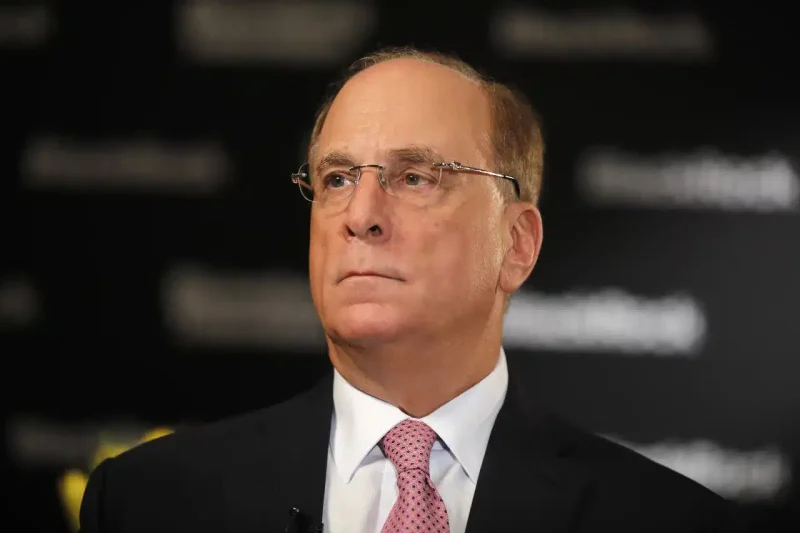

Blackrock CEO Larry Fink, has issued a stark warning regarding the U.S. dollar’s status as the world’s reserve currency. In his latest annual letter, Fink emphasized that the U.S. faces significant economic challenges, particularly concerning its growing national debt.

He stated that if the U.S. fails to control its fiscal trajectory, Bitcoin could emerge as a viable alternative to the dollar.

U.S. Debt Crisis Could Undermine Dollar’s Global Dominance

BlackRock CEO Larry Fink’s concerns center around the increasing U.S. national debt, which has surpassed 100% of the country’s GDP. He warned that if this trend continues, it could lead to a situation where the U.S. struggles to maintain its global financial position. Considering that the interest on the national debt is projected to be more than $952 billion this year, the fiscal pressure may intensify and cause potential significant impacts. Fink noted that if current trends continue, the federal government of the United States will have a permanent deficit by 2030, whereby all federal revenue would be directed to debt servicing.

According to BlackRock CEO Larry Fink, if these issues persist, then confidence in the U.S. dollar is likely to decrease. He said that, since this year, presumably Bitcoin or other digital assets could be considered less risky and offer an opportunity to get rid of the risk associated with assets in U.S. dollars. This statement comes amid criticism of Bitcoin’s status as digital gold by Peter Schiff due to recent price decline and volatility.

Fink also pointed out that the fact that Bitcoin is free from the control of the conventional institutions and accepts it in exchange for goods and services make it very attractive to investors especially during inflationary times.

Tokenization and Digital Assets as Solutions for Market Modernization

While writing the letter, the Blackrock CEO stressed digital finance as one of the key elements of an economy and the tokenization of assets. Tokenization is the process by which traditional financial instruments such as equities, bonds, or properties are transformed into blockchain-embedded tokens.

According to Fink, tokenized assets could be more transparent, cost-effective, and liquid as compared to conventional financial structures. He spoke of the existing structure of financial transactions as primitive, comparing it to sending mail through the post office.

BlackRock’s embrace of digital assets further supports this perspective. The firm has made strides in developing tokenized financial products, such as the BUIDL fund, a tokenized money market fund.

This fund has quickly expanded, and it has the potential for becoming one of the largest tokenized funds in the market. According to Fink, the tokenization process will be a slow disintegration that will democratize the financial markets by enabling quicker and fractionalized ownership.

Role of Bitcoin in the Future of Finance

Under BlackRock CEO Larry Fink, the company has made considerable investments in Bitcoin, launching the iShares Bitcoin Trust (IBIT), which has quickly become one of the largest Bitcoin exchange-traded products in the world.

Fink reiterated his belief in the innovation behind decentralized finance (DeFi), pointing out that it can make markets faster, cheaper, and more transparent.

However, he also acknowledged the risks associated with the rise of Bitcoin and other digital assets. While he sees their potential, Fink warned that the U.S. must act quickly to address its growing fiscal challenges. Failure to do so could see Bitcoin and other digital currencies being adopted as a hedge against the dollar’s decline.

A Call for Financial Innovation and Regulatory Reform

In his letter, Blackrock’s CEO Larry Fink suggested that the current financial system should be overhauled and has called for innovations such as tokenization and blockchain technology. He underlined the need for addressing the existing issues related to the deep fakes and identity verification to unlock institutional adoption of DeFi.

Effective regulatory frameworks are crucial to ensuring that digital assets can thrive in a secure and transparent environment.

Besides market shifts, Fink called to support financial innovation. Evaluating the perspectives, he pointed to the necessity to provide the right balance of regulation and develop proper integration of digital assets into the existing financial system. If so, these innovations can offer solutions to the problems that traditional financial systems present.

The post Larry Fink Predicts Bitcoin Could Replace US Dollar As Reserve Asset, Here’s Why appeared first on CoinGape.