Bitcoin price stays firm above $103,000 as BlackRock’s crypto ETF discussions with SEC spark speculation of a long-term rally toward $120,000.

Bitcoin (BTC) Holds Firm at 120-Day Peaks

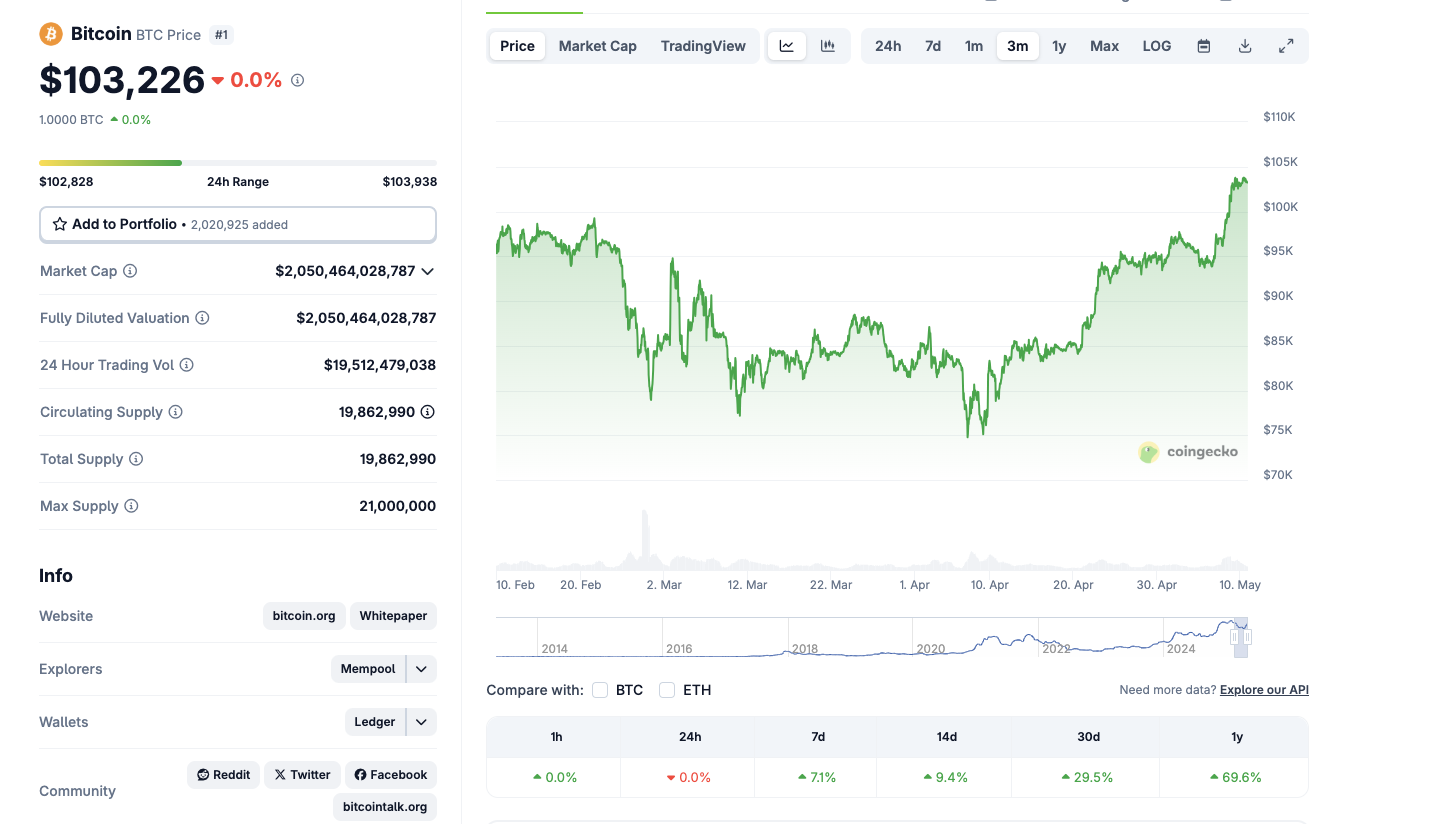

Bitcoin price climbed to a 120-day high of $103,890 on Friday, propelled by favorable macro conditions and renewed institutional appetite.

Despite multiple rejections near $105,000, BTC price maintains a steady floor above $102,500, suggesting solid buyer interest.

Coingecko data indicates that while short-term traders are rotating into altcoins, long-term holders remain broadly inactive, emphasizing conviction in Bitcoin’s upside potential.

Compared to earlier consolidations, this current range shows significantly higher volume and stability, with volatility compression hinting at an imminent directional move.

With broader market sentiment still risk-on and macro liquidity expectations improving, the foundation for a push toward $120,000 is increasingly plausible.

BlackRock Engages SEC on Staking and Options Integration in Crypto ETFs

In a strategic development, BlackRock held discussions with the U.S. Securities and Exchange Commission focused on integrating staking and options trading into future crypto ETF structures.

The dialogue centered around the feasibility of enabling staking rewards within regulated ETF frameworks and outlined technical considerations for offering options on these funds.

While regulatory hurdles remain, the willingness of the world’s largest asset manager to pioneer these features signals growing institutional readiness to deepen crypto exposure.

If approved, staking-enabled ETFs could provide passive yield to holders, while options-based ETFs would allow for broader hedging and speculation by corporate and institutional players.

These enhancements could attract substantial inflows, potentially pushing Bitcoin beyond its previous all-time highs at $107,000.

The post Bitcoin Price Watch: $120,000 Rally Ahead as BlackRock Enters BTC Staking Discussion with SEC appeared first on CoinGape.