Ripple (XRP) came close to slipping below the critical $2 mark on Saturday, only to see a modest recovery as bullish traders reclaimed the $2.15 level. Regulatory uncertainty surrounding SEC Chair nominee Paul Atkins sparked withdrawal from XRP derivatives markets, signalling more downside risks ahead.

Why Is Ripple (XRP) Price Going Down Today?

Ripple’ (XRP) latest downturn has been attributed to mounting concerns of “conflict of interest” over the nomination of Paul Atkins as SEC Chair under the Trump administration.

While Atkins has long been regarded as a crypto-friendly figure, opposition from U.S. Congress has raised fears of potential regulatory hurdles for Trump’s crypto plans and ongoing altcoin ETF filing reviews.

Recently, Ripple secured a major legal victory in its protracted battle with the SEC, bringing long-awaited closure to the case. However, uncertainty surrounding Atkins’ confirmation has cast a shadow over XRP price momentum.

As seen in the chart above, Ripple price tumbled a low as $2.06 on Saturday, before rebound towards the $2.15 level at the time of publication.

Atkins’ critics within Congress have expressed concerns over potential conflicts of interest, signaling broader resistance to pro-crypto policies.

If his confirmation is blocked, it could indicate a more hostile stance toward upcoming legislative initiatives—such as the proposed Crypto Strategic Reserve, which requires congressional approval for federal cryptocurrency acquisitions.

