Ethereum price is up 0.50% today following in Bitcoin’s (BTC) footsteps. But, data from CoinGlass shows that $6 billion will be liquidated if Ethereum (ETH) moves just a $1,000. With so much at stake, let’s explore what’s next for ETH, the second-largest cryptocurrency.

Ethereum Price Today

Ethereum price is up 0.50% today and trades at $1,596. In the past three days, ETH’s value has coiled up inside the $1,538 to $1,613 range, indicating a significant drop in volatility. There are two short-term key levels to watch – $1,613 and $1,689, both of which are equal highs and resting above it are buy-side liquidity. Likewise, a move below $1,538 could trigger sell-side liquidity.Hence, these two key liquidation levels that investors need to watch in the short-term.

$6B in Ethereum (ETH) Positions at Liquidations at Risk

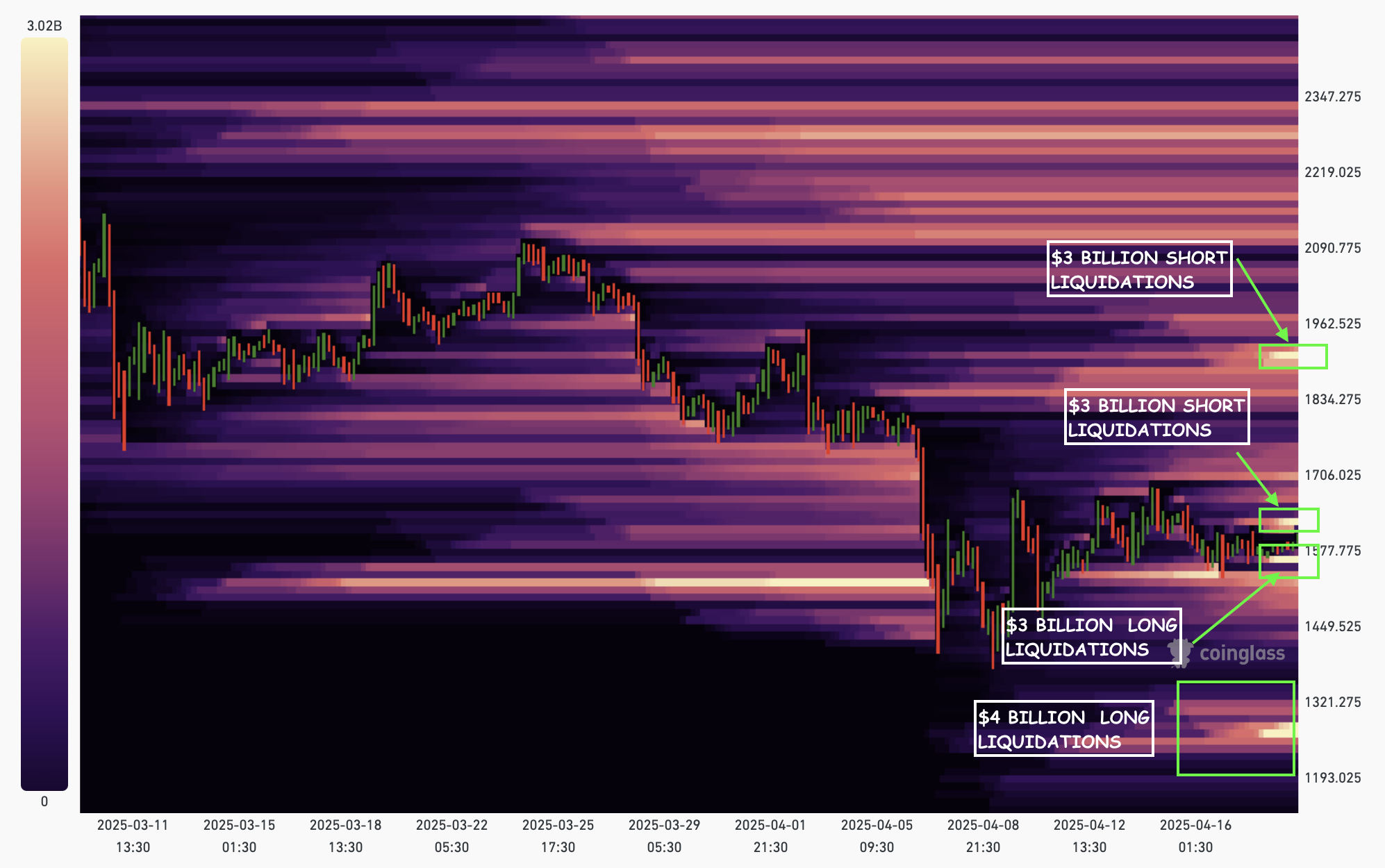

According to CoinGlass data, there are two key levels to watch – $1,560 and $1,650, a retest of both these levels will lead to $6 billion in liquidations of both long and short positions.

Due to the ongoing consolidation, positions are accumulating on either sides, which explains the huge amount of liquidation risk. Ethereum price prediction for 2025 remains neutral due to the sideways movement.

In addition to these key levels, another $3 billion in short positions will face liquidation if ETH price reaches $1,911. On the flipside, $6 billion in long positions will be wiped if ETH hits $1,269.

Ethereum Technical Analysis & Forecast

Since April 9, Ethereum price has been trading between $1,385 and $1,689. Despite this large range, the lack of volatility and uncertain market conditions, ETH has formed an even tighter range that extends from $1,538 to $1,613.

The daily chart shows RSI hovering around 40 after recovering from an oversold level. The AO indicator is also showing receding histograms under the zero level, showing a declining bearish momentum.

Both this indicators hint that there might be more consolidation in the larger range before Ethereum price decides on a directional bias.

As far key levels to watch includes, investors need to pay attention to $1,650 to $1,700 as the near term resistance level. Beyond this, $1,900 is the crucial resistance before Ethereum price approaches $2,000.

On the flip side, $1,560 is the near-term support level. Beyond this, a sweep of $1,250 could provide the required demand to push Ethereum price higher

Polymarket Odds of Ethereum Price Hitting ATH in 2025

While Ethereum’s technical analysis remains directionless, investors continue to lose hope due to ETH’s lackluster performance. Polymarket data shows there’s a 3% chance Ethereum price hits ATH before June 2025.

To conclude, the outlook for Ethereum price is undertain due to the ongoing consolidation, lack of directional bias from Bitcoin, risky macroeconomic and geopolitical situtions. In the short-term $6 billion in both long and short position are at risk of liquidation which hints that investors should stay away until ETH provides a decisive directional bias.

The post Ethereum Price is Up 0.50% Today With a Risk of $6 Billion in Liquidations appeared first on CoinGape.