Dogecoin price struggles under the $0.18 resistance as geopolitical tension rises. Here’s how DOGE could react if it matches 30% of US M1 Supply.

Dogecoin (DOGE) Faces Mild Pullback Amid India-Pakistan Crisis

Dogecoin (DOGE) price momentum has weakened over the past two weeks, mirroring broader risk-off sentiment in the broader crypto markets. This bearish sentiment further intensified on Tuesday, amid rising geopolitical tensions between India and Pakistan, which have triggered caution across global equities markets.

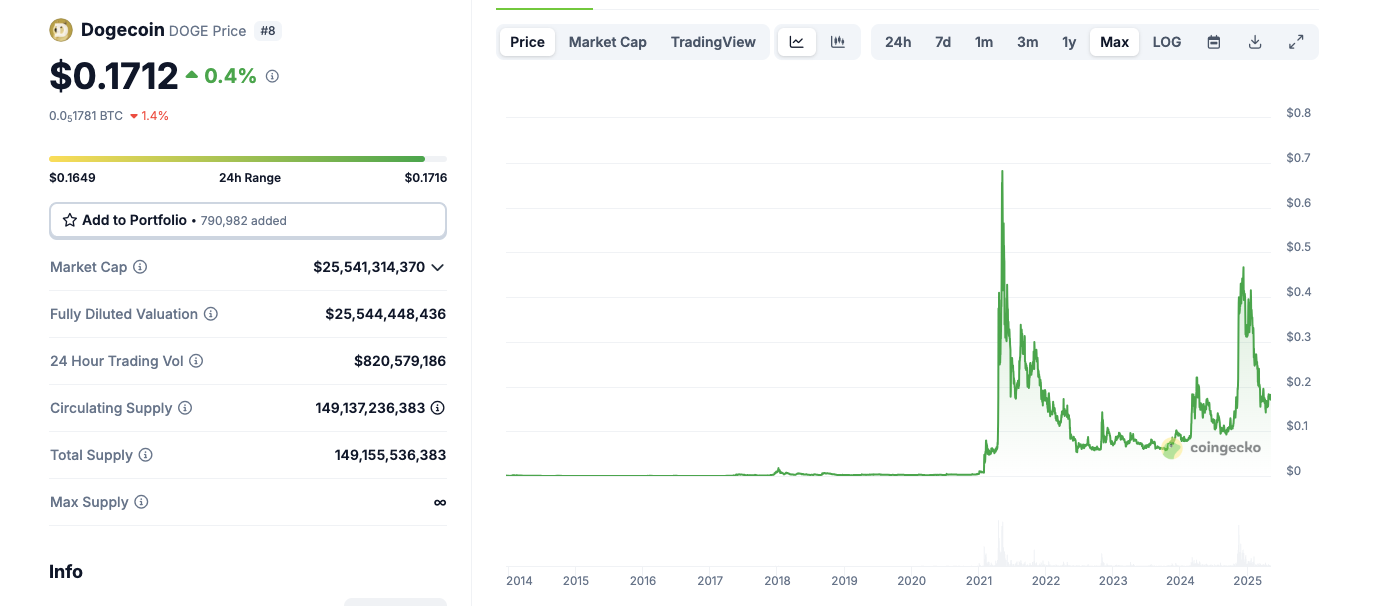

As of May 6, 2025, DOGE trades at $0.1712, reflecting a 0.2% drop in 24 hours, a 1.7% loss over the past week, and a 4.1% decline in the last 14 days.

Dogecoin price struggles under the $0.17 at press time Tuesday, as the meme coin has repeatedly failed to break above the key psychological resistance level at $0.18 during a broader market recovery earlier during the trading session.

The current DOGE price downturn reflects a cautious stance by traders, given the absence of Dogecoin-specific catalysts and increased volatility in global macroeconomic conditions.

Against Bitcoin, Dogecoin is also losing ground, currently trading at 0.051781 BTC, which marks a 1.4% daily decline.

This underperformance relative to BTC indicates that investors are rotating capital out of higher-risk assets like DOGE and into more established cryptocurrencies and high liquidity markets.

U.S. M1 Supply Trends Boost Long-Term Bullish Case for Risk Assets Like Dogecoin

Like other risk assets, DOGE price benefits when central banks expand liquidity, especially through mechanisms like increases in the U.S. M1 supply.

M1 includes physical currency and demand deposits, essentially the most liquid portion of the money supply.

