Bitcoin price breaks $100,000 on May 8, 2025, as ETFs, Fed pause, and state crypto laws fuel rally. Will BTC now advance to new all-time highs?

Bitcoin clears $100,000 first time in 120-days

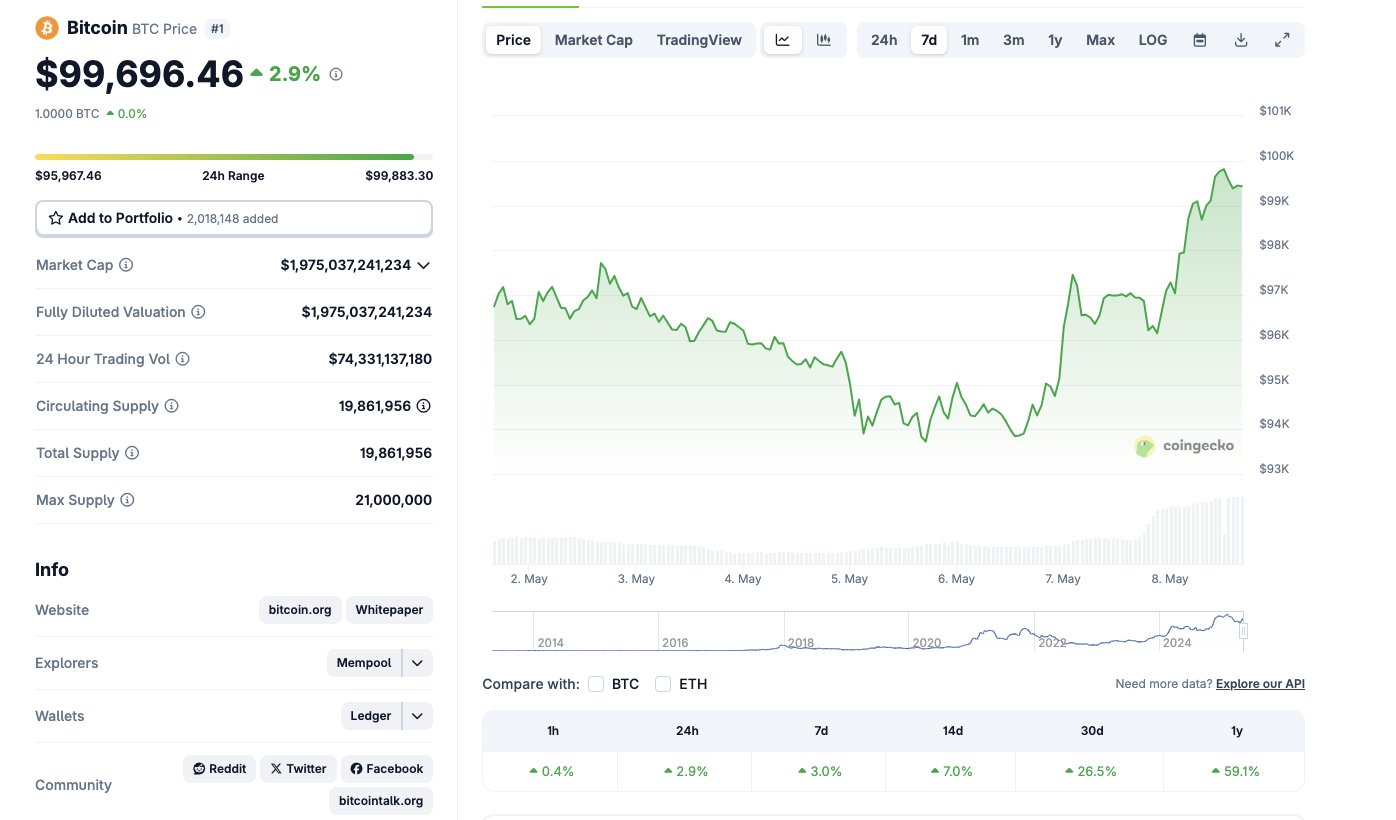

Bitcoin price crossed the $100,000 mark on Thursday, May 8, 2025, trading at its highest level since February. The milestone represents a 4.5% 24-hour gain, pushing BTC to $100,800 at the daily peak before settling near $99,696 at press time.

The renewed BTC price rally on Thursday can be attributed to a convergence of macroeconomic signals, adoption milestones across US states, amid surging institutional demand from Bitcoin ETFs.

Coingecko data further shows data BTC price gained 26.5% in the past 30 days and 59.1% over the last year. Traders now anticipate another leg up as BTC eyes new all-time highs, less than 10% away from breaching its previous record around $107,000.

