Bitcoin price has shed 21% of its value from its record high of around $108,000 recorded in January 2025. Despite the uncertainty, Strategy (formerly MicroStrategy), which is currently the fourth-largest Bitcoin holder, has continued to accumulate. However, as the price inches lower, Strategy’s $44 billion BTC portfolio is at risk of dropping below the average buying price of $67,556. If this happens, what would happen to the company’s 531,644 BTC? Let’s explore.

Why Bitcoin Price Drop Below $67K Threatens Michael Saylor’s Strategy

Bitcoin price today trades at $85,550. Meanwhile, Strategy’s average buying price for its $44 billion Bitcoin portfolio is $67,556 per data from Strategy Tracker. This means that at the current BTC price, Strategy is 26% above water and sitting on $9 billion in unrealized profits.

However, the most recent Bitcoin purchase by Strategy drew criticism from Bitcoin critic Peter Schiff who observed that each new purchase takes the company closer to making losses. He opined,

“At the moment you still have about a 25% paper gain. By soon your average cost will be above the market price, meaning your entire Bitcoin position will be held at a loss.”

Schiff’s comments come after popular market analyst Whale Panda criticized Strategy’s plan to buy Bitcoin using debt. The analyst stated that Saylor would likely trigger the next Bitcoin bear market if he fails to get the cash needed to pay off the debt offerings used to fund MicroStrategy’s BTC accumulation.

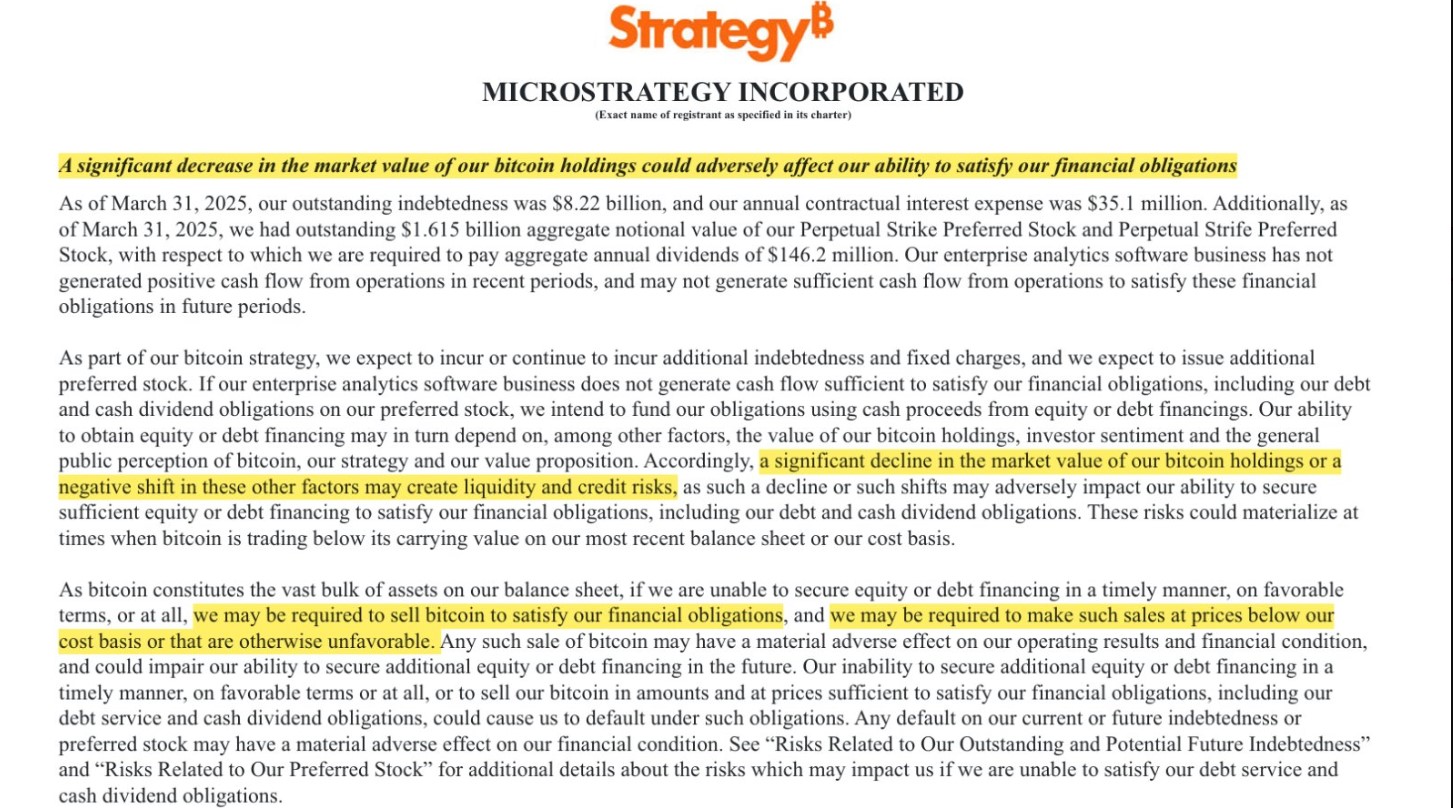

Moreover, last week, an SEC filing by Strategy emerged stating that if BTC price continues to decline, Strategy might sell Bitcoin at a loss to meet its financial obligations. This means that if Bitcoin falls below $67,000 and MicroStrategy is required to pay off debt, it will have to start liquidating BTC and end Saylor’s HODL strategy.

The possibility of MicroStrategy going underwater explains why $67,000 matters to Saylor’s Bitcoin plan and Strategy’s business model.

What Happens to Strategy’s $44B BTC if Price Drops Below $67,000?

The impact that the drop in Bitcoin price below $67,000 would have on Strategy’s $44 billion BTC portfolio depends on whether such a dip is temporary or sustained. If Bitcoin briefly retests $67K but bounces back above Strategy’s average buying price, the company may not face a liquidation risk. However, this dip may create market FUD.

On the other hand, if Bitcoin price drops to $67,000 and sustains the drop to retest lower levels, Strategy will face liquidation and credit risk. In its recent SEC filing, the company stated,

“These risks could materialize at times when Bitcoin is trading below its carrying value on our most recent balance sheet or our cost basis.”

The resulting selloff will trigger market-wide fear and panic, causing retail traders to also dump their holdings. This may also create a black swan effect across the crypto market.

These scenarios highlight why Bitcoin needs to hold above $67,000 to ensure MicroStrategy’s $44 billion Bitcoin portfolio does not suffer losses.

Bitcoin Technical Analysis

On-chain and technical data show a bullish Bitcoin price prediction, which may prevent a dip to $67,000. Analyst Miles Deutscher observed that BTC has broken out of a descending trendline for the first time since it fell from its ATH in January.

This breakout suggests that the downtrend is weakening. If Bitcoin sustains this bullish breakout, it could result in additional gains.

At the same time, IntoTheBlock data shows that on April 14, more than $465M BTC was withdrawn from exchanges, signaling accumulation. If the technical and on-chain data remains strong, it may prevent Bitcoin from falling below Strategy’s average buying price of $67,000, avoiding the liquidation risk.

The post Here’s What Would Happen to Strategy’s $44B BTC if Bitcoin Price Crashes Below $67K appeared first on CoinGape.