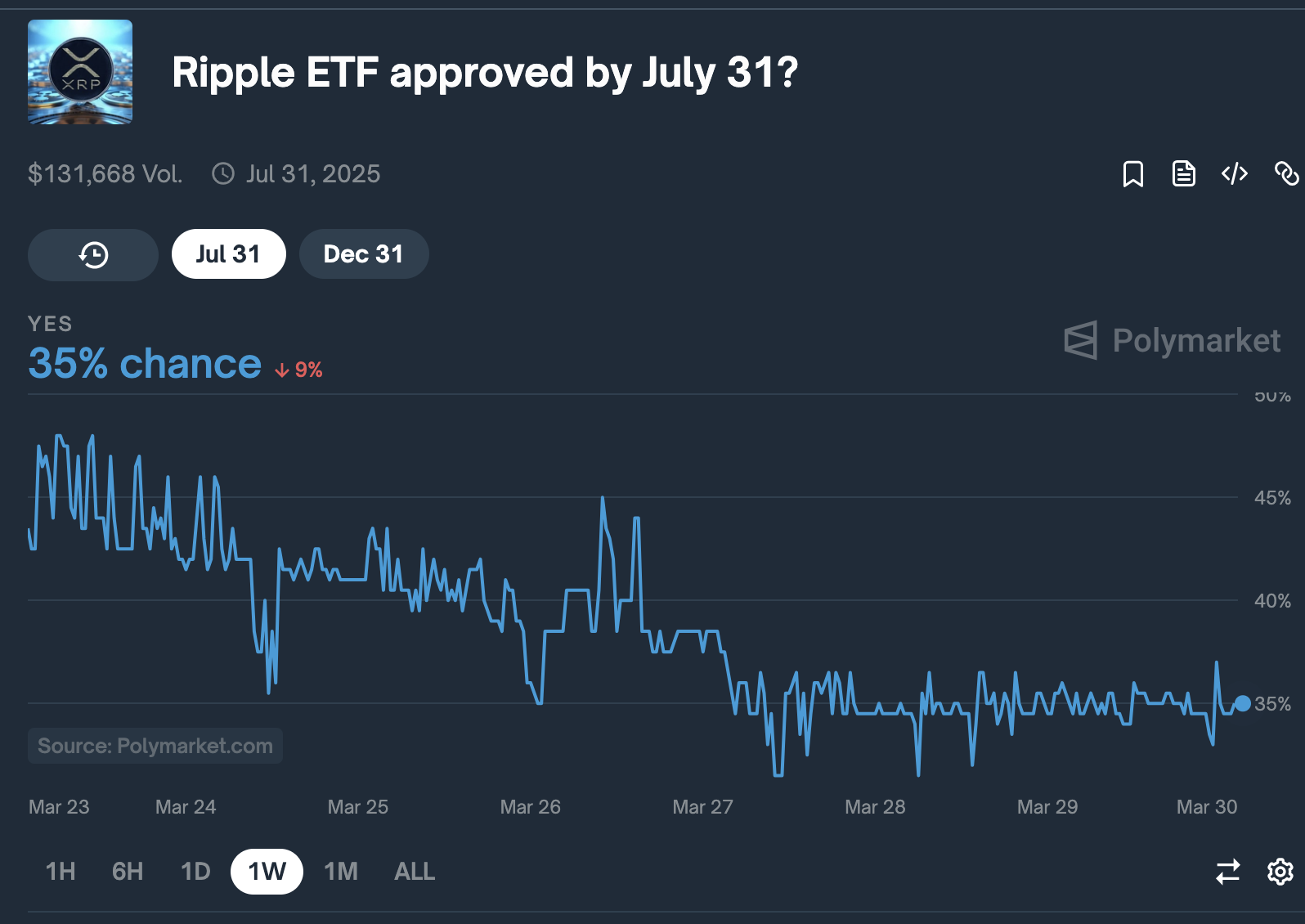

According to Polymarkets data, investors are now pricing 35% chance that the US SEC could approve XRP spot ETFs before July 31. Notably that figure has now declined 7% since the scrutiny around Trump’s SEC chair nominee, Paul Atkins began.

More significantly, investors worry that a less crypto-friendly successor could delay or outright reject altcoin ETFs, dealing a major setback to institutional adoption.

This uncertainty has contributed to XRP’s recent sell-offs, as market participants brace for potential regulatory headwinds.

Traders Withdraw $220M as Market Sentiment Deteriorates

XRP’s bearish trend has not been confined to spot market losses alone. In the derivatives sector, traders are aggressively unwinding their positions, signaling a broader loss of confidence in XRP’s short-term recovery prospects.

