Bitcoin price surged 3% on Thursday, climbing above $97,000 for the first time in two months. The rally was fueled by multiple bullish catalysts that reinforced investor confidence in BTC’s mid-term trajectory.

BTC price surges on ETF optimism and Saylor’s $21B push

Bitcoin (BTC) rose 3.4% this week, trading near $97,000 at press time. According to Coingecko data, Bitcoin price traded as high as $97,341, driving its market above $2 trillion for the first time since early March.

The BTC price surge followed news that 21Shares filed for a spot SUI ETF, helping restore regulatory sentiment.

This came just days after the SEC postponed decisions on seven altcoin ETF applications.

The new SUI filing suggests the delays are procedural, not signs of rejection, which reassured markets.

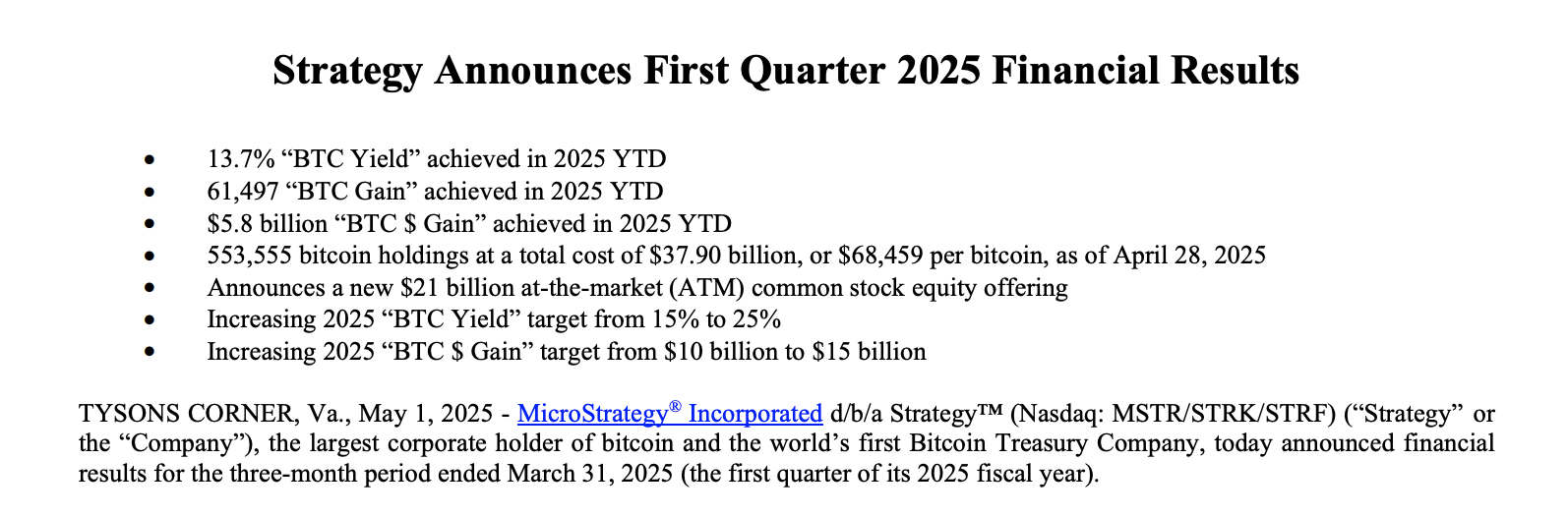

Adding to the bullish momentum, Strategy, led by Michael Saylor unveiled Q1 results and a massive new investment plan.

Despite a $4.2 billion unrealized loss in Q1 2025 due to quarter-end BTC pricing, the company launched a $21 billion at-the-market (ATM) equity offering to buy more Bitcoin.

Strategy currently holds over 553,000 BTC at an average cost of $68,459. The firm also raised its 2025 BTC yield target from 15% to 25%, citing strong early-year performance.

Importantly, Strategy’s report highlighted a $12.7 billion accounting uplift from the switch to fair value accounting, boosting retained earnings. This marks a broader shift in corporate Bitcoin adoption, with over 70 public companies now holding BTC on their balance sheets.

Institutional momentum is now building on multiple fronts:

Renewed ETF activity, fair value accounting for corporate holders, and continued capital inflows. BTC’s sharp rebound above the $96,500-$97,000 zone confirms this bullish bias.

A weekly close above $97,000 could unlock the path to $105,000 in the near term, with some analysts projecting a move toward $145,000 by Q3 if macro tailwinds persist.

The post Bitcoin Price Prediction: BTC Eyes $145,000 Rally as Michael Saylor Launches Another $21B Plan appeared first on CoinGape.