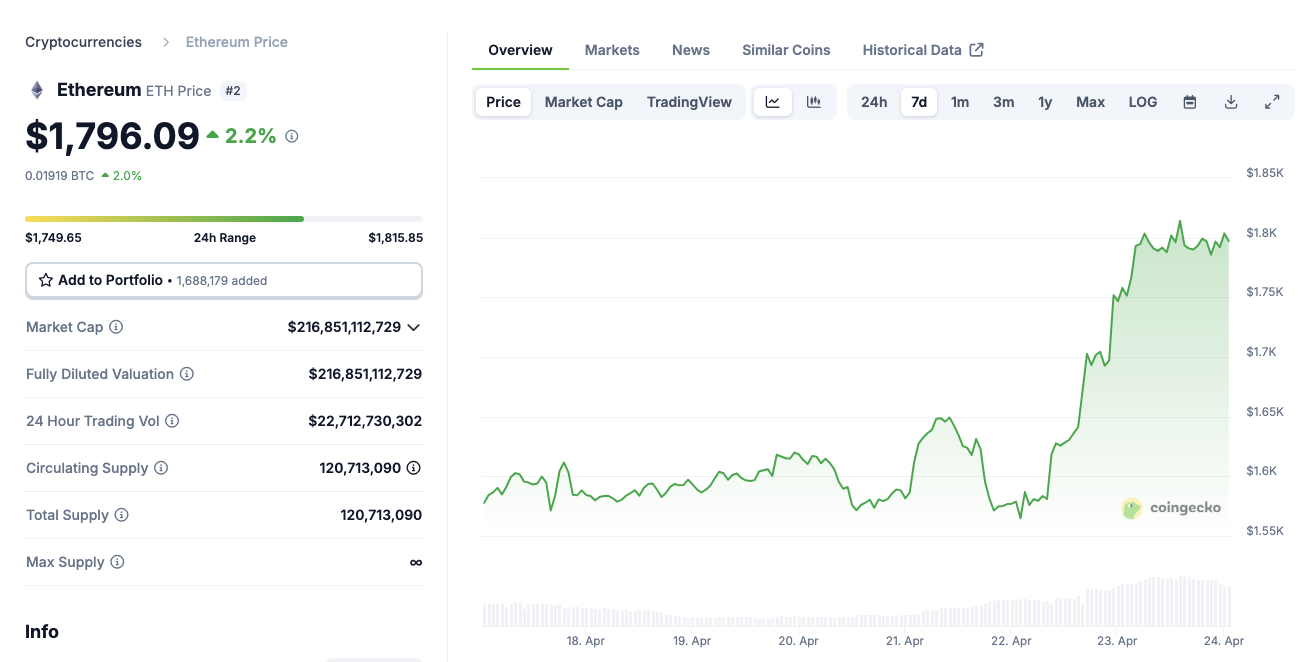

Ethereum price touches $1,800 for the first time in April as Solana post stronger gains, on the weekly timeframe. Can ETH catch the altcoin market momentum?

Ethereum (ETH) Price Crosses $1,800 first time in April

Ethereum (ETH) breached the $1,800 level on Wednesday for the first time this month, marking a significant technical milestone. The rally came amid a sharp increase in trading activity, with 24-hour volume rising from $60.66 billion to $78.06 billion — a 28.73% spike.

However, after reaching a high of $1,818, ETH has since pulled back to $1,790, reflecting broader market hesitation and competitive pressure from rival chains like Solana.

The initial price surge mirrored a general upswing across the crypto market as risk appetite coinciding softer improving macro sentiment as Trump softens stance on trade tariffs this week.

Still, Ethereum’s retreat below the $1,800 psychological level suggests a potential near-term top, as traders assess whether the network can keep pace with competitors in the high-performance smart contract space.

Solana (SOL), Ethereum’s major Layer 1 rival, has gained 20% over the past week, crossing $150 on Wednesday. In contrast, ETH’s 15% weekly gain — peaking at $1,818 — underscores the widening divergence in investor enthusiasm.

While Ethereum remains the second-largest cryptocurrency by market cap, its share of overall crypto trading activity is narrowing, raising questions about its ability to catch-up the market momentum.

