The crypto market has already been influenced by high volatility with the introduction of Donald Trump’s tariff, but the U.S. PCE inflation report has stretched it further. With the US Personal Consumption Expenditures releasing the inflation number, the BTC price and rest market is in complete turmoil, but is this just momentary or long lasting? Let’s discuss this.

Crypto Market News: February U.S. PCE Inflation Data Hit 2.5%

The PCE inflation index is a key metric used by the U.S. Federal Reserve to measure inflation. Higher-than-expected data affects the Fed’s decisions on various monetary policies, so it is an important metric. More importantly, it affects the global financial markets, including the BTC price.

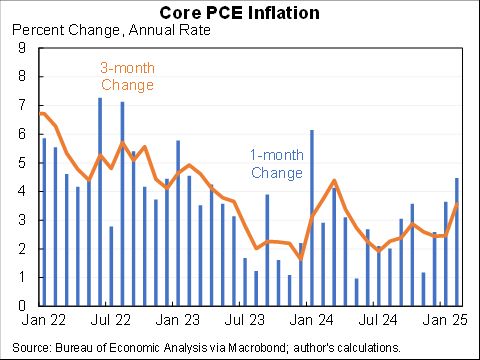

According to the Bureau of Economic Analysis, the inflation rate for February was 2.5%, as expected. However, the core PCE (excluding food and energy) came 0.1% higher than the forecast 2.7%, signaling a persistent surge.

Experts believe that the rising inflation is not entirely positive news, especially for the crypto market. This could eventually delay the Fed’s interest rate cut decisions. More importantly, they fear that stagflation could set in if inflation remains high.

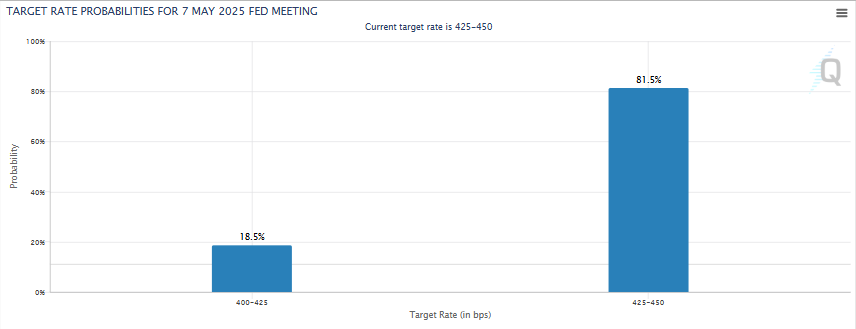

The March FOMC meeting kept the interest rates unchanged, but there’s high anticipation around the next meeting to witness cuts and a Bitcoin price rally. For now, digital assets are in turmoil, declining with the ongoing market downtrend.

BTC Price and Crypto Market Crashed With PCE Inflation Data, What’s Next?

The cryptocurrency market had already been suffering for weeks amid investors’ bearish sentiments. The US PCE inflation data has brought further volatility as millions have been liquidated in longs, and the total market cap has declined by nearly 3%.

In this, the BTC price has declined 3.3%, trading at its lowest point in nearly a week at $82.4k. Along with that, most altcoins are down with the HYPE, TON, FLOKI, and many others being the biggest losers per CoinmarketCap heatmap.

As the bears dominate the market, investors fear a further drop, significantly as analysts like Peter Bradnt predict Bitcoin price crash to $65,635. However, the February inflation data is basically neutral to bearish and does not have a long-term impact unless the Fed’s decision intervenes or Donald Trump’s tariff stretches. In addition to these, the rising yield can add downward pressure.

Despite the possibility, the long-term Bitcoin price prediction remains bullish, with analysts like Michaël van de Poppe and others foreseeing an upward trend. Additionally, the U.S. Strategy Bitcoin Reserve and SEC’s changing regulatory approach to fuel the rally.

Final Thoughts: Crypto and BTC Price to Recover After a Pause

The U.S. PCE inflation data has fueled the crypto market’s uncertainty, beginning a short-term downtrend. Amid this turmoil, digital assets like Bitcoin and others are in a crucial zone, either toward an uptrend or crash,

This will entirely depend on the investors’ sentiments and macroeconomic trends. The upcoming few days could be challenging for investors due to high uncertainty, but experts believe that a BTC price rebound is imminent.

The post US PCE Inflation Hits 2.5% in February: What It Means for Crypto Market and BTC Price? appeared first on CoinGape.