After a massive crash at the beginning of the month, the crypto market braces for a crucial week as the Federal Reserve prepares for the interest rate decision. After cryptocurrencies nearly lost a trillion, the central bank’s move is essential for the investors as its decision could impact not only digital assets but other financial markets. Let’s discuss.

How Will the Federal Interest Rate Decision Impact the Crypto Market?

At present, the biggest contributor to the crypto market, Bitcoin, trades at $83,2K, with the rest of the altcoins exhibiting the same consolidatory performance. As a result, the global digital assets market cap is just $2.72T, and the trading volume is $69.74B. Also, the investor sentiments are still in a fear zone amid economic uncertainty.

In addition, the FOMC meeting and the Federal Reserve interest rate decision could decide the performance of the cryptocurrencies. If the Fed implements a rate cut (lower interest rate), the market could witness high liquidity.

More importantly, this could influence investors to take the risks. As a result, this is the bullish scenario for the cryptocurrencies, where Bitcoin and altcoin could seek high returns, especially if the Fed ends QT.

The market’s performance would be unexpected if the Fed decided to keep the interest rate study. The volatility may or may not increase, but the investors’ disappointed sentiments could impact the market momentarily.

Lastly, the rate hike scenario, which is unexpected, could bring downward pressures as crypto traders move toward safer assets rather than digital assets. All these possibilities will bring different results.

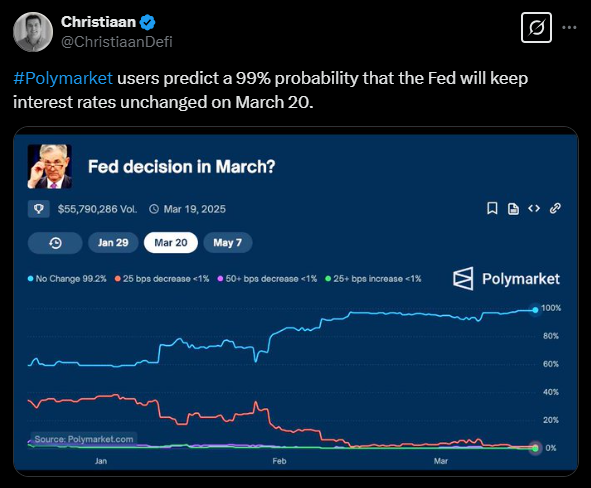

Experts believe the Fed will keep the interest rates unchanged, increasing the chances of bullish outcomes. However, various other factors also need to align as many other macroeconomic events could impact the cryptocurrencies.

Other Macroeconomic Events to Impact the Crypto Market

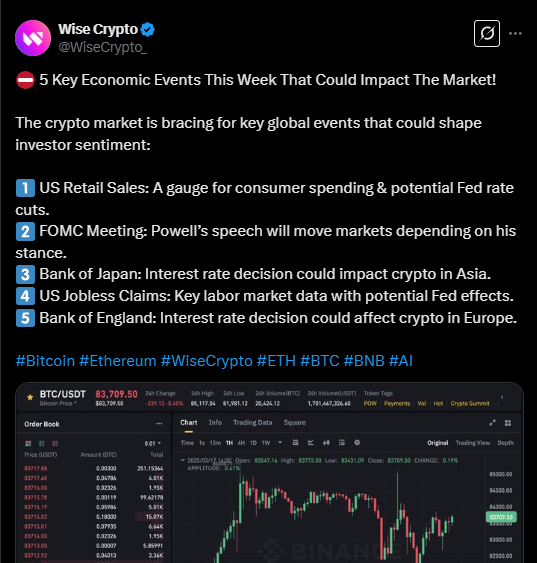

Beyond the Federal Reserve interest rate decision, several other macroeconomic factors could influence this week’s cryptocurrency market. The key factors include U.S. jobless claims, U.S. retail sales, February Housing Starts data, geopolitical developments, etc.

Additionally, the upcoming Trump and Putin meeting to discuss the Ukraine peace policy could also have a significant impact.

Other worldwide events like Japan’s and England’s Interest rate decisions could also have a significant impact. Investors must stay updated with the market and remain cautious this week.

Bottom Line

Bitcoin is following a highly bullish pattern at present. The same pattern led to a massive rally for gold in the 1970s. Over the years, BTC price can surge to $250k due to this bullish pattern, and the Federal Reserve interest rate cuts could play an important role in that.

However, the different scenarios could impact the crypto market differently. More importantly, macroeconomic factors like U.S. jobless claims could influence the market. Investors must be prepared for volatility ahead.

The post How Will Federal Reserve Interest Rate Decision Impact Crypto Market this Week? appeared first on CoinGape.