The crypto market will receive a boost next week when the Securities and Exchange Commission (SEC) hosts a roundtable on tokenization. This meeting, which BlackRock will participate in, marks a major shift in how the agency regulates the industry. This article looks at the top 5 altcoins that will explode ahead of the SEC meeting with BlackRock and other firms.

Key Altcoins to Watch Ahead of SEC’s Meeting with BlackRock

Top altcoins in the Real World Asset Tokenization industry will surge ahead of the inaugural SEC roundtable on tokenization. This event will take place on May 12 and will have representatives from companies like BlackRock, Franklin Templeton, Apollo Management, Invesco, and Robinhood. Collectively, all these firms have over $15.6 trillion in AUM.

The roundtable will also have representatives from top companies in the crypto market like Securitize, DTCC, Blockchain Capital, and Maple Finance. It will happen at the agency’s headquarters, and according to SEC’s Hester Pierce, it will generate ideas on how the SEC should approach the industry.

Some of the top altcoins to buy ahead of the SEC meeting with BlackRock are Ondo Finance (ONDO), Ethereum (ETH), Ethena (ENA), Chainlink (LINK), and Stellar (XLM).

Best RWA Altcoins to Buy

Ondo Finance (ONDO)

Ondo is one of the top RWA altcoins to buy before the SEC roundtable. It is a top player that offers yield-bearing stablecoins like US Dollar Yield (USDY) and US Treasuries Yield (OUSG).

It will likely do well because it partners with BlackRock and Securitize. The OUSG token is backed by BlackRock’s BUIDL, which was launched in partnership with Securitize.

ONDO price has formed a falling wedge chart pattern on the daily chart, and it is above the ascending trendline that links the lowest level since March 24. As such, it will likely retest this trendline and then surge towards the meeting.

Ethereum (ETH)

Ethereum is another top altcoin to buy. Its main relationship with BlackRock is that the company runs ETHA, the biggest spot Ethereum ETF in the industry. It will also be a major player in the tokenization industry.

ETH price has formed a small bullish flag pattern on the daily chart, pointing to an eventual rebound to $2,135, the lowest level in August last year. A move above that level will point to more gains, possibly to $2,500.

Ethena (ENA)

Ethena runs USDe, the fourth-biggest stablecoin with over $4.6 billion. Its main catalyst is that it has a partnership with Securitize, which will participate in the SEC meeting with BlackRock and other companies. They are building the Convergence Blockchain and are collaborating on USDtb, a stablecoin backed by BlackRock’s BUIDL.

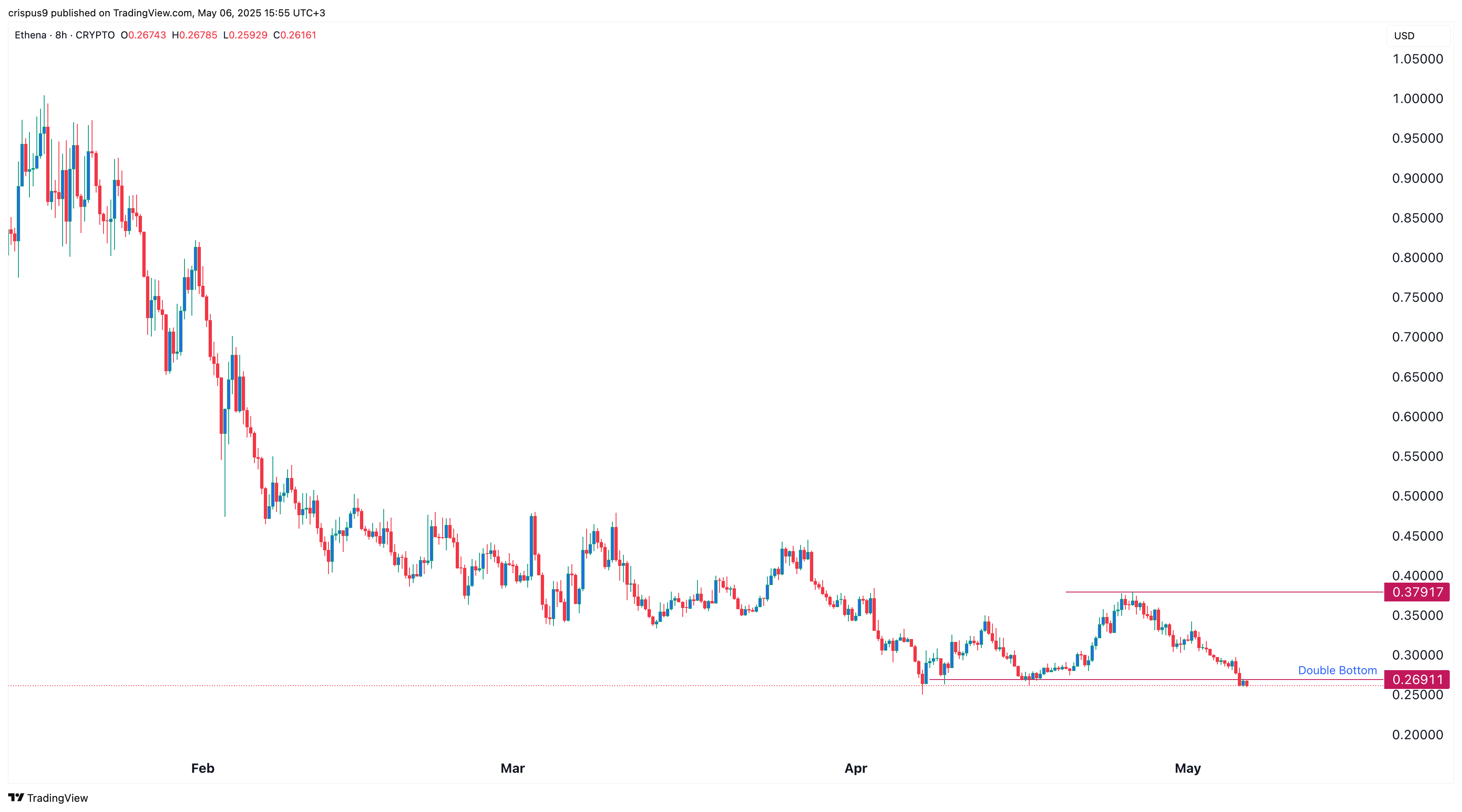

Ethena price has formed a double-bottom pattern at $0.2690, pointing to an eventual rebound in the coming weeks. If this happens, the value of ENA will likely rise to the resistance at $0.3791.

Chainlink (LINK)

Chainlink is one of the top RWA altcoins that may explode ahead of the SEC meeting with BlackRock. It will benefit because its Cross-Chain Interoperable Protocol (CCIP) feature is the backbone of many tokenization projects.

LINK price has formed a giant megaphone pattern on the weekly chart, pointing to more gains in the coming weeks. The target will be $30, up by 135% above the current level.

Stellar (XLM)

Stellar is one of the top crypto tokens that may surge ahead of the meeting. That’s because Franklin Templeton will also participate in the roundtable. Franklin’s $450 million tokenized fund runs on the Stellar’s network.

The most likely Stellar price forecast is bullish because it has formed a falling wedge pattern. It has also retested the support at $0.25, and could rebound soon.

Summary on the Top Altcoins to Buy

This article has identified some of the top altcoins to buy ahead of the SEC meeting with BlackRock and other firms. Most of these crypto tokens have a relationship with BlackRock and are large players in the RWA industry.

The post Why These 5 Altcoins Will Explode Ahead of SEC’s Meeting With BlackRock? appeared first on CoinGape.