Ethereum price consolidated within a narrow 2% range between $1,750 and $1,820 in late March, but an upcoming liquidity event could trigger further downside in April 2025. With FTX set to begin creditor repayments on May 30, Ethereum (ETH) and Solana (SOL) traders are preparing for potential market turbulence.

Ethereum (ETH) Set to Close March 2025 with 18% Losses

Ethereum price underperformed significantly in March 2025, weighed down by a combination of network upgrade concerns, Trump’s tariff policies, and heightened congressional scrutiny of former SEC Commissioner Paul Atkins.

At press time, ETH price is hovering around $1,830 level, reflecting an 18% decline from its March 1 opening price of $2,237. In contrast, Bitcoin (BTC) has remained relatively stable, down less than 2% for the month, consolidating above $83,400 after opening March at $84,400.

The stark divergence in performance underscores Ethereum’s exposure to additional bearish catalysts beyond broader macroeconomic risks.

FTX Payouts from May 30 Could Drain $800 Million in Ethereum and Solana Liquidity

Ethereum’s underperformance relative to Bitcoin signals the influence of asset-specific headwinds.

One major catalyst is the impending FTX repayments, set to commence on May 30. Over the past few months, the bankrupt exchange has systematically moved assets into exchange wallets, preparing for liquidation.

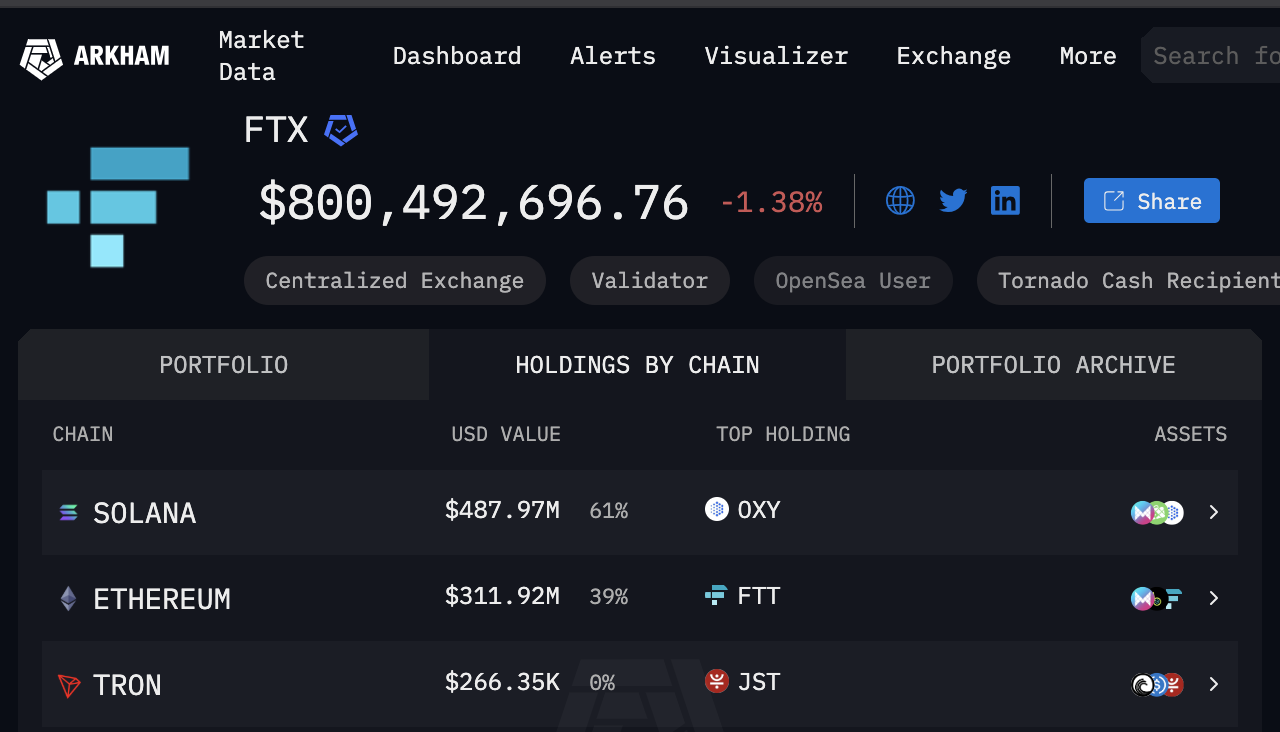

On-chain data from Arkham Intelligence reveals that FTX holds over $800 million in assets hosted on the Ethereum and Solana blockchains.

As seen in the chart above, 61% of these holdings are Solana-based assets, while 39% are Ethereum-based.

Since FTX’s collapse in November 2022, Solana, Bitcoin, Ethereum, and XRP have surged in value, with SOL leading the gains at approximately 650%.

However, court filings confirm that FTX repayments will be made in USD, necessitating asset liquidations to generate cash.

The anticipation of this forced selling has already placed downward pressure on ETH and SOL prices, with further declines expected in April 2025.

FTX will begin repaying major creditors on May 30 from its $11.4 billion reserve, with some payouts reaching up to 118% per claim.

However, the repayments are based on crypto prices at the time of FTX’s bankruptcy, disregarding the significant gains these assets have made since late 2022. To compensate for the time delay, creditors will receive an additional 9% annual interest on their claims.

Ethereum and Solana Could Underperform in April 2025

Given the upcoming FTX liquidation event, Solana and Ethereum price forecast signals could continue lean bearish and underperform relative to Bitcoin and other major assets.

The market has already priced in expectations of substantial sell pressure, and further downside remains likely if liquidation volumes exceed current projections. Unless new demand offsets these sales, ETH and SOL could see a challenging start to Q2 2025.

The post Ethereum and Solana Traders on Red Alert as FTX Begins $800M Repayments on May 30 appeared first on CoinGape.