Ethereum (ETH) and the rest of the crypto market have been in turmoil for weeks now. The intensity of struggles increased with Donald Trump’s tariff plan introduction and various other events, causing investors’ sentiments to become bearish. As the Ethereum price crashed, multiple whales sold in fear of a further downtrend. However, experts believe in a different approach, as a few claim that April’s macroeconomic events will bring an ETH price rally.

Crypto Whale Offloads ETH After Ethereum Price Crash 10%

Despite being the second biggest cryptocurrency of the market, ETH was not immune to the market’s volatility and unpredictability. Amid the bear’s dominance, the Ethereum price lost 10% of its value in the week alone and 54% from the December 2024 peak, influencing investors’ sentiments severely.

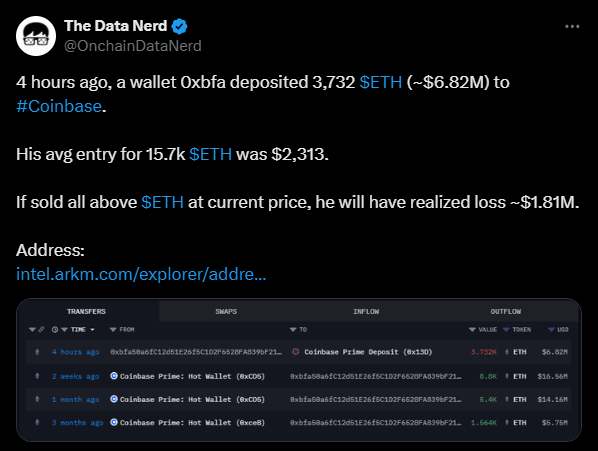

As a result, reports reveal that the short-term holders have lost more than $400M, with the investors fearful sentiments amid the Trump administration’s reciprocal tariff event. One Ethereum whale alone offloaded 3,732 ETH, equivalent to $6.82M on the coinbase exchange. The whale will bear a staggering $1.8M loss if they sell these.

Although the loss and seller’s activity have been high, ETH staking and exchange reserve reports suggest that long-term holders are maintaining bullish sentiments. With a 3% surge in price, currently trading at $1,859.51, experts anticipate complete recovery.

Experts Advise Buying the Ethereum Price Crash Dip

Ethereum’s status as a top cryptocurrency has kept the investors’ bullish perspective alive. Soma analysts like CryptoELITES believe that the ETH is at its bottom and will rally 700% by the end of the year.

Another added that the recovery is hard and fast despite Ethereum and other cryptos having the worst Q1 in seven years. He claimed that macroeconomic factors like Donald Trump’s tariffs and inflation concerns drove this downtrend instead of a break in historic cycles.

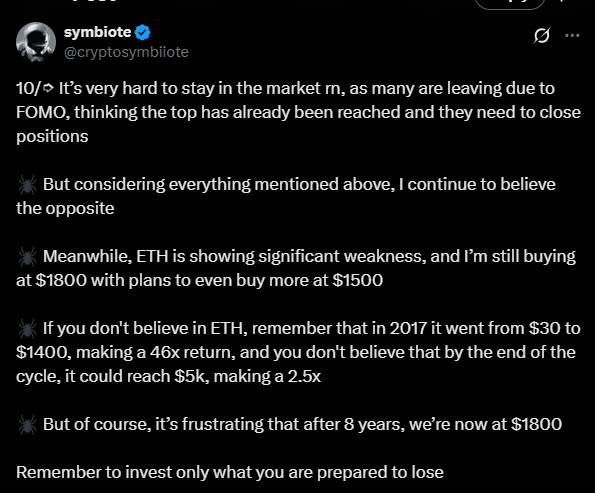

However, at the same time, the experts believe that upcoming macroeconomic investments, like tariff announcements and inflation reports, would assist in the recovery. In an X post, crypto analyst symbiote claims the rise in gold and inflation would lead to their fall, pushing investors to cryptocurrencies.

With the rise of gold, tariffs, and inflation, inflation will eventually start to fall. And if investors believe inflation is under control, they will shift to more risky assets like crypto

He believes these events could trigger a shift in digital assets if the inflation comes under control, before predicting an ETH price rally to $5,000. The analysts cited ETH’s 2017 rally, where it jumped from $30 to $1400, making 46x returns.

Mixing historical performances and macroeconomic events, analysts ‘ Ethereum price prediction hints at an upcoming rally.

Bottom Line

The crypto market crash under the influence of U.S. key macroeconomic events has affected investors’ sentiments significantly. As a result, Ethereum declined to the current level of $1,863.05 but is attempting recovery today before Trump’s new tariff announcement. Analysts anticipate that these macroeconomic events could bring significant recovery, even an ETH price rally, so investors must keep an eye on that.

The post Whale Offloads ETH at Loss, But Experts Predict Ethereum Price Rally Amid April Macroeconomic Events appeared first on CoinGape.