Shiba Inu price risks a massive drop as a decline in the number of daily active addresses indicates waning network activity. This decline often suggests reduced investor confidence in the meme coin, which may trigger selling activity. As the sentiment shifts, what’s the next path for SHIB? Let’s explore.

Shiba Inu Price At Risk as Active Addresses Hit 1-year Low

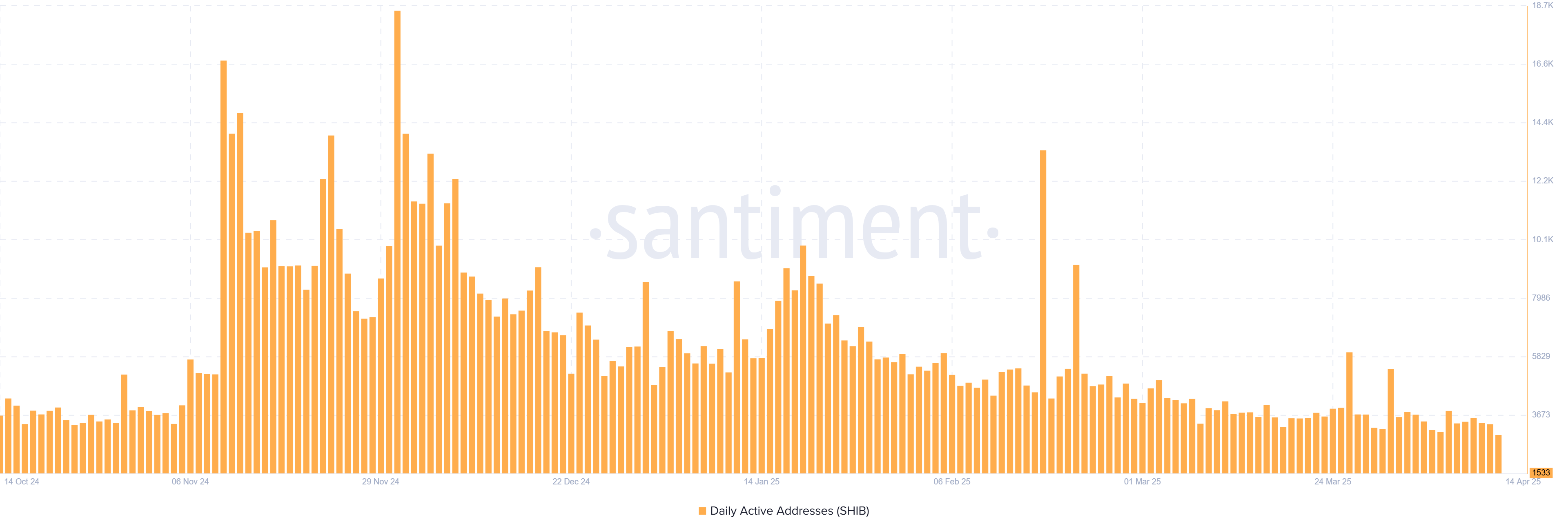

The number of daily active Shiba Inu addresses has dropped significantly and is currently at the lowest level in one year. This drop highlights a bearish Shiba Inu price prediction as it suggests reduced market interest and fading retail demand for the SHIB meme coin.

Data from Santiment shows that the number of daily active addresses stood at 13,436 in mid-February. This metric has since plunged to 2,948, which depicts a 78% in less than two months.

The active address count is directly correlated with the price. Therefore, when the address count is low, it shows a bearish market sentiment and could precede a notable decline in Shiba Inu price. As a recent Coingape article reported, SHIB could fall to as low as $0.0000055 if bears take control.

Besides fading retail interest, the other reason that could be causing the decline in SHIB daily active addresses is the declining Total Value Locked (TVL). Data from DeFiLlama shows that the layer 2 network has shed nearly three times its TVL since hitting a peak of $6M in December last year. As the network activity fades, Shiba Inu price may edge lower unless buyers step in.

Shiba Inu Technical Analysis

Shiba Inu price trades at $0.0000123 with a slight 0.7% gain in 24 hours. The meme coin has been facing sideways price moves in the last week, and if there is no significant uptick in the buying activity, SHIB might continue stalling at the current range.

Shiba Inu is touching resistance at the descending trendline on its daily price chart. This also marks the middle Bollinger band, and if SHIB can flip this level, it could push the price to the upper Bollinger band and reverse the bearish trend.

The RSI has reached 48, which is close to a neutral level, indicating that neither the buying nor selling pressure is high. If Shiba Inu can surge above the upper band, it will ignite a bull run for SHIB.

However, considering the fading retail interest and the reduced network activity, it is likely that Shiba Inu price will continue to plunge lower. The four-hour chart shows a slight shift and if the meme coin can break out of resistance at the upper trendline, it could defy the bearish thesis and possibly surge.

The post Shiba Inu Price At Risk as Active Addresses Plunge 78% to 1-Year Low appeared first on CoinGape.