Peter Schiff, a BTC critic, has recently predicted that Bitcoin price could plummet to as low as $10,000. Schiff has expressed concerns over Bitcoin’s long-term viability, particularly in comparison to gold. His argument revolves around Bitcoin’s current performance, which he believes is being driven by short-term hype rather than solid fundamentals.

Schiff’s prediction is particularly alarming for those who view Bitcoin as a store of value. In the current trends, Peter Schiff notes that millions of young people are invested in Bitcoin while gold, a standard hedge, is pushing higher.

This view stems from his assertion that when gold prices rise to new record levels then the value of Bitcoin may plummet.

“By the time they get to their target of $5K for gold, they will drag Bitcoin down to $10K, meaning a drop of 95% from the highest it was valued at in 2021,” Schiff reasoned.

Bitcoin Price Recent Performance Against Gold

According to Peter Schiff, Bitcoin price has underperformed in relation to gold. Gold prices recently broke through $3,000 per ounce as global economic conditions continued to affect the global economy. Meanwhile, Bitcoin has depreciated in value, especially in terms of the precious metal, gold.

Since early 2025, the prices of Bitcoin have come down by over 30% against gold with one Bitcoin currently only equivalent to 27.4 ounces of gold as compared to 41 ounces in December of 2021.

If Bitcoin is an asset that people only buy when the stock market is going up and risk appetite is high, what is it that investors are buying? It’s not a stock as it will never have earnings or pay a dividend. It’s clearly not a risk-off asset, a store of value, or digital gold.

— Peter Schiff (@PeterSchiff) March 28, 2025

Another issue that Schiff dislikes about Bitcoin also revolves around its categorization as a “risk asset.” He says that BTC price movements are synchronized with the rest of the market, especially when investors are more willing to take risks. While gold provides investors with a safe-haven, the Bitcoin price operation is defined as having a volatility closer to that of the traditional markets among investors. Therefore, as argued by Peter Schiff, BTC price may decline as investors turn to the safe-havens, such as gold, in turbulent times.

Market Analyst Weigh In On Bitcoin Trend

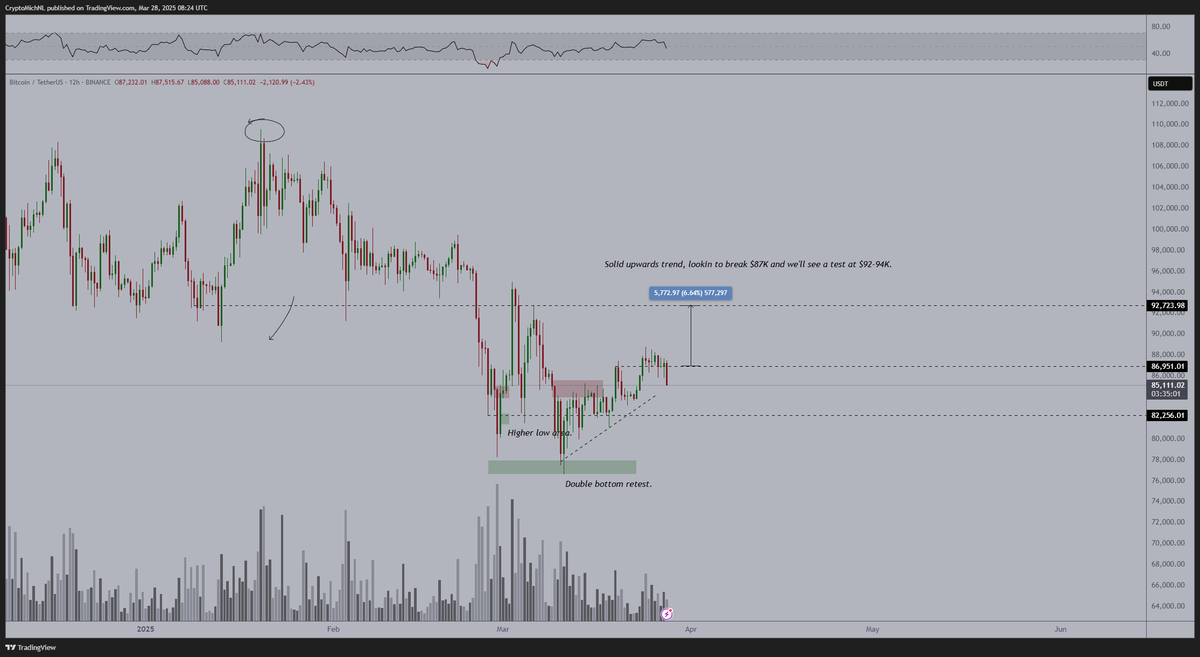

Several market analysts are echoing Schiff’s concerns, suggesting that Bitcoin price could face challenges in the near term. Peter Brandt, a veteran trader, has pointed out that Bitcoin might be on a path to $65,635, citing a “bear wedge” pattern that has emerged in the cryptocurrency’s price charts.

Meanwhile, crypto trader Michaël van de Poppe shared his own cautious outlook on Bitcoin’s short-term prospects. Van de Poppe noted that while Bitcoin price has been holding above the $80,000 mark, its price action is starting to show signs of weakness. He added, “It starts to look slightly less good,” and suggested that if Bitcoin falls below $84,000, a deeper correction could be imminent.

Similarly, the crypto trader TheKingfisher expressed doubts about a sustained bullish recovery, indicating that Bitcoin’s current price movement aligns with a typical market cooldown. He suggested that Bitcoin could be approaching a “seasonal reset” as part of the broader market trend.

Alternative Views on Bitcoin’s Future Trend

Not everyone shares Peter Schiff’s pessimism about Bitcoin price. Charlie Morris, founder of ByteTree, highlighted that despite recent challenges, Bitcoin may have already seen its worst. He explained that while gold ETFs are experiencing slower inflows, Bitcoin could be positioned for a potential recovery.

This view contrasts sharply with Peter Schiff’s, emphasizing that the cryptocurrency may not be as doomed as some critics suggest.

Additionally, Robert Kiyosaki, author of Rich Dad Poor Dad, has weighed in on the broader market of precious metals and cryptocurrencies. While Kiyosaki acknowledged Bitcoin’s role as a hedge against inflation, he predicted that silver would outperform both Bitcoin and gold in the near term

The post Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K appeared first on CoinGape.