

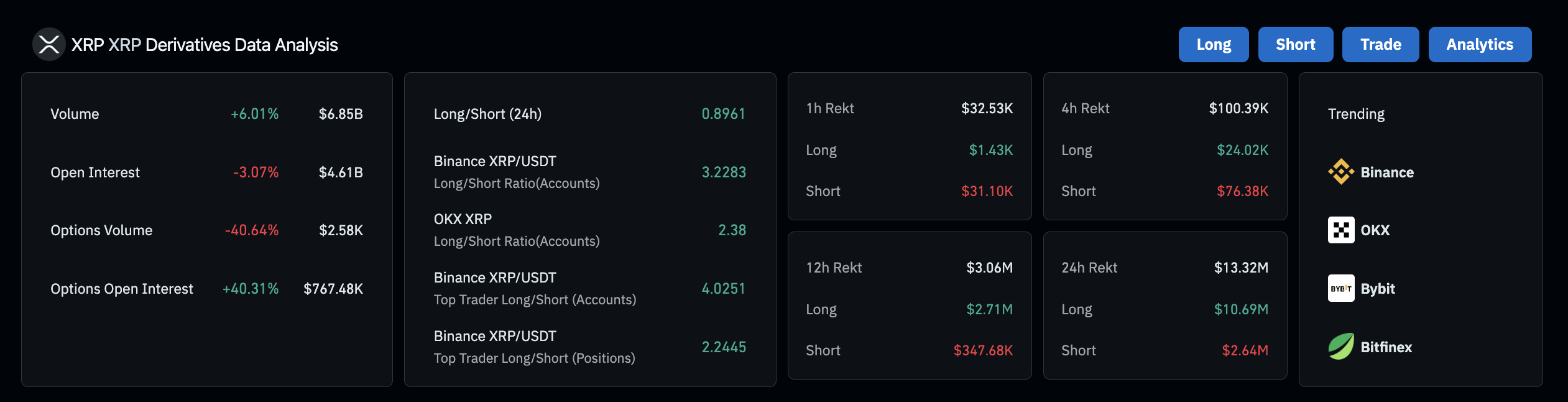

XRP derivatives suggest heightened caution heading into the new week. Despite an initial spike in long contracts following the SEC settlement, weekend activity showed a pronounced reversal. Open Interest across major platforms such as Binance and Deribit declined by 4.7%, indicating deleveraging as traders braced for headline volatility.

The funding rate on perpetual futures has turned neutral, a sharp shift from the 0.03% positive premium observed last Thursday.

Without a positive catalyst to restore price stability, XRP is likely to consolidate below $2.40 or potentially test the $2.25-$2.09 support range. A break below those levels could invite more aggressive short positioning and trigger a stop-loss cascade across margin platforms.

Until legal clarity stabilizes, derivative traders appear content with a defensive posture, awaiting a decisive technical reclaim above $2.50 or further downside to re-enter large positions, as indicated by the $360 million decline in trading volume on Sunday.

XRP Price Forecast: XRP Holds Above $2.36 Support as Bulls Defend Upside Continuation

XRP’s daily candle on May 11 closed with a sharp -4.32% drop, printing a full-bodied Marubozu Black bar, often indicative of bearish control.

Despite the aggressive pullback, XRP has found short-term support at $2.36, which coincides with the midline of the Keltner Channel (KC).

This dynamic level, at $2.2366, is critical; maintaining price action above it preserves the broader bullish structure built since late April. Importantly, the lower KC band at $2.005 provides a secondary support region should the market deepen its correction.

Momentum remains cautiously tilted to the upside. The recent breakout above $2.46 earlier this week suggested buyers had recaptured directional control.

Despite Friday’s volume delta registering a steep negative -33.09 million and a cumulative volume reversal, XRP remains structurally bullish above the KC midline.

The previous volume clusters in early May point to accumulation rather than distribution. As such, the ongoing pullback may represent a healthy correction before continuation.

Bitcoin price forecast today reflects consolidation around key support zones, and XRP typically correlates with BTC’s broader momentum.

If Bitcoin maintains strength above its own technical mid-bands, XRP could rebound toward the upper KC at $2.4682 and retest $2.50 psychological resistance. A daily close above this level would validate continuation toward $2.70.

In contrast, a breakdown below $2.2366 would expose XRP to accelerated losses toward the $2.00 zone, aligning with increased sell-side delta pressure.

For now, bullish momentum remains viable while XRP holds $2.36, and price action must be closely watched at the KC median to determine the next breakout or breakdown path.

The post XRP Price Analysis: Ripple Enters Another Legal Controversy as Trump’s Support Triggers $360M Profit-Taking appeared first on CoinGape.