Metaplanet stock price has come crashing down more than 9%, slipping under 400 JPY levels, despite the firm announcing its 2 billion JPY Bitcoin purchase plan. This happened as the Japanese stock market tanked 4% in early trading hours on Monday, as they prepare for President Trump’s “Liberation Day” on April 2.

Metaplanet Issues 2 Billion JPY In Zero-Interest Bonds for Bitcoin Purchase

Earlier today, Metaplanet announced the issuance of its 10th Series of Ordinary Bonds worth 2 Billion JPY to the EVO FUND. The officials stated that they would use these funds exclusively to fund Bitcoin purchases.

The zero-interest bonds, each with a face value of ¥50 million, are scheduled for redemption on September 30, 2025. Simon Gerovich, Representative Director of Metaplanet, oversaw the bond issuance. In a message on the X platform, Gerovich wrote: “Buying the dip!” Apart from the Japanese firm, Bitcoin miner Marathon Digital has also announced a $2 billion stock sale to fund its Bitcoin purchases ahead.

In less than a year of adding Bitcoin to its balance sheet, the Japanese firm has already accumulated 3,350 BTC at an average purchase price of $83,000 per BTC. To execute its BTC purchase plan moving ahead, the firm has also tapped Eric Trump to join its board of advisers. Despite the current development, the stock price has come under severe selling pressure, dropping by 23% over the past week after a strong rally in early March.

Trump Liberation Day Pushes Japanese Stock Market Down 4%

As the global markets prepare for the Trump “Liberation Day” set to kick in on April 2nd, Japan’s stock market has dropped more than 4% in the early trading hours on Monday. Bitcoin price sees continued selling pressure, slipping under $81,500 as markets brace for greater macro uncertainty this week. This overall development has led to further selling pressure on the Metaplanet stock in recent days.

Global market is bracing for major turbulence ahead as risk-ON assets face strong selling pressure as Trump’s reciprocal tariffs kick in. President Trump has declared Wednesday as “Liberation Day,” marking the start of a wave of new tariffs. The U.S. is set to impose 20%+ tariffs on imports from over 25 countries, targeting goods valued at more than $1.5 trillion by the end of April. Amid this massive uncertainty, the Gold price is eying a solid $3,100 levels.

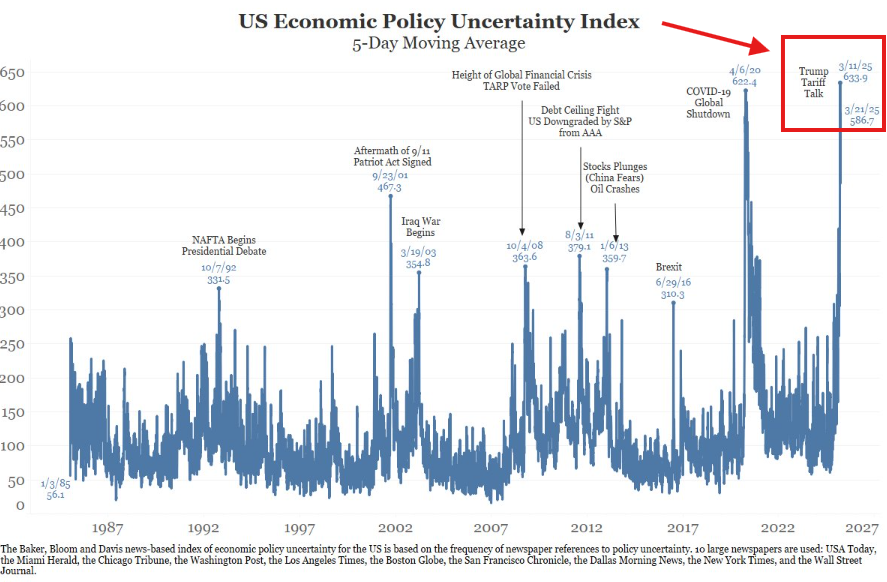

Policy Uncertainty Surges to Historic Highs

The Economic Policy Uncertainty Index has soared to unprecedented levels, surpassing nearly every major crisis in modern U.S. history. Current uncertainty levels are approximately 80% higher than those recorded during the 2008 financial crisis.

This surge in policy-related uncertainty is contributing to wider market swings, with analysts predicting an exceptionally volatile trading week ahead. Investors remain on edge as they navigate heightened instability across financial markets.

The post Metaplanet Stock Crashes 9% Despite 2 Billion JPY Bitcoin Purchase Plan appeared first on CoinGape.