4 factors that drove Bitcoin price above $100,000

1. Trump-UK trade deal drives renewed risk appetite

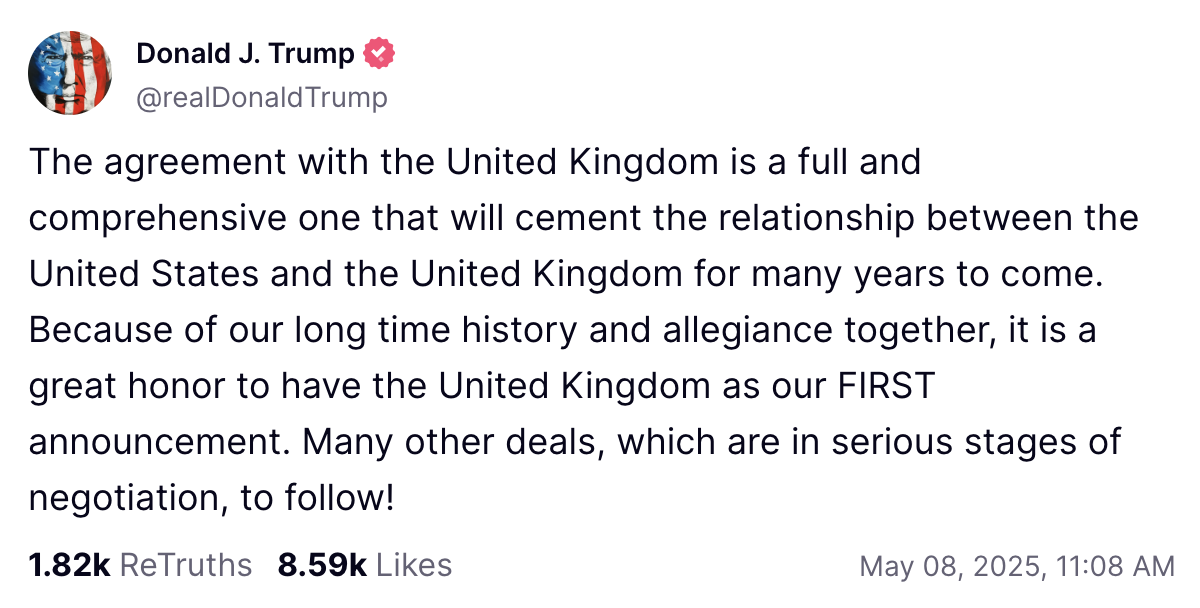

Market sentiment turned sharply bullish following a formal announcement from President Donald Trump confirmed a comprehensive trade agreement with the United Kingdom. The message emphasized the depth of US-UK relations and hinted at more bilateral deals in the pipeline.

The trade optimism has sparked renewed investor appetite for risk assets, with Bitcoin among the biggest beneficiaries.

Trump’s executive order establish crypto strategic reserve in March 2025. has helped frame Bitcoin as a strategic hedge against geopolitical uncertainty and global de-dollarization risks.

2. Three US states enact major crypto laws in rapid succession

- Arizona Governor signed House Bill 2749 into law:

On May 7, Arizona Governor Katie Hobbs signed a bill establishing a Bitcoin and Digital Assets Reserve Fund. The fund will be managed by the state treasurer and composed of digital assets obtained through airdrops, staking rewards, and accrued interest.

The bill follows the governor’s veto against Senate Bill 1025, which had proposed investing 10% of states $32 billion Treasury assets in cryptocurrencies and NFTs.

Hobbs cited a preference for budget-neutral, lower-risk strategies in approving HB 2749. The newly-approved law now allows Arizona to engage in passive crypto asset management while maintaining fiscal conservatism. Staking rewards from unclaimed assets held over three years will also be funnelled into the reserve.

