Over the years of growing popularity, adoption, and investors’ demand, Bitcoin (BTC) has been viewed as Gold’s competing store value. The competition turned fierce as U.S. President Donald Trump signed the executive order for the Bitcoin Strategic Reserve. Interestingly, amid the competition, Gold’s performance relative to BTC can hint at where the Bitcoin price is headed next, especially as the digital asset meets significant recovery today.

Gold vs. Bitcoin: Where’s Bitcoin Price Headed?

The Gold vs. Bitcoin USD chart reveals that gold has been in a strong and continuous downtrend ever since January 2023 when compared to Bitcoin (GOLD/BTC). At the same time, the trendline reveals that BTC is outperforming gold at the same interval.

Although gold is achieving new highs in the traditional market and Bitcoin is trading near $86k, the comparative analysis puts the latter in dominance.

Interestingly, in this two-year period, the GOLD/BTC ratio has tested its 200-day EMA four times and is approaching the same for the 5th time. It could become a pivotal moment for the Bitcoin price action toward a low or a rally.

Will Bitcoin Price Finally Rally With the 5th 200 EMA Target?

The GOLD vs. Bitcoin USD analysis reveals that every time gold soared against the other and touched the 200-day EMA, it resulted in a surge for BTC. As the current scenarios present the charts near the same pivot for the 5th time, Bitcoin can form a strong uptrend.

However, it is important to note that the last four times have not been entirely favorable for the digital asset, but the exhaustion at the 200-day EMA may push the token to the verge of a rally.

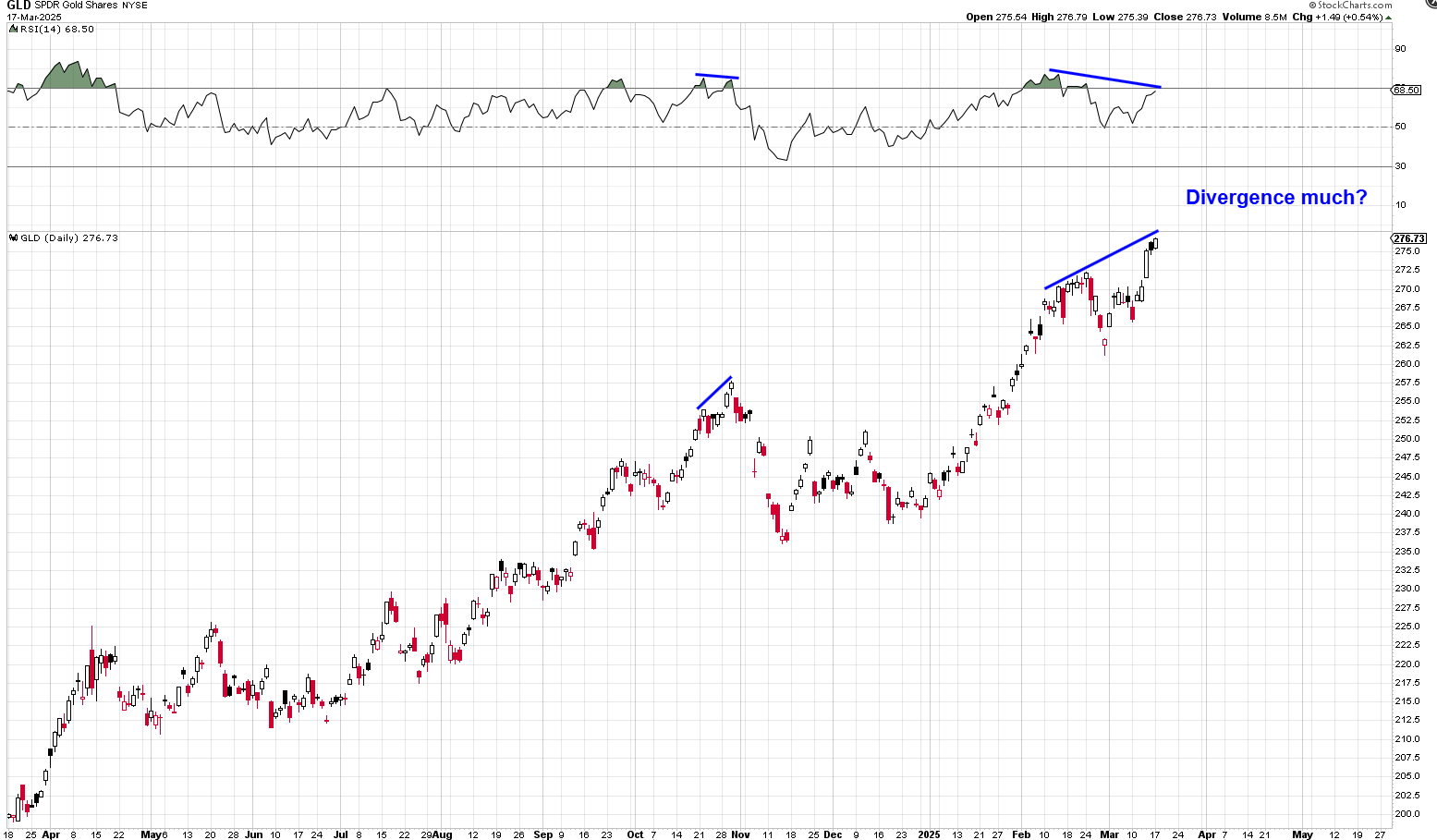

More importantly, the RSI divergence in the Gold is another bullish signal for the token. A separate SPDR Gold Shared (GLD) chart reveals that there’s a notable bearish RSI divergence.

This is an indication of the weakening bullish momentum and a potential reversal. As a result, it indicates the possibility of a BTC price rally if the gold’s momentum slows down.

Bottom Line

Gold’s performance against the BTC token is a significant indicator of what’s coming next for the token. The current performance and Bitcoin price predictions build a bullish scenario for the token as it is preparing for the potential rally due to the exhaustion at the 200-day EMA.

With the historical patterns of Gold vs. Bitcoin backing this top cryptocurrency’s surge, there’s a probability of higher returns. However, investors must take unpredictability and volatility into consideration.

The post Here’s How Gold Hints Bitcoin Price May Rally Next appeared first on CoinGape.