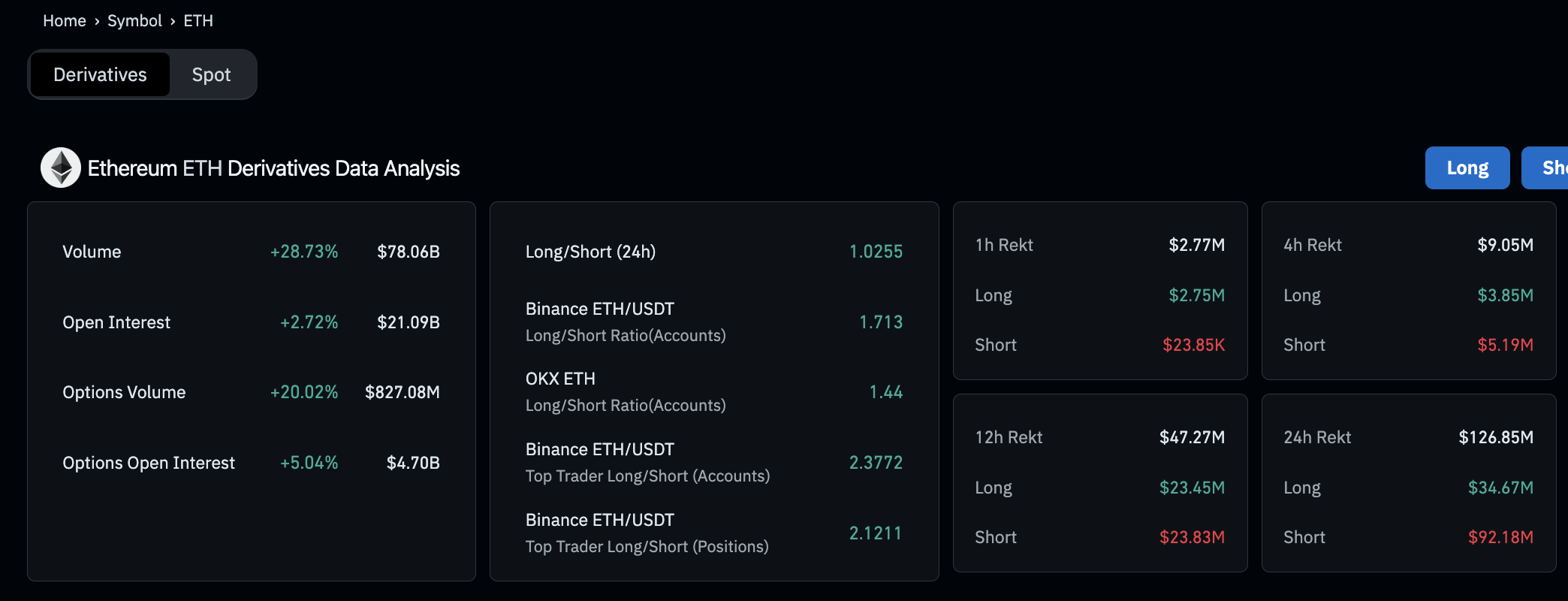

Ethereum Derivatives Trading Volume Crosses $78B

Ethereum’s derivatives market is seeing a sharp uptick in activity, indicating heightened speculative interest. Coinglass’ latest data shows ETH derivatives trading volume jumped 28.73% in the past 24 hours to $78.06 billion.

At the same time, open interest climbed 2.72% to $21.09 billion, while options trading rose 20.02% to $827.08 million. These metrics suggest an active buildup of bullish positions as market sentiment improves.

The long/short ratio on Binance ETH/USDT sits at 1.0255, indicating a slight long bias, while top trader ratios skew more decisively bullish: 2.3772 for accounts and 2.1211 for positions.

This hints that Ethereum whales are actively betting on continued price upside. However, high liquidation data — with $126.85 million wiped in 24 hours (including $92.18 million in shorts) — points to elevated volatility and rapid position adjustments.

The $17.4 billion surge in daily volume represents a clear increase in market engagement, though not all signs point to sustained bullish continuation. Ethereum’s price is consolidating just below resistance, and failure to break decisively above $1,800 could lead to a short-term retracement toward $1,750–$1,760.

What’s Next

Ethereum’s next move hinges on whether buyers can retake control above the $1,800 threshold. While derivatives data suggests underlying strength, ETH must outperform rivals like Solana to reassert dominance.

With macro conditions improving and risk appetite rising, a confirmed breakout could see ETH price test $1,850–$1,880. However, failure to hold $1,790 risks renewed bearish pressure in the coming sessions.

Ethereum Price Forecast Today: ETH Eye $1,820 Retest With Bullish Momentum Building

Ethereum price forecast signals lean positive as ETH continues to hover near a critical resistance zone around $1,800, with bulls looking to push the price toward $1,820. The daily chart reveals a decisive breakout from recent consolidation, supported by rising momentum and a positive RSI oscillator structure.

Notably, the Relative Strength Index (RSI) has surged to 39.72 from sub-20 levels earlier in April, indicating improving bullish momentum and a possible trend reversal. The RSI MA crossover has turned green with strength, reflecting growing buyer conviction.

A daily close above this 100-day SMA at $1,821 would confirm bullish continuation toward the $1,880 region.

Meanwhile, Bitcoin price forecast today suggests also leans bullish, with BTC setting new peaks in each of the last three days of trading, supporting broader market sentiment and reinforcing ETH’s upside potential.

However, the 200-day SMA near $2,328 remains a longer-term hurdle, and failure to hold above $1,790 could invite bearish pressure back toward $1,720.

The post Ethereum Price Analysis: Critical Moment for ETH as Trading Volume Surges $17.4B in 24 Hours appeared first on CoinGape.