Bitcoin price continues to struggle under the $90,000 mark on Tuesday April 22, as into crypto in response to Trump’s onslaught on the US Fed Chair unsettling global financial markets.

In an exclusive interview, AMLBot CEO Slava Demchuk hints how compliance standards and blockchain analytics tools could improve global investor confidence and accelerate sovereign adoption of cryptocurrencies.

Crypto Hacks Hampering $5 Trillion Market Cap Growth Target

The cryptocurrency market is targeting a $5 trillion valuation in its next bull cycle but faces a growing spate of security breaches.

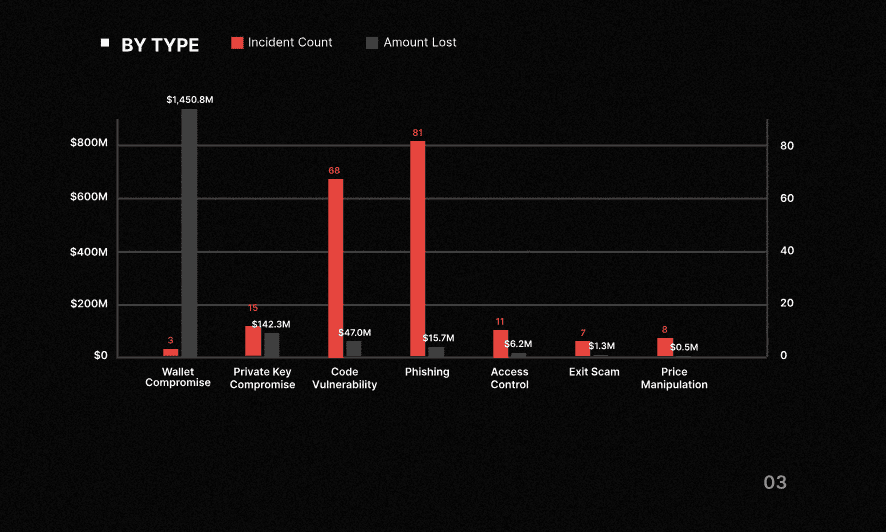

According to CertiK’s Q1 2025 Hacked report, total losses from 197 crypto crime incidents reached approximately $1.67 billion—more than three times the losses recorded in the previous quarter.

One of the largest incidents involved centralized exchange Bybit, which suffered a $1.45 billion exploit. CertiK reports that attackers are increasingly relying on sophisticated methods, including social engineering, AI-generated scams, and smart contract manipulation, to evade detection.

With institutional interest expanding and sovereign entities exploring digital assets, experts say unchecked security risks could slow growth and undermine confidence in the asset class.

Compliance Expert Provides Risk Mitigation Impact

Speaking to the risk spate of crypto exploits, Demchuk emphasized that blockchain compliance tools themselves can become targets if not properly secured. “Tools designed to enhance transparency and detect risk can, if misused, enable phishing and obfuscation of illicit activity,” he said.

According to the Certik chart above, Phishing, Code vulnerability and Private Key compromise are the most successful hack methods, each occurring 81, 68 and 15 times respectively. Combined, the three factors were responsible for just $206 million or 8% of the total losses.

Meanwhile, High-profile hot wallet compromise, occurring 3 times, including the Bybit hack, resulted in $1.45 billion losses, which accounts for more than 80% of total heisted funds.

“Our mission has always been to democratize access to compliance tools and promote crypto hygiene across the digital asset ecosystem. In our view, compliance platforms must ensure accessibility for good actors without opening the door to malicious use.

That’s why we implemented firm access controls and continue working with law enforcement globally to track stolen assets, dismantle fraud networks, and assist victims.”

– AMLBot CEO, Slava Demchuk

AMLBot has responded by implementing a series of safeguards: business-only onboarding tiers, real-time threat modeling, and segmented dashboards that limit access to sensitive data for retail users.

Demchuk said these controls are designed to prevent misuse of compliance infrastructure and reflect the need for tools that evolve alongside the threats they are meant to address.

Compliance as Catalyst to Prevent Crypto Crimes

AMLBot’s systems have reportedly prevented more than $100 million in potential losses since 2019. The platform screens wallets for links to criminal activity and uses machine learning to detect patterns associated with common fraud schemes, including pig butchering scams.

Demchuk cited the company’s recent cooperation with Thai authorities as an example of how public-private collaboration can strengthen crypto security.

He advocates for basic global compliance measures—such as KYC verification and politically exposed person (PEP) screening—even in jurisdictions without formal regulatory oversight. These tools, he argues, could reduce the scale of losses like those seen in the first quarter.

Compliance as Catalyst for Institutional Confidence

In addition to preventing fraud, compliance is viewed as a key factor in attracting institutional capital. The EU’s Markets in Crypto-Assets (MiCA) framework has raised the regulatory bar for crypto firms operating in the bloc.

Demchuk believes compliance tools and standardised practices can help cryptocurrency protocols and firms enhance due diligence processes.

As sovereign entities consider holding Bitcoin reserves and more institutional products come to market, Demchuk said the next phase of growth will depend on how well firms integrate compliance into their operations. Without it, he warned, the sector may struggle to maintain long-term credibility.

Conclusion

Bitcoin’s rise above $90,000 on Tuesday signals strong investor appetite amid macroeconomic uncertainty in the US markets.

But as the cryptocurrency industry grapples with security risks the $1.7 billion in stolen crypto during the first quarter of 2025, represents a 330% increase from Q4 2024 figures, beaming critical spotlight on global compliance infrastructure.

AMLBot CEO Slava Demchuk says a combination of analytics, repsonsible use of compliance tools, and proactive risk controls will be necessary to reduce incidence of crypto crimes and attract institutional capital.

Without such measures, the industry’s $5 trillion market cap goal may remain out of reach.

The post $1.7B Crypto Stolen in Q1 2025: Slava Demchuk Says Compliance Could Mitigate Losses appeared first on CoinGape.