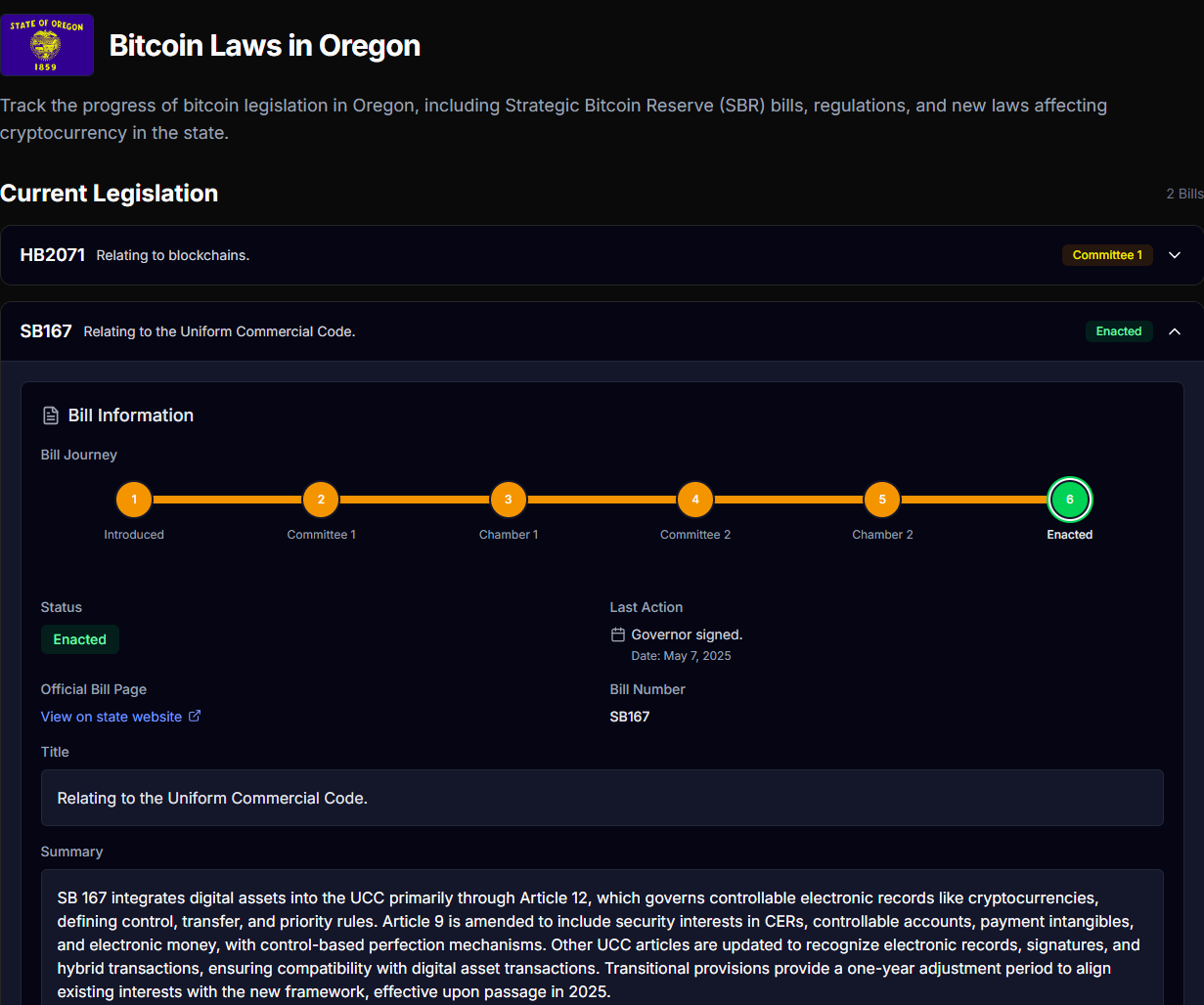

- Oregon enacts Senate Bill 167:

Oregon state amended the state’s Uniform Commercial Code to include digital assets such as cryptocurrencies, tokenized instruments, and electronic money. Signed into law by Governor Tina Kotek, the legislation introduces UCC Article 12, providing legal clarity on how digital assets can be used as collateral and managed in secured transactions.

The new rules also recognize electronic signatures and records, easing digital commerce integration. Transitional provisions give parties a one-year adjustment period. Prior to the update, crypto assets operated in legal gray zones under state law.

With this move, Oregon strengthens its infrastructure for asset-backed crypto innovation and enterprise use cases.

- New Hampshire becomes first state to adopt Crypto reserve:

New Hampshire became the first US state to approve Treasury laws to receive and hold Bitcoin in reserve. The move follows prior legislative actions that permitted tax payments in crypto and explored blockchain-based public record systems.

The latest statute, passed on May 8, directs the state to accept Bitcoin from federal forfeitures, grants, and settlements as reserve assets.

It does not authorize discretionary market purchases but ensures crypto assets entering public custody are lawfully held and secured. Treasury officials will partner with approved custodians to manage private keys and staking operations.

3. Fed pause and recession risks reinforce Bitcoin hedge appeal

On Wednesday, US Federal Reserve held interest rates steady in its latest FOMC meeting but flagged rising unemployment as a growing concern. Investors now anticipate multiple rate cuts later in 2025 to cushion a slowing economy.

The shift in tone has rekindled the inflation hedge narrative around Bitcoin, with capital rotating out of treasuries and into hard assets.

Bitcoin’s fixed supply continues to appeal to investors preparing for policy easing and potential currency debasement. Market expectations of looser monetary policy have lifted global risk asset markets and has evidently played a role in driving BTC price above $100,000.

4. Institutional demand and ETF inflows intensify

Institutional capital has remained a key pillar of support during the current rally. Following renewed tensions between the United States and China, large corporate players have accelerated capital allocation into Bitcoin.

Exchange-traded funds (ETFs) have played a pivotal role in this dynamic. Over the past 13 trading days, Bitcoin ETFs recorded net inflows of $5.3 billion, with only two days of outflows.

On April 30 and May 6, net redemptions were modest at $56.3 million and $85.7 million, respectively. The consistent inflows indicate sustained institutional conviction and reflect Bitcoin’s growing status as a macro asset class comparable to gold or tech equities.

What’s next?

Bitcoin’s latest move above $100,000 places it within reach of entering a fresh price discovery phase. With only a single-digit percentage gain needed to break prior highs, markets are watching closely for institutional confirmation. If large players hold out for new highs, the rally could extend well into Q2.

However, some analysts suggest a partial rotation into altcoins may occur if Bitcoin shows signs of exhaustion. Capital rotation could benefit Ethereum, Solana, and newer sectors like Crypto AI tokens.

Looking ahead, the direction of Fed policy and geopolitical trade talks will remain key catalysts in the weeks ahead.

The post Bitcoin price tops $100K as 3 US states approve crypto BTC reserve laws in 24 hours appeared first on CoinGape.