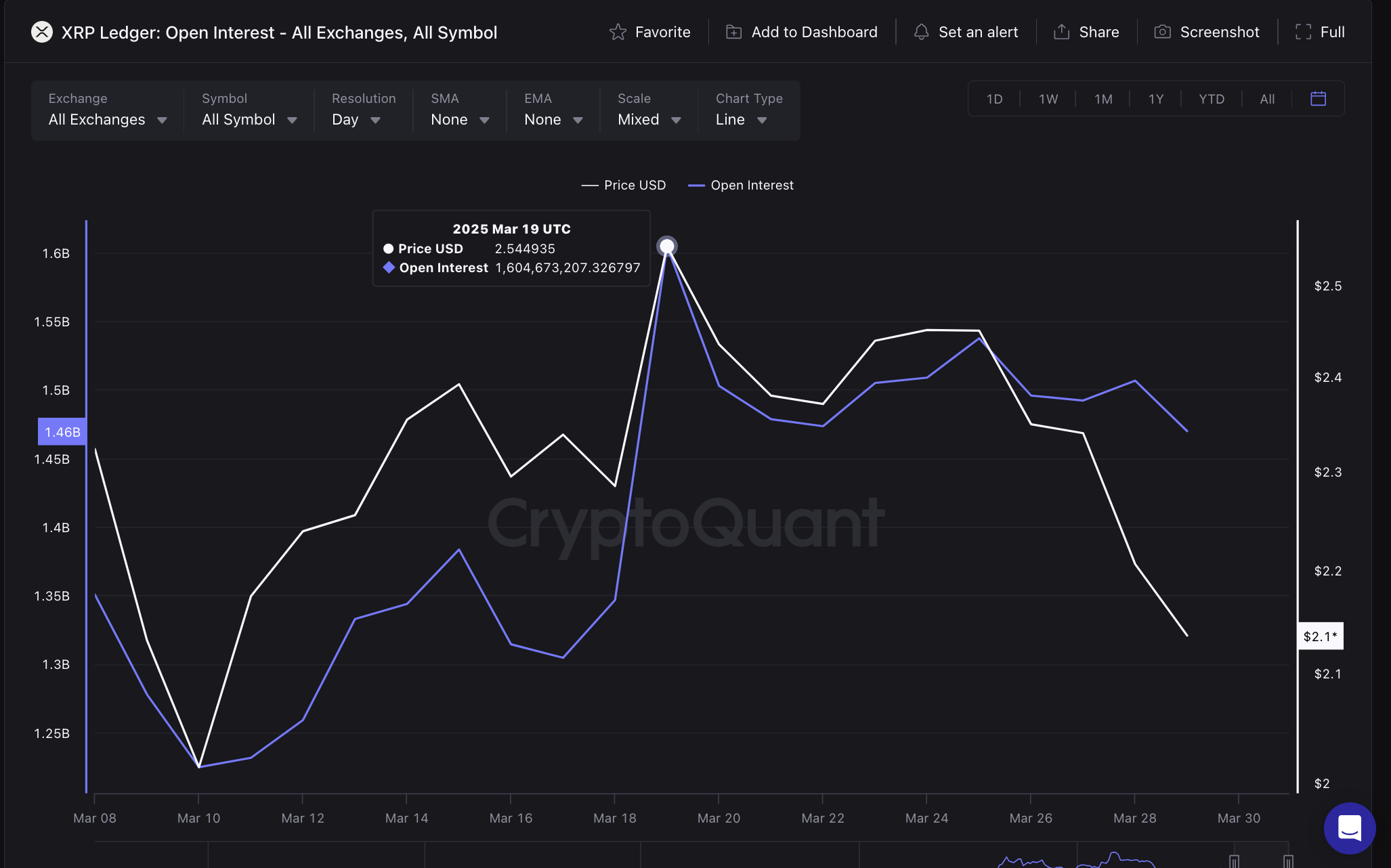

According to CryptoQuant, XRP’s open interest—a key indicator of futures market activity—has fallen sharply from $1.6 billion on March 19 to $1.48 billion at press time, reflecting a $220 million decline in just 10 days.

This mass exodus suggests that traders are moving to reduce their exposure rather than betting on a swift rebound.

Extended periods of large-scale withdrawals from open interest typically indicate persistent bearish momentum, as market participants either lock in profits or cut their losses ahead of further declines.

Unless broader sentiment shifts in favor of crypto regulation, XRP may continue facing selling pressure in the near term.

XRP Price Forecast: Bearish Breakdown or Rebound to $2.40?

XRP price is struggling to regain bullish momentum after falling below key moving averages, signaling potential downside risks.

The XRPUSDT daily chart depicted below reveals XRP is currently trading at $2.17, facing resistance from the 50-day SMA at $2.41 and the 100-day SMA at $2.51, as sellers remain firmly in control.

The declining trading volume further reinforces bearish sentiment, indicating weak demand at current levels.

The Bearish Breakout Probability is supported by the BBP (Balanced Bollinger Percentage) indicator, which sits at -0.3190, a sign of persistent downward pressure.

If XRP fails to reclaim the $2.20 support, the price could slide toward $2.00, a psychologically significant level that could trigger panic selling. A breakdown below this mark could open the floodgates for a further decline toward $1.80.

On the flip side, a bullish recovery scenario would require a decisive break above the $2.41 resistance. This would invalidate the bearish outlook and potentially drive XRP toward $2.60, aligning with the 100-day SMA. However, without a surge in buying volume, XRP may remain vulnerable to further sell-offs.

The post XRP Price Analysis: Paul Atkins “Conflict of Interest” Triggers $220M Withdrawals from Ripple Markets appeared first on CoinGape.