The FTX Collapse of November 2022 continues to haunt its users even today. Sam Bankman‑Fried (SBF), the once‑high‑profile founder of FTX, is now serving a 25‑year prison sentence for defrauding over one million customers.

Even celebrity endorsers – Tom Brady, Stephen Curry, and Shohei Ohtani – are facing lawsuits from investors seeking to recoup losses.

This seems legit. FTX’s downfall wiped out roughly $11 billion in user funds and has fundamentally reshaped trust in centralized exchanges (CEXs).

As new derivatives platforms and crypto exchanges struggle to prove their credibility in this post‑FTX environment, CoinGape sits down with Andrea Soto Reig, Marketing Head at Bitunix.

Andrea guides us how they’re rebuilding user confidence and trust in their platform Post-FTX World.

[In fact] A lot has changed, especially in terms of trust and security. If previously users weren’t too concerned about where they were keeping their assets and what exchange they were using, now they are much more cautious.

Many people lost money and confidence. Instead of just chasing profits, users now ask questions like: “Where is my money kept?” “Can I withdraw anytime?” The event also pushed the industry to be more transparent.

Since emerging on the landscape in 2021, the Derivatives-focused exchange, Bitunix, has over 2 million registered users with $5 billion in cumulatively trading volume.

FTX Didn’t Kill But Changed the Ways, Says Andrea

The SBF-led decline of FTX has been unpopular for the whole web3 industry. After the Chapter 11 bankruptcy plan’s approval in January, 2025, initial distributions to creditors are on.

However, according to the reports, nearly 400,000 creditors of the bankrupt cryptocurrency exchange FTX fear missing out on $2.5 billion in repayments due to legal formalities.

Owing to this, the collapse has deeply reshaped the CEX landscape both operationally and reputationally.

Bitunix Marketing Head Andrea says,

At Bitunix, we’ve noticed users are more informed now and more curious. They look for proof of reserves, security measures, and how funds are protected.

So overall, it didn’t kill trust in CEXs, but it changed the way trust needs to be earned. No more blind faith. It’s now about showing real responsibility, not just talking about it.

Is Maitaining PoR Enough for Exchanges To Secure Users’ Trust

One thing that FTX collapse changed significantly in the operational segment of CEXs is the publication of Proof of Reserves.

As the cryptographic auditing mechanism, PoR lets users independently verify the ratio of how much assets a CEX holds vs what it claims. It provides On-chain or publicly verifiable”snapshots” of an Exchange’s holdings. These are then matched against the total liability to its users.

Post‑FTX, leading centralized exchanges began regularly publishing Proof‑of‑Reserves (PoR) to restore confidence. Binance published its first Mazars‑audited Bitcoin PoR on November 22, 2022, and continues periodic updates till today.

OKX rolled out a live PoR dashboard in late 2022, offering real‑time proofs. Other names that started this practice include Kraken, BitMEX, Deribit.

Also Read: Celsisum Founder Sentenced to 12-years Prison

However, according to Bitunix Marketing Head Andrea, just maintaining PoR is not enough.

After the FTX collapse, users now care much more about security, so this is a trend (very positive) that will remain for the next few years,” says Andrea.

The most important is that Bitunix has full Proof of Reserves (PoR) approval. This means 100% of user funds on the platform are fully backed by real assets — users can verify this and know their money is safe.

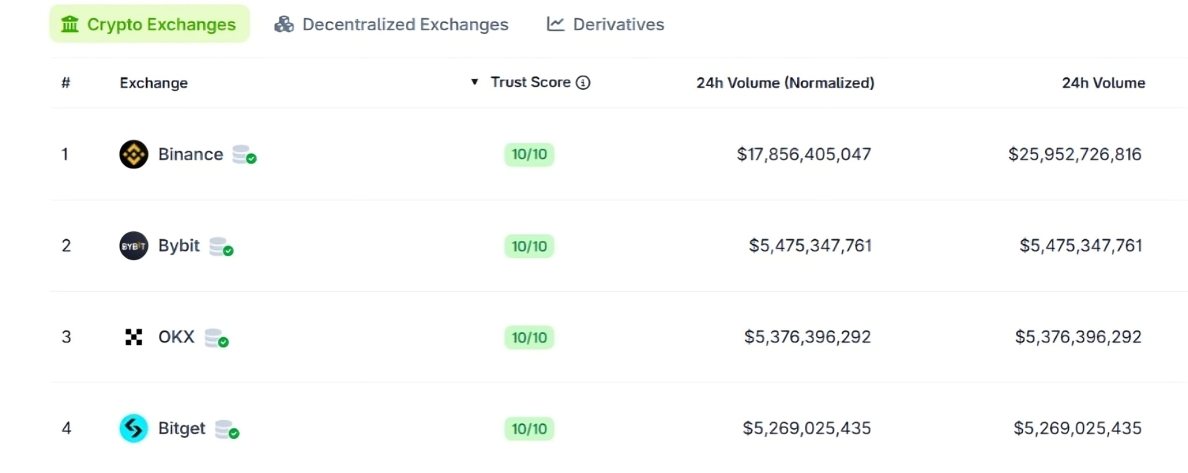

But it’s not just about having PoR — it’s also about what those reserves are made of. If you look at rankings like CoinMarketCap, many exchanges show PoR, but some hold volatile or risky tokens like memecoins.

At Bitunix, we’ve chosen to back user assets with more stable and trusted tokens: Bitcoin, USDT, Ethereum, etc… This reduces risk and ensures price stability when it comes to protecting user funds.

Also Read: Mark Zuckerberg Returns to Crypto

What FTX Taught to Users and Exchanges

FTX collapse taught many things to crypto users and exchanges. According to Marketing Head Andrea,

The FTX collapse taught us that trust without proof is dangerous. No matter how big or respected a platform seems, users should always demand transparency. For exchanges, the lesson is simple: don’t mix customer funds, don’t over-leverage, and don’t hide your balance sheet.

For users, it’s about not blindly trusting platforms just because they’re popular. Exchanges need to publish Proof of Reserves, be clear about who controls the money, and always allow withdrawals without delay.

Another myth is that if an exchange is big, it must be safe, which FTX proved wrong. The truth is, that exchanges vary a lot in the way they operate. Some hold user funds properly and stay transparent, while others cut corners.

Last Lesson As FTX Schedules its Next Repayments Process On May 30

Around 460,000 former FTX users are awaiting their repayments from the collapsed exchange.

Under the approved Chapter 11 bankruptcy plan, FTX has initiated its creditor repayment process in February. The cumulative amount is as high as $13 billion in reimbursements.

As of May 9, 2025, only the initial “Convenience Class” repayments have been completed. This implies that 162,000 accounts or 35% of the 460,000 eligible convenience‑class claimants have received their funds so far.

The next repayment tranche for claims over $50,000 is scheduled to begin on May 30, 2025.

One last lesson from Andrea as FTX continues its repayments process is:

The number one thing FTX should keep in mind is the human side of this story. These aren’t just accounts on a screen, they’re people who lost savings, time, and peace of mind.

If they’re repaying users, the process needs to be fair, fast, and transparent. No vague updates. No favoritism. Every user, big or small, deserves clear communication.

They have to be close to the ones who lost their assets and compensate them. For the industry, this could be a small step toward healing, but only if it’s handled the right way.

Also Read: Timeline of FTX Repayment

The post Post-FTX World: Bitunix Marketing Head Discusses Building Brand Trust And CEX Derivatives appeared first on CoinGape.