Bitcoin price stays above $85,000 as 6,000 BTC exits exchanges, reinforcing bullish sentiment amid U.S. tariff-driven market volatility.

Bitcoin (BTC) Targets $90K Breakout as Bulls Hold $85K Support for Three Consecutive Days

Bitcoin (BTC) demonstrated resilience on Thursday, maintaining its position above $85,000 despite renewed volatility stemming from President Donald Trump’s latest tariff announcement.

According to TradingView data, BTC price climbed 2% to reach $87,756 on Binance before retracing toward $87,000 at press time. Notably, BTC has now held above the $85,000 mark for three consecutive days, while Ethereum (ETH) has also established a support base above $2,040.

This trend suggests that traders are opting to hold their positions in anticipation of another push toward $90,000 rather than taking profits prematurely.

Why Is Bitcoin’s Price Rising Today?

The 2% Bitcoin price uptick on Thursday coincided with Trump’s confirmation of a 25% tariff on auto imports, set to take effect on April 2. In response, investors rapidly shifted capital away from U.S. stocks expected to be affected by the new trade policies.

Within 24 hours of Trump’s announcement, Tesla shares dropped 5%, while the S&P 500 fell 65 points, a 1.12% decline. This suggests that Bitcoin’s rally was fueled by investors reallocating funds from traditional equities into cryptocurrencies, which are perceived as more resistant to trade policy pressures.

Investors Withdraw 6,000 BTC as U.S. Macroeconomic Sentiment Improves

Bitcoin and the broader crypto market experienced significant volatility in early March 2025. The market initially surged following Trump’s proposal to establish a U.S. strategic crypto reserve on March 2. However, within 24 hours, he announced tariffs on Canada and Mexico, triggering immediate sell-offs amid inflation concerns.

As negotiations progressed, the Trump administration introduced waivers to mitigate inflationary impacts on key domestic markets.

These adjustments, along with positive signals from the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) reports in mid-March, paved the way for the Federal Reserve’s rate pause last week.

