Ethereum’s (ETH) price is likely going to revisit $1,900s before it explodes to $3,000 or higher, according to one crypto analyst. This outlook could provide a buying opportunity where patient investors could accumulate ETH before it explodes higher.

After following Bitcoin’s (BTC) footsteps during the recent weekend rally, ETH price reached a peak of $2,104 on March 25, 2025. During the Asian session, exhaustion of buying pressure led to a minor retracement which aligns with the crypto analyst’s short-term bearish outlook. Let’s explore Ethereum price prediction and important levels to watch before a full-blown uptrend begins, pushing ETH to new yearly highs.

Analyst Hints Ethereum Price Pullback Could Provide Buying Opportunity Soon

MAXPAIN, a crypto analyst, explained using the Time Price Opportunity chart that Ethereum price could retrace nearly 9% form the recent peak of $2,104 to revisit key support levels. The analysis was based on Time Price Opportunity (TPO) chart, which shows a value area, extending from $1,874 to $1,924. Just above the range high, rests liquidity formed due to equal lows, which is what MAXPAIN is targeting.

Based on this outlook, a good place to buy ETH on the dip would be around the $1,900 area. So this means that Ethereum price will undo its recent 6.5% rally fully.

So far, ETH’s value has already shed 3% from the $2,104 peak and trades at $2,044, aligning with the crypto analyst’s outlook. So, the intra-day Ethereum price prediction might seem bearish until it approaches the $1,900 buy zone. However, a bounce here could be a good place to bet as Bitcoin and the crypto market, in general, looks primed for an explosive uptrend due to the recent boost in global liquidity index.

Key Ethereum Levels To Watch

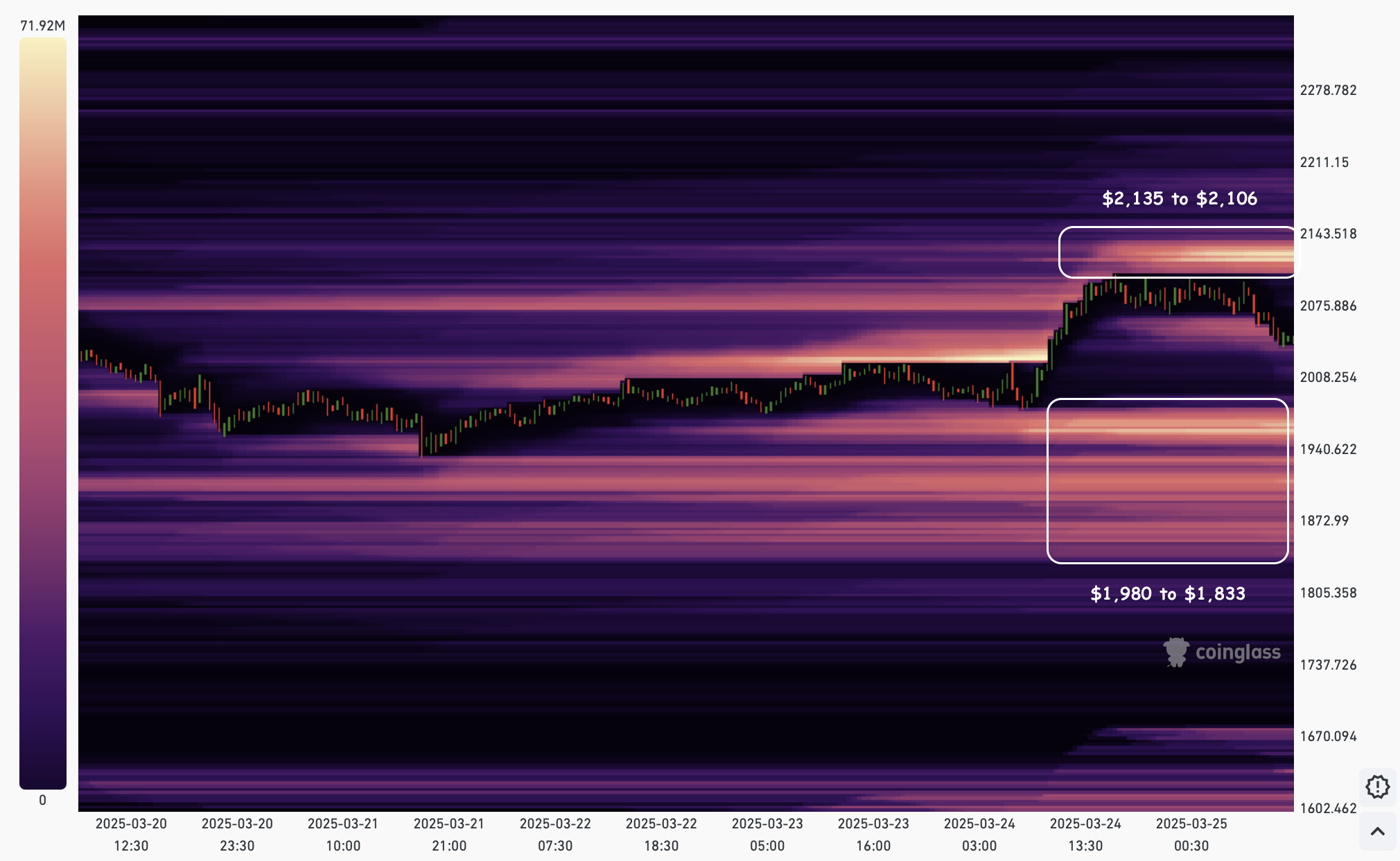

According to CoinGlass Liquidity Heatmap, there are two zones to watch. For short sellers, key levels stretch from $2,135 to $2,106. Here, roughly $450 million worth of liquidity is present. A swift move above this level will cause a forced closing of short positions.

Likewise, between $1,980 to $1,833 is where more than $700 million worth of long positions will be forced to close.

Hence, a move in either direction would cause massive pain. The directional bias from the TPO chart shows a high probability that long positions get liquidated first. However, it is entirely possible for Ethereum price to move higher, especially if Bitcoin fails to slide lower. Regardless of the directional bias, investors need to be cautious.

To conclude, the analyst’s outlook suggests that the Ethereum price will retrace nearly 9% from the recent peak, providing a buying opportunity around the $1,900 area before potentially hitting $3,000. The liquidation heatmap model further adds credence to this short-term pullback before ETH makes its move toward the next key psychological level of $3,000.

The post Analyst Outlines Buying Opportunity Before Ethereum (ETH) Price Skyrockets to $3,000 appeared first on CoinGape.