Hyperliquid has been among users’ most preferred crypto platforms, driving HYPE token price even in the crypto market crash or similar conditions. However, the last few weeks’ incidents have affected its image and performance severely, causing security and transparency concerns. Amid the whales continuously exploiting Hyperliquid’s liquidation system, its worth is declining. What’s all the chaos? Let’s discuss this.

Hyperliquid Price in Turmoil Following the Jelly Incident

Hyperliquid, being a decentralized crypto platform, has been gaining investors’ attention against the top centralized exchanges on various metrics. However, all that shifted with the crypto whales exploiting the network and drawing security concerns.

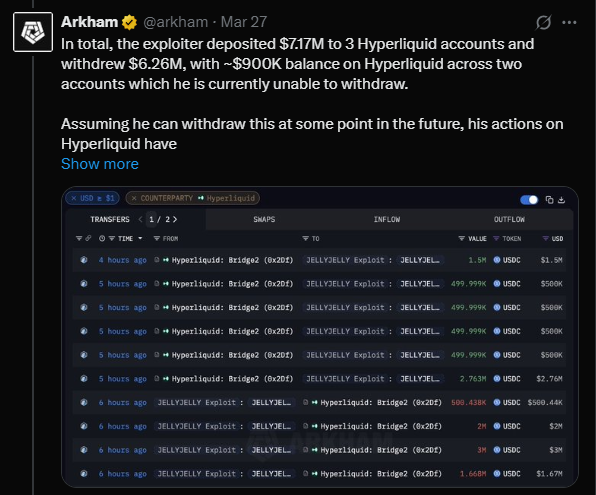

This began with a Bitcoin whale shifting a $4M loss on the network by removing its collateral in mid-trade. Soon, more and more similar incidents happened on the platform, resulting in serious security concerns. The most recent one includes the JELLY price manipulation incident, where a trader deposited $7M across three accounts and executed leveraged trades.

Interestingly, two accounts took the long positions and the other in the short. Their association resulted in the JELLY price surging 400%. With that, the short got liquidated, but the loss got passed to Hyperliquid’s Provider Vault (HLP).

In response, Hyperliquid delisted the JELLY token, citing suspicious activity. Although the foundation promised to compensate affected users, the Hyperliquid price was severely affected due to specific account limitations.

Community Criticism Fueled Hyperliquid Price Crash

This incident drew the global crypto community’s attention and criticism. Various crypto leaders showed disappointment with the platform, with some, like Bitget CEO, calling Hyperliquid unprofessional and stating that it is following FTX’s path.

More importantly, community criticism followed due to the compensation for the JELLY incident for specific accounts. Investors have pointed out bias and favoritism.

Users with JELLY long positions at the time of settlement will be refunded by the Foundation as if their position settled at the closing price of 0.037555. This results in all JELLY traders being settled at a price advantageous to them, except flagged addresses, said Hyperliquid

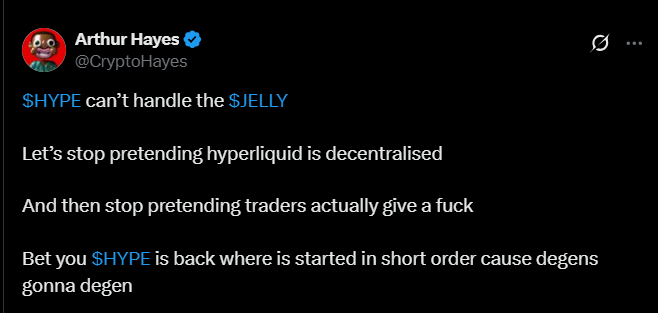

The Bitget CEO also highlights structural flaws. Her concerns were echoed by BitMEX co-founder Arthur Hayes, who also questioned HyperLiquid’s decentralization claims.

Amid all this chaos, the Hyperliquid price crashed, losing more than 20% of its value over the week and 8% in the last 24 hours. It currently trades at $12.92 and stands 63% away from its all-time high of $35.02 set three months ago.

Hyperliquid News: New Risk Management Policy Draws Attention

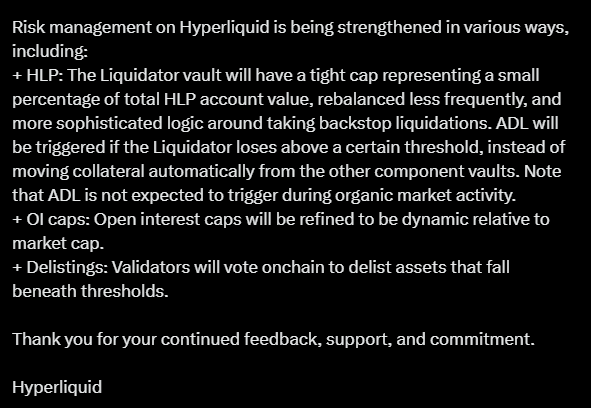

Hyperliquid has taken strict action to prevent such events. In an X post announcement, the team revealed four major updates in the risk management policy. From now on, the liquidator vault will have a tighter cap, which means it will only hold a small portion of the total HLP account value.

In addition, the frequency of rebalancing has reduced. More importantly, liquidation will be handled with a more sophisticated system. There are also changes in the functioning of the automatic deleveraging (ADL). Once the liquidator vault hits a certain limit, the ADL process will be triggered, preventing the automatic movement of funds.

There are also changes in the Open Interest policies. Per the new risk management policy, the OI is based on the market and will reflect the current condition better. Interestingly, the most important update is allowing validators to remove poorly performing digital assets with on-chain voting.

What’s Next For Hyperliquid Price?

These whale incidents have exposed the Hyperliquid and similar DeFi trading models’ vulnerability. The HYPE token has faced extreme conditions and price declines amid criticism and community backlash.

Despite everything, the platform is still working. Some experts believe that the new risk management update may improve investor sentiments toward the platform. However, the bearish trend on the Hyperliquid is likely to stay high for some time, affecting its price.

The post Hyperliquid (HYPE) Price Crashed After Risk Management Updates Past Jelly Incident: What’s Happening? appeared first on CoinGape.