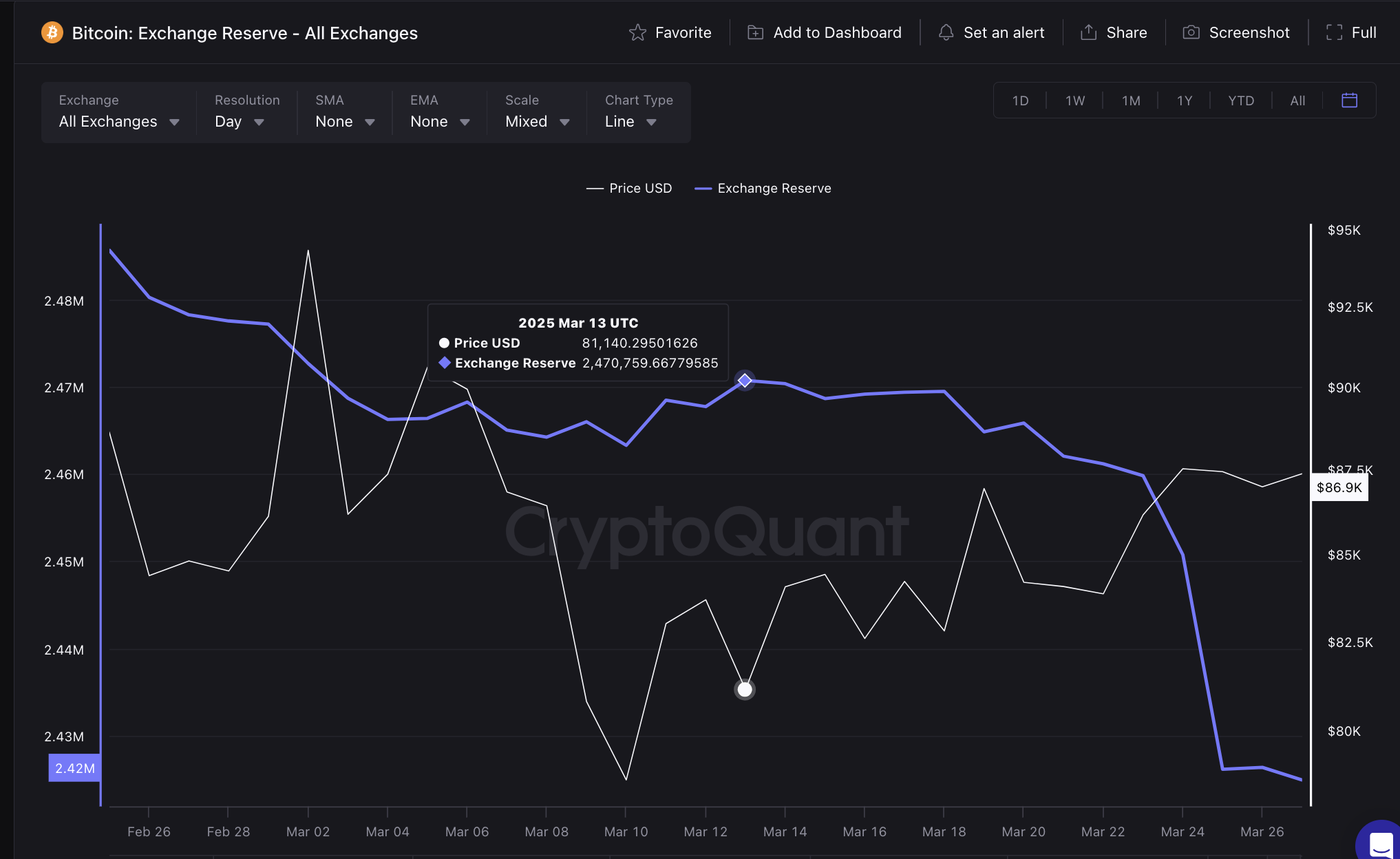

Since then, investors who had previously exited risk assets have returned to a bullish stance. This shift is evident in CryptoQuant’s Exchange Reserves chart, which tracks the total BTC held in exchange-linked wallets.

Investors have been withdrawing significant amounts of BTC since mid-March as inflation concerns eased. On March 13, BTC exchange reserves stood at 2.48 million. At press time, that figure has declined to 2.42 million BTC, indicating a net withdrawal of over 6,000 BTC—worth approximately $525 million—within the past two weeks.

This reduction in short-term supply has helped Bitcoin maintain its $85,000 support level for three consecutive trading days.

Why the $525 Million BTC Outflow Is Bullish for Bitcoin’s Price

A decline in exchange reserves is often a bullish indicator, as it suggests two key market dynamics. First, traders who are optimistic about Bitcoin’s short- to mid-term outlook tend to transfer their holdings from exchanges to long-term storage options. Second, large investors, or “whales,” often move newly acquired BTC into cold storage or multi-signature wallets for security and compliance reasons.

Both factors reduce Bitcoin’s short-term supply, increasing the likelihood of a rapid breakout toward $90,000 when the next major demand surge occurs.

Bitcoin Price Forecast: BTC Holds $87K as Bulls Eye $90K, but Rejection Risks Persist

Bitcoin price forecast signals currently suggest a cautious bullish outlook as BTC holds above $87,000, with critical resistance emerging at $88,761, as indicated by the upper Donchian Channel (DC).

The price remains supported by $82,680, highlighted by the mid-band of the DC. Bitcoin has stayed above the $85,000 support for three consecutive days, reinforcing the bullish case.

However, consolidation near resistance raises the risk of rejection if momentum weakens.

The Parabolic SAR at $78,746 remains significantly below the current price, signaling that bulls still control the trend. A clean breakout above $88,761 could set the stage for BTC to test the $90,000 psychological level.

Conversely, failure to break this level could invite profit-taking, leading to a potential retracement toward $82,680.

If bears gain control and push BTC below $82,680, the next key support lies at $76,598, coinciding with the lower DC band. Until then, BTC remains in an uptrend, but the next move depends on whether bulls can sustain momentum above resistance.

The post Bitcoin Price Forecast: 6,000 BTC on the Move as Trump’s Tariffs Impact Tesla appeared first on CoinGape.