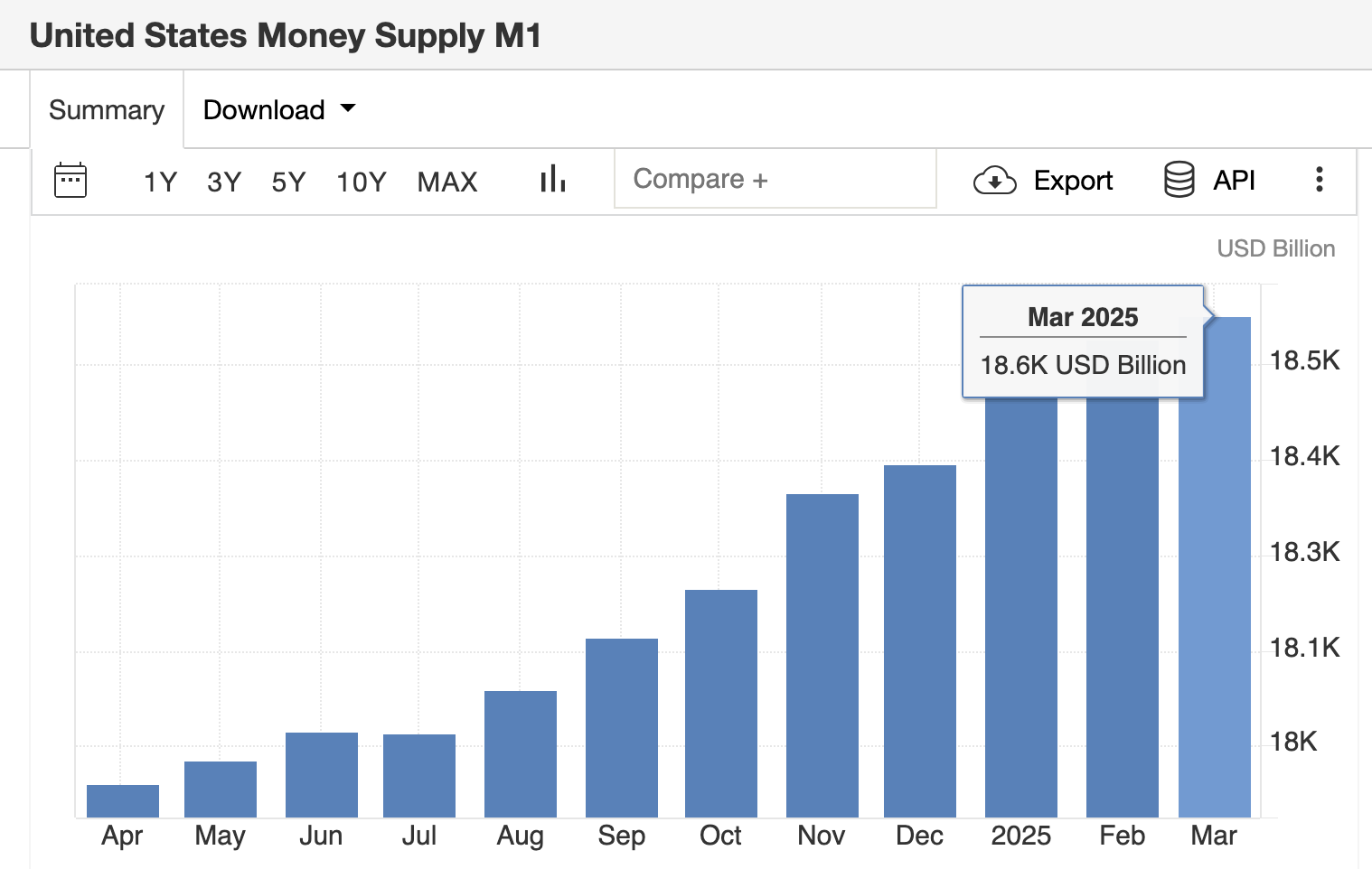

According to recent Federal Reserve data, U.S. M1 stands at approximately $18.5 trillion, having more than doubled since the 2020 pandemic era.

This expansion has historically benefited risk-on assets like tech stocks and cryptocurrencies. Increased M1 often correlates with looser financial conditions, more speculative capital, and higher retail inflows into digital assets.

With persistent inflation and rising fiscal deficits, analysts expect further pressure on the Fed to maintain accommodative liquidity conditions through 2025.

The correlation between rising M1 and crypto price appreciation has held across past bull cycles.

With Dogecoin ETFs under review with the US SEC, if approved, investors view it as a speculative hedge against fiat devaluation. If DOGE adoption increases during a period of monetary expansion, its could enter a parabolic price breakout.

Here’s Dogecoin Price Prediction If It Matches 30% of U.S. M1 Supply

Dogecoin price would reach approximately $35.60 per coin if it matched 30% of the U.S. M1 supply. This is based on the assumption of a $6.1 trillion valuation, 30% of $18.5 trillion, and a projected 150 billion DOGE supply.

This speculative scenario represents a 20,700% gain from today’s price of $0.1712. It assumes near-universal DOGE adoption across U.S. transactions, payments, and reserves, an unlikely but mathematically plausible forecast. Even if DOGE captured just 5% of M1, the token could trade around $5.93, a level unseen even during the 2021 bull run where it hit an all time high of $0.73.

Such a price surge would require fundamental catalyst, such as mainstream integration, and significant institutional demand for Dogecoin ETFs.

The post How High Could 1 Dogecoin Price Go If It Matches 30% of US M1 Supply? appeared first